Many clients may not be aware that there are five investment factors or styles: Growth, low volatility, quality, size and value.

Two interesting things about factor investing. First, many investors know at least a little something about growth and value. Second, without the help of an advisor, investors may be unwittingly embracing factors that don't jibe with their objectives and risk tolerance levels or not gaining enough exposure to a particular style.

An easy way of explaining value investing to factor novice clients is that it's simply the style where a stock trading below intrinsic value is purchased. Reference Warren Buffett and they'll get the idea. Conversely, growth investing emphasizes identifying securities with above-average rates of earnings and sales growth.

The other factors have merit, but focusing on growth and value this year could be advantageous for both advisors and clients. For starters, regime change is underway. From 2007 through 2020, growth substantially outperformed value. To start 2021, that scenario is reversing as the S&P Value Index is higher by 8.4% year-to-date as of March while its growth counterpart is off 0.8%.

Second, as noted above, many clients are already familiar with the growth and value styles. Of the 100 largest US-listed exchange traded funds by assets, 13 are dedicated growth or value funds and that doesn't include a variety of sector funds that tilt towards one of those styles.

Deeper Due Diligence

As advisors well know, not all style funds, active or passive, are cut of the same cloth. To that end, it's worth studying whether factor funds are better aligned with cap-weighted or style-based benchmarks. Researchers at index giant MSCI did just that, studying growth and value funds, including international fare, over the March 2011 through December 2020 period.

Not surprisingly, the MSCI research confirms growth style funds beat cap-weighted benchmarks over that period while value funds lagged.

“Further, all funds showed reduced tracking error when compared to their corresponding style, rather than to market-cap benchmarks, as shown in the chart below,” notes MSCI. “Lower tracking error suggests greater alignment between a manager’s investment strategy and the benchmark, and may help determine which type of benchmark is appropriate.”

As the researchers note tracking error reduction in value funds wasn't quite on par with growth competitors over the tracked period. That could be a sign value managers, realizing the style was out of favor, were making bets outside of their style's jurisdiction. In a vacuum, that's not problematic, but over long holdings, increasing tracking error leads to higher costs – something that today's ever savvier client bases are sure to get wise to.

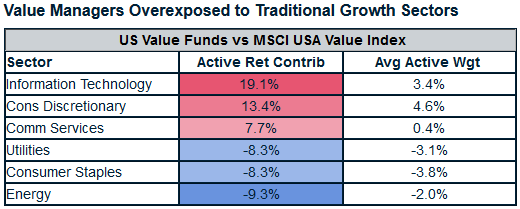

As the chart below indicates, value managers indeed were drifting, overweighting sectors usually thought of as growth while eschewing some standard value groups.

Courtesy: MSCI

Why All This Is Important

Alright, so I got some into some “index/style nerd” stuff just now, but factor awareness is another tool in the box. The reality is Bloomberg, CNBC, et al will mention the other factors on occasion, but they'll beat the drum on growth and value, meaning clients will grow curious about their portfolios' exposure to these factors.

“What’s more, by comparing tracking error between market-cap and style indexes, we found that style indexes were more appropriate benchmarks for growth and value funds,” adds MSCI. “In addition, while value and growth managers tend to show tilts toward their target styles, this tilt varies across managers and across time. A better understanding of these exposures can shed further light on their impact on the performance of these funds.”

At a time when value is coming back into vogue and rising Treasury yields are pressuring FAANG and other growth fare, active managers in both styles may be caught flat-flooted – value with not enough of the right exposures and growth managers too much of what is no longer a good thing. Adivsors can seize that opportunity to discuss appropriate growth/value allocations with clients via lower cost passive products.

Realted Advisorpedia Articles:

It's High Time to Finally Embrace Mid Caps

Good News Advisors: Dividends Are in Again

Concentration Eating Into Diversification? Try Equal Weighting

Two Sectors Advisors Should Focus on in 2021

Finding Next Generation of Innovators Is Easier than You Think