It's human nature to ponder “what's the next big thing?” We engage in that line of thinking with cultural phenomenon, sports and myriad pursuits. Yes, that includes investing.

If they're not thinking about it themselves, advisors are fielding questions about what companies are the next Amazon, Facebook, Tesla, etc. Obviously, stock picking is a tricky endeavor under any circumstances, but attempting to identify the next story name that delivers four- or five-digit returns over time is exceptionally difficult.

Difficult or not, many investors are craving access to innovative companis and access to disruptive growth, innovative firms goes a long way in explaining why the Nasdaq-100 Index (NDX) topped the S&P 500 in 11 of the 13 years ending 2020.

Good news: Advisors can offer clients exposure to a basket of stocks with the potential to become the next big things via the NASDAQ Next Generation 100 Index (NGX). The idea here is remarkably straight forward: The NASDAQ Next Generation 100 Index is a collection of the 100 companies next in line to join NDX. Think of it as a proving ground for possible inclusion into the Nasdaq-100.

Practical Mousetrap for Innovation

Although NGX isn't an old index – it went live last August – advisors can take heart in knowing it's constructed in nearly identical fashion to NDX and follows the same quarterly rebalancing and annual reconstitution schedules. There are, however, important differences between the two benchmarks, including at the sector level.

“Most notably, the major difference in industry exposure is the allocation to Technology. Yes, both indexes are overweight Technology but the Nasdaq-100 tends to average more than half its weight in Technology, with approximately 56% as of September 30, 2020,” according to Nasdaq Global Indexes research. “On the other hand, the Nasdaq Next Generation 100 allocated roughly 36% to Technology. Another difference is the exposure to Industrials, with the Nasdaq Next Generation 100 at a 17% allocation compared to only 5% in the Nasdaq-100. Health Care is another major differentiator, as the Nasdaq Next Generation 100 recently had nearly triple the exposure to this industry, 20% versus only 7% for the Nasdaq-100.”

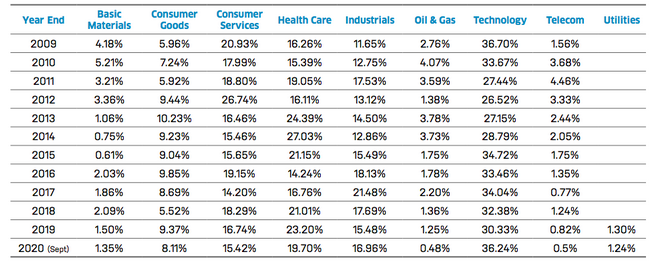

Nasdaq conducted a backtest of NGX, confirming that advisors and clients should expect the “junior varsity” index will consistently be overweight, but it's other sector exposures are likely to be fluid as the chart below indicates.

Courtesy: Nasdaq Global Indexes

Mid-Cap Comps

NGX is useful on another front: Offering clients mid-cap exposure. Mid-cap stocks are often called the market's “sweet spot.” Sweet or not, money managers typically overlook this asset class despite its history of topping both large- and small-cap equities with volatility metrics that are more favorable than smaller stocks.

“When compared to its midcap benchmarks, we find that the industry exposure of the Nasdaq Next Generation 100 Index is more focused than that of the S&P Midcap 400 but shares some similarities to the Russell Mid Cap Growth Index, particularly with the emphasis toward Technology and Healthcare,” notes Nasdaq.

Translation: NGX can offer a growth-ier alternative to mid-cap blend funds and even some mid-cap growth fare.

Advisors looking to access NGX in cost-efficient fund form can consider the Invesco NASDAQ Next Gen 100 Fund (QQQJ).

Related: ESG Investing Isn't Expensive or in Bubble Territory