The “FANA” stocks are stuck in the mud. Is it a pause or a trend shift?

Facebook, Apple, Netflix and Amazon are some of the most iconic businesses of the last decade. And, while everything in this article should be considered observations, not recommendations to buy or sell any security, when the stock market’s “generals” start to wane, it helps to assess that fact.

You are likely familiar with FAANG, the group of 5 stocks that have led the Nasdaq and in turn the S&P 500, higher for several years. That group and a few more of their ilk have created perhaps the most misinterpreted stock market of our generation.

Past performance is past-tense. Trends reverse themselves.

The “stock market” has done pretty well over the past decade. However, much of that success points back to the FAANG and similar stocks. What they have in common is that they are listed on the Nasdaq (not the New York Stock Exchange), and their earnings have grown at a very fast clip, as have their valuations.

Most of them don’t pay dividends, or have very low dividend yields, now that their prices have appreciated so much. Clearly, these embody the term “large cap growth stocks.”

As is often the case, there comes a point in every market cycle where subtle changes occur. They can persist for months or even years, but they are there. Many investors miss these clues, but in retrospect, they help us to identify pockets of major risk to our wealth.

Most importantly, these early-warning signals help us to avoid one of the saddest investment outcomes: where the signs of major risk were present, but you just didn’t see them until it was too late. We have all been there. The key is to learn from our experience, both good and bad.

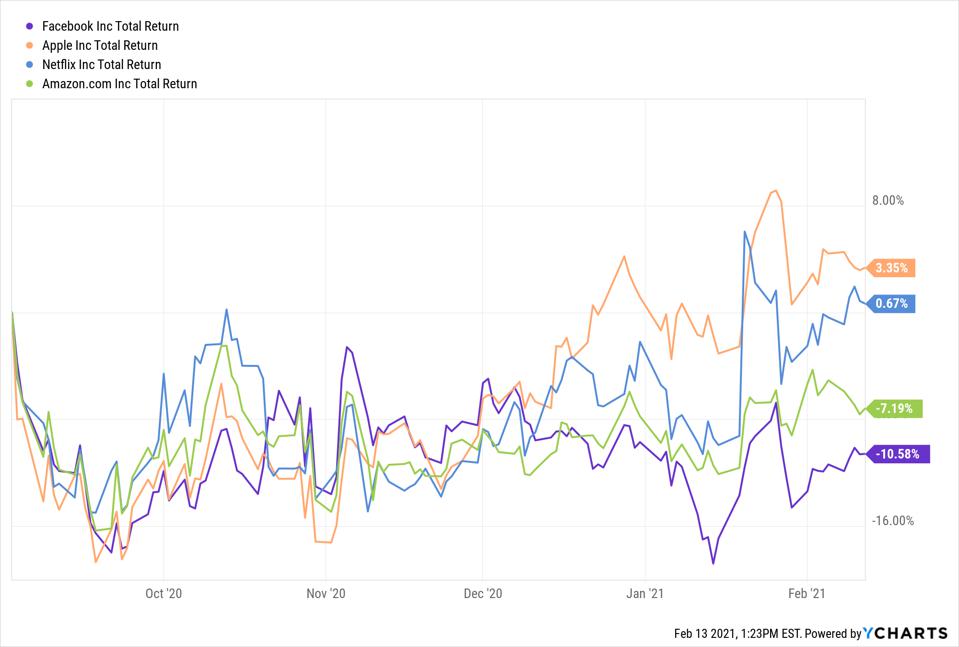

And that brings us to FANA, my offshoot of the FAANG stock set. As the above chart shows, their returns have flattened out since the start of September. At a time when the S&P 500 and Nasdaq have each posted returns of about 11% in 5 1/2 months, the “usual suspects,” the FANA stocks, have not been the drivers. This is a rare event in this new decade.

This could be a sign of something. Or, of nothing. But I think there’s a good chance that we are witnessing a shift. Not to or away from specific stocks. But my chart work tells me the shift is getting more palpable by the day.

Potential changes now developing

- The largest, highest-valuation sectors are transitioning from being THE performers and leaders to at best “part of the gang” and at worst, the eventual downside leaders. See the year 2000 in your stock market history on more of what that could look like.

- “Value stocks look increasingly attractive, but not in the aggregate. It has more to do with certain pockets, particularly those related to commodities and hard assets. This is more than just a “buy low p/e ratio” kind of environment. It is more of an “inflation may be coming” sentiment, bubbling up after years of being suppressed and overshadowed by FAANG/FANA/Electric car makers and all of the crazy-speculative stuff that has dominated recent headlines.

- Long-term interest rates continue to tick higher. If you are looking for a catalyst for a diminished outlook for high-growth stocks, here’s a good one. Higher borrowing rates mean 2 things to growing businesses: higher costs for new borrowing, and higher costs to refinance existing debt.

Importantly, these are factors, not a forecast. If we have learned anything about today’s investment climate, it is that fundamentals have taken a back seat to emotions in a way that many of us have not seen. In my case, that goes back as far as the markets of the 1980s.

And, emotions are a funny thing. They can take a hint of reality, like rising interest rates or suddenly lagging FANA stocks, and turn them into a runaway train. While the reasons were very different a year ago, the same concept is potentially present today.

Summary

Investing today means considering what worked in the past, but recognizing that clinging to old rules-of-thumb and labels can be very dangerous. So-called “animal spirits” now dominate so much of what impacts our wealth.

Do all that you can to sniff out what market trends and pivots have already begun, even if they are not making big headlines just yet. That is a better approach than waiting for the headlines tell you what just happened.

Related: How To Social Distance From Three Worn Out Investment Concepts