For many advisors, dividends stocks and the related funds were go-to allocations in client portfolios for years. That makes sense because payouts are applicable for even the broadest of client bases.

Younger investors don't need the income right away, meaning their dividends can be reinvested putting the powers of compounding and time on their sides. Conversely, old investors do need the income, but many shouldn't or don't want to be excessively allocated to bonds.

Though not perfect, dividend stocks enjoyed a moment and by “moment” I mean a decade-plus of relative safety and seemingly unabated – broadly speaking – payout growth from the end of the financial crisis through early 2020.

Quick history lesson: Then the coronavirus pandemic hit, forcing a slew of U.S. companies, many found in the consumer cyclical, energy and real estate sectors, to cut or suspend payouts. Not to mention the Federal Reserve stepping in and forcing banks to set aside cash to cover bad loans while limiting dividend increases and stock buyback plans.

Those four sectors combine for about 29% of the S&P 500's weight confirming the first half of 2020 was brutal went it came to negative dividend action. By the time 2020 drew to a close, a combined 331 companies in the S&P 500, S&P MidCap 400 and Russell 2000 indexes cut or nixed payouts.

Things Are Looking Up

Fortunately, advisors can restart the dividend conversation with clients and they don't need to lean on the low bond yields point because the payout environment turned noticeably more sanguine in the latter stages of 2020.

When the year, S&P 500 dividend raisers outnumbered offenders by a more than 3-to-1 margin. In the mid-cap index, the number of firms boosting payouts was more than 50% higher than those cutting or halting dividends. Still, strategy selection is paramount for advisors deploying index funds and exchange traded funds as avenues for generating equity income.

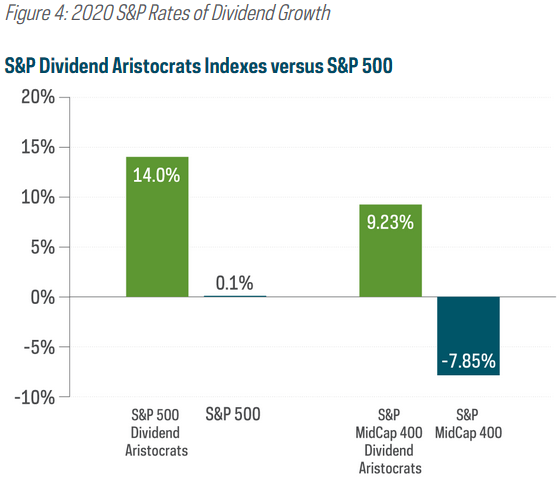

“Despite the market avoiding a worst-case scenario of widespread dividend cuts in 2020, dividend growth has been hard to come by of late,” according to ProShares research. “While we noted there were more companies that grew their dividends than cut them in 2020, the S&P 500’s aggregate rate of dividend growth was flat. The rate of dividend growth among large-cap stocks has actually been trending lower for the last several years. And mid-cap stocks fared even worse, posting a dividend decline of roughly 8% for 2020.”

As the chart below indicates, prioritizing dividend growth over yield, even in today's low bond yield climate, is pivotal in fostering superior client outcomes.

Courtesy: ProShares

Locating Reliable Growth

At the sector level, advisors don't have to incur risk on clients' behalves to access reliable dividend growth.

“Three of the four largest dividend-paying sectors—Information Technology, Health Care and Consumer Staples—had dividend growth throughout the year (2020),” notes WisdomTree.

Add to that, financials, the second-largest dividend-paying sector in 2019, were primarily stymied by the aforementioned Fed action and a small number of dividend offenders, namely Capital One and Wells Fargo.

I don't have a crystal ball, but as the U.S. economy shakes off the effects of the pandemic, banks will be able to repatriate some of the cash set aside for bad loans back into earnings and perhaps boost dividends and buybacks – something JPMorgan Chase (NYSE:JPM) is already doing, at least in terms of repurchases.

Two other things for advisors to consider and both are positives. First, last year's dividend carnage was instructive because it's a reminder to steer clear of companies that are financing dividends with debt, particularly high interest debt, rather than free cash. Second, an array of high-quality dividend growers currently trade at compelling multiples, meaning durability can be had at a reasonable price.

Related: Concentration Eating Into Diversification? Try Equal Weighting