As investing looks more like a casino, here’s how to keep risk in check

Bitcoin, meme stocks, SPACs, and penny stocks are all the rage to start 2021. What could possibly go wrong?

Perhaps nothing will. But if you are someone who is more of the “stay wealthy” type instead of one of those “get wealthy now” folks, this is an uncomfortable market climate. Some historical perspective can help.

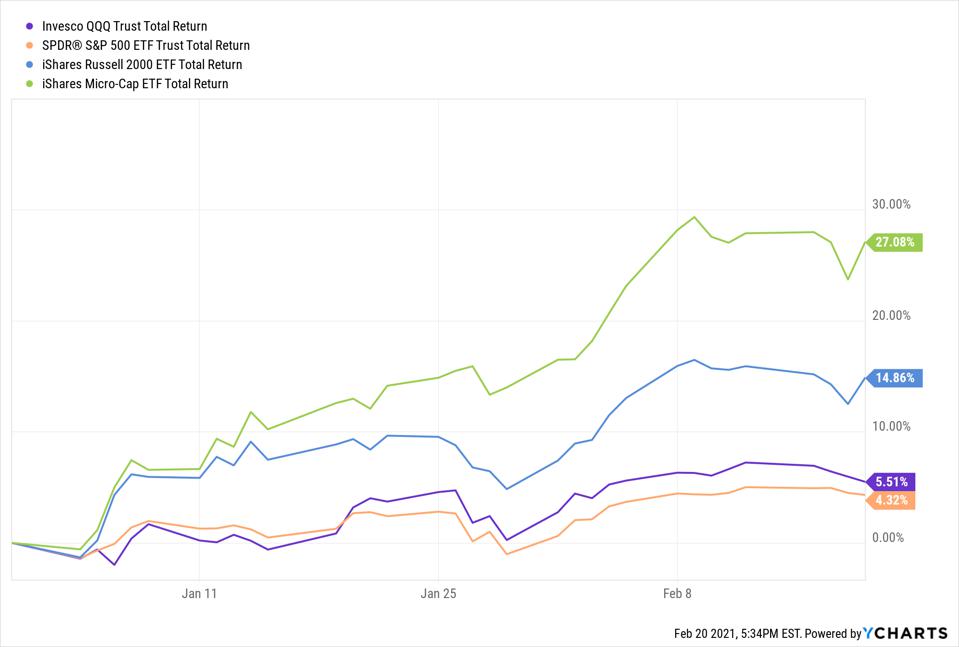

This is where we are through the first 7 weeks of 2021:

Observations

- The Russell 2000 Small Cap Index (blue line) is flying, up more than 2% per week to start the year

- Microcaps - the smaller group of the Small Caps, have gained nearly double the Russell 2000. That index is up more than 27% in these first 7 weeks. If you are keeping score at home, that’s about a 200% annualized return to start the year. No, I am NOT forecasting that! Just doing the math.

- Those “old codgers,” the S&P 500 and the Nasdaq 100 are “only” up 4-5% each. Naturally, I am being facetious. Those indexes are surging to start the year, too.

Yet in this pandemic-era bull market melt-up, something is troublesome about that. As someone who follows the markets with great intensity, and has since the 1980s, when the mainstream indexes get overshadowed every day by the level of excitement and attention being paid to the most speculative ends of the market, it calls for an assessment. And, some history.

