Written by: Jack Manley

After a rocky start to the year, a number of major U.S. equity markets are in or near correction territory. Understandably, after a stellar 2021, many investors are nervous about reliving the volatile days of March 2020 – as a result, sentiment has noticeably soured.

However, to make better sense of this period of poor performance, it is worth taking stock of a few things: what is driving this correction, how should it be framed within the context of the 2022 outlook and where might markets move from here?

It has long been understood that 2022 was going to be a challenging year for equity investing. There are a myriad problems that today’s stock market is facing: the prospect of rising interest rates; upward pressure on input costs; a slowing U.S. economy; the ongoing pandemic; and stretched valuations. Escalating tensions in Ukraine between NATO and Russia, an unanticipated factor in 2021, have further challenged sentiment.

Given these challenges, it makes sense that technology and tech-adjacent names have been the driving force behind this downward move: the NASDAQ, peaking in November 2021, is now firmly in correction territory. Technology names have long been susceptible to the aforementioned issues, and as rates rise, investors’ willingness to look beyond poor near-term earnings prospects – a hallmark of some high-flying, cash-hungry technology names – diminishes. In addition, when markets need to let off steam, the easiest pressure release is through multiple contraction: technology has among the highest relative valuations in the equity market.

Looking forward, excepting a diplomatic resolution to the looming conflict in Ukraine, most of these issues seem unlikely to abate: the Fed has made clear that it will continue normalizing policy this year; an increasingly tight labor market with millions of unfilled positions will likely inspire continued upward wage pressure; and the supply chain issues that have contributed to the lion’s share of inflation in recent months will require at least several more months to be fully unkinked.

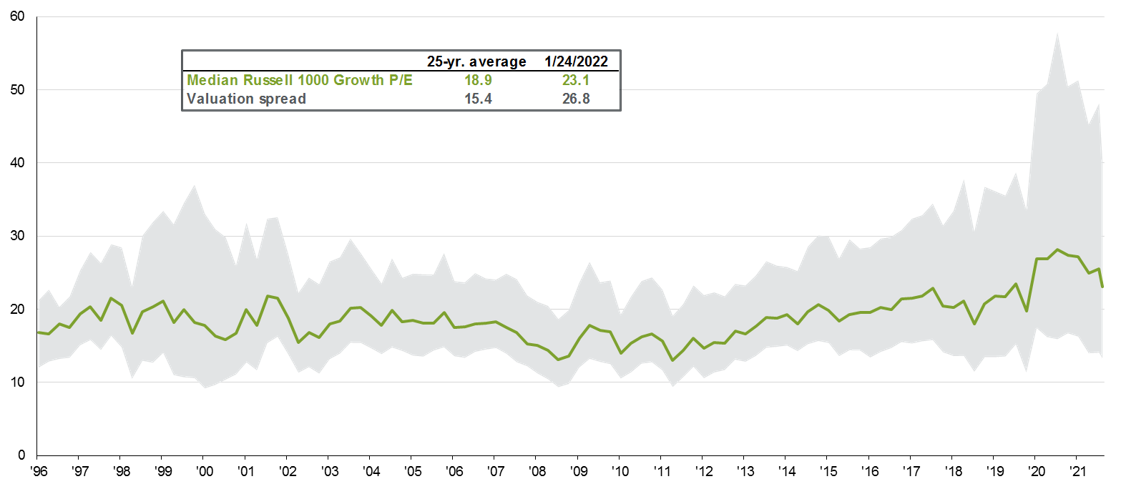

For these reasons, investors will do well to look for two things in equity markets this year: attractive relative valuations and the ability to generate earnings despite persistent headwinds. For now, cyclical and value assets still possess those qualities, with value stocks trading at a steep discount relative to growth stocks and strongly correlated to GDP growth. However, this does not preclude an allocation to growth equities: not all technology companies are incapable of generating strong earnings growth this year, especially those with a viable product already at market; and as shown in the chart below, the valuation spread within the Russell 1000 Growth is wider than that of the S&P 500, indicating that even within growth equities there are valuation opportunities.

Ultimately, investors must recognize that 2022 will likely continue to be a bumpy ride. As a result, prudent sector and security selection through active management will be more critical than in recent memory.

The valuation dispersion in growth equities is considerable

Valuation dispersion between the 20th and 80th percentile of Russell 1000 Growth stocks

Related: What Will Happen to the Top 10 S&P 500 Companies in 2022?

Source: Compustat, FactSet, Standard & Poor’s, J.P. Morgan Asset Management. Dispersion is calculated using the index's constituents as of 6/30/2021 and based on quarterly next twelve month price-to-earnings ratios. Guide to the Markets – U.S. Data are as of January 24, 2022.