Written by: David Lebovitz

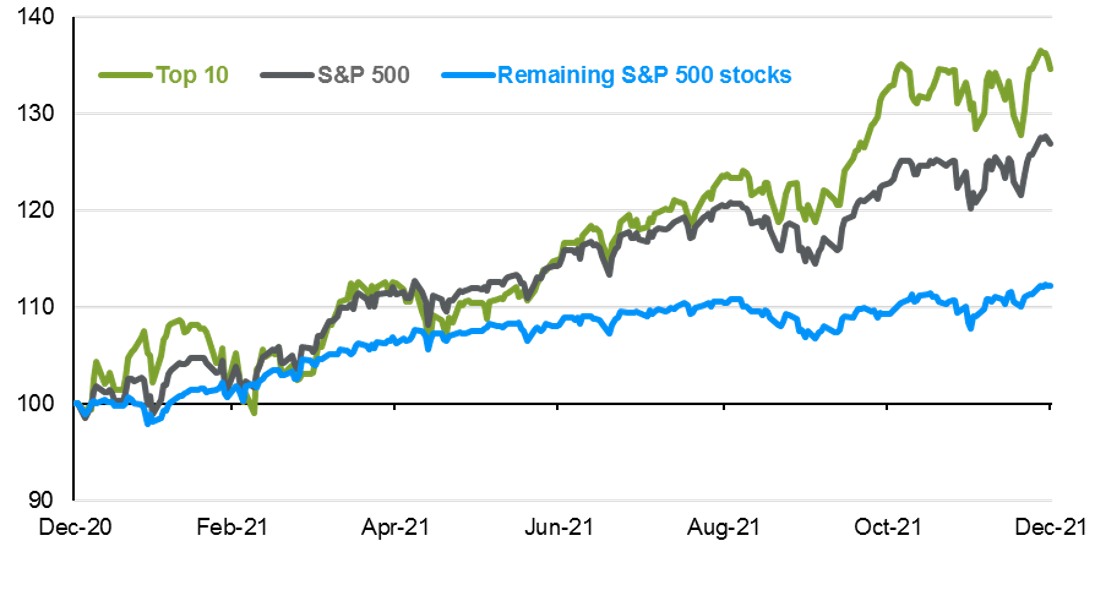

2021 was a better year than expected for U.S. equities, as a 34.5% increase in earnings expectations offset a 7.6% decline in valuations, leading to a price return of 26.9%. Beneath the surface, however, the S&P 500’s top 10 holdings accounted for nearly 2/3 of this return, contributing 19%-pts versus a contribution of 8%-pts from the remaining stocks. This narrow performance has been a characteristic of the U.S. equity market since the pandemic began, and echoes much of the prior expansion as well. Furthermore, it has left S&P 500 valuation dispersion near its widest levels on record.

That said, wide valuation dispersion is not only a symptom of the equity market as a whole; at the end of last year, valuation dispersion within the S&P 500’s top 10 names was more than 100 points (51 points when Tesla is excluded), and valuation dispersion within the Russell 1000 Growth index was more than 2.5 standard deviations above its long-run average. The reality is that the pandemic and subsequent policy response has created winners and losers across different parts of the capital markets; the question for investors is what could cause this dynamic to shift?

Before the rapid spread of the omicron variant late last year, we expected that robust economic activity in 1H22 would lead long-term interest rates to rise, the more cyclical parts of the equity market to outperform, and valuation dispersion to narrow. We now expect a softer pace of growth to start the year, but a fading pandemic and tighter monetary policy could still lead long-term interest rates higher as a result. High-P/E, growth names have benefitted from low long-term rates for the better part of a decade, while the more cyclical, value-oriented parts of the market have struggled. If higher rates weigh on high-flying growth stock valuations while supporting parts of the value complex, this valuation gap should begin to close.

The magnitude of this closure will depend on the trajectory of long rates. As such, many investors are focused on the outlook for the Federal Funds rate, but the more relevant dynamic may be related to the Federal Reserve’s (Fed’s) $8tn balance sheet. If inflation proves to be too sticky for the Fed’s comfort, they could allow the balance sheet to contract in an effort to push long rates higher and cool both economic activity and inflation. Against this backdrop we would increasingly rely on valuation to guide investment strategy, as the most susceptible names would be those sporting sky-high valuations.

The top 10 S&P 500 names accounted for nearly 2/3 of the 2021 return

Rebased to 100 on 12/31/2020

Source: Standard & Poor's, FactSet J.P. Morgan Asset Management. Top 10 stocks include: AAPL, MSFT, AMZN, FB, GOOGL, GOOG, TSLA, BRK.B, JPM, JNJ, and V. Data are as of December 31, 2021.

Related: Is Build Back Better Dead?