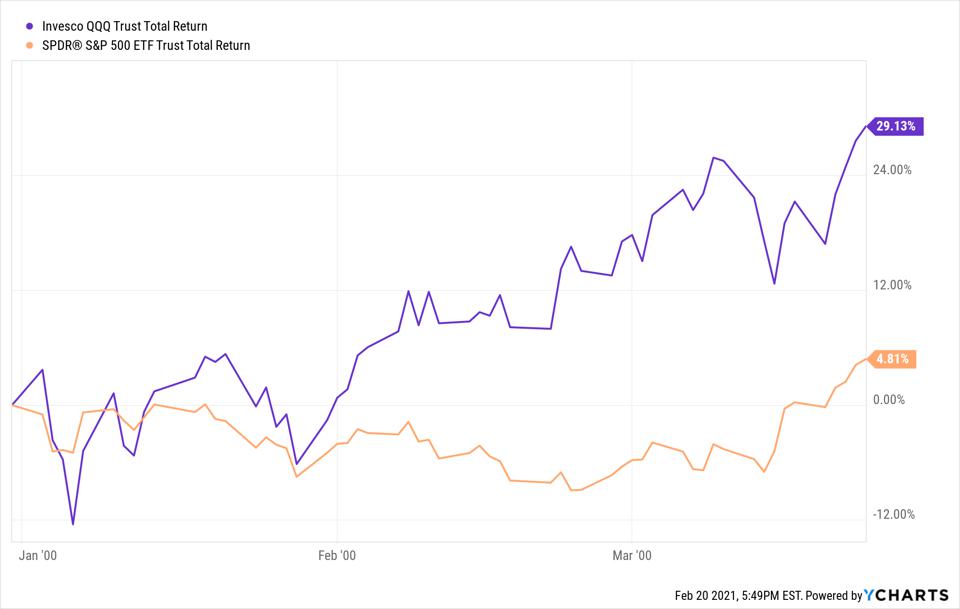

Back in 2000, as the D0t-Com Bubble was playing its final inning, the Nasdaq was the toast of investors everywhere. It was, after all, the home of the cool new companies. The S&P 500 was pushed to the background, relatively speaking.

2000 - also a nice start, but...

That’s what happens when a bubble is in place, and a market index (Nasdaq 100) floats up 29% before the first quarter is even finished. That’s what happened in 2000. The S&P 500 had a fine quarter, but its sub-5% return to start that year was, in a strange way, not so noticeable.

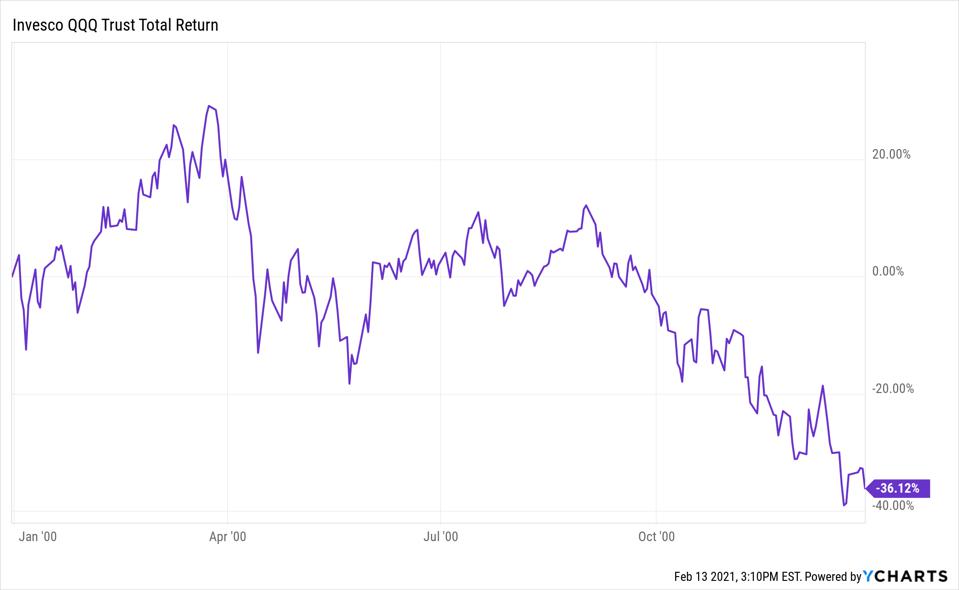

However, in 2000, that was the end of the ride for the Nasdaq. Here’s how the full year 2000 looked for that index. Despite that roaring start, the bubble burst, sending the “Naz” down below where it started the year. In fact, that happened in only 2 weeks.

2000: late March, the stocks hit the fan

Let me clarify that: when the bubble popped, the Nasdaq 100 fell over 30% in 2 weeks! And that decline continued in fits and starts, before ending with a full year 2000 loss of more than 36%, as you see in purple above. Not shown is that the S&P 500 fell 10% in those first 2 weeks, and ended up down about 9% for the full year 2000.

Takeaways

- Don’t underestimate how quickly the “sexy” parts of the market can drop hard when bubbles finally pop

- Timing bubbles is useless. It’s better to focus on recognizing them, and avoiding “all-or-nothing” investment approaches, the more insane the bubble seems. To me, it seems pretty insane right now. But that does not mean it can’t last weeks, months or longer until the next big blowup.

- The investment markets are more than just what is currently making headlines, and more than the S&P 500. As I have highlighted in other articles recently, there are always pockets of opportunity, regardless of market conditions. At times, you just need to look in some places you are not used to looking in.

This is an excellent time to take account of where some of those less-travelled investment roads are. Rising interest rates, commodities and some value sectors and non-U.S. areas increasingly look like non-bubble areas.

So, enjoy the bubble in stocks while it lasts. But don’t let your FOMO-emotions overtake your most high-priority investment objectives.

Related: As Old Stock Favorites Fade, Here Is What To Consider For Your Portfolio