Written by: Gabriela Santos

The current buzzword in markets is “stagflation”, a reference to the undesirable combination of economic stagnation, high inflation, and high unemployment – a tricky backdrop for policy makers and investors. Recently the direction of travel seems concerning, with steady downward revisions to 3Q global growth at the same time that global inflation has remained high and surprised to the upside. However, it is very premature to use the stagflation term with any conviction. The economic growth rate itself remains above average and a turning point where growth expectations start to stabilize and inflation starts to decelerate may be on the horizon. Key to this shift is an improvement in supply disruptions, which are showing early signs of a turnaround. Once investors regain conviction, cyclical equities should re-take the baton from more defensive sectors. On the other hand, fixed income is still not in the clear, as yields remain too depressed for a return to a version of normal.

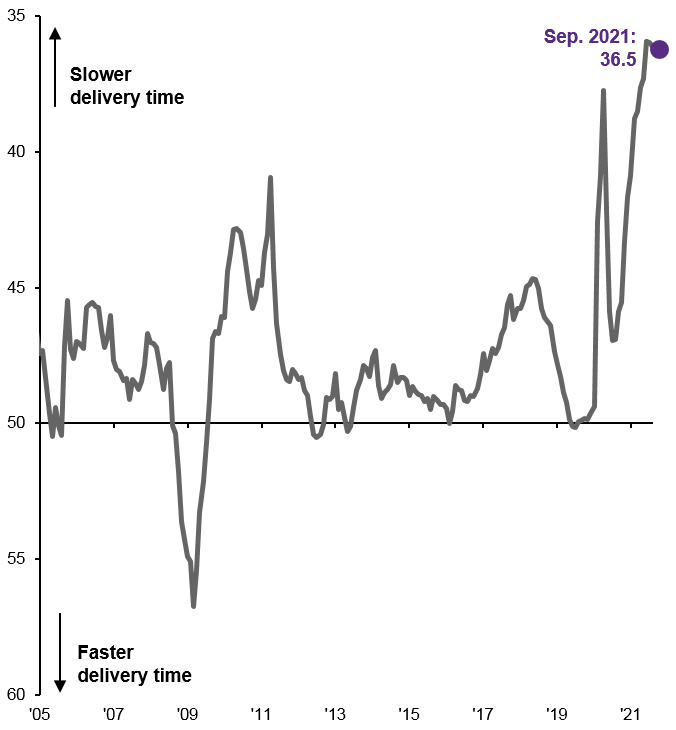

For the past year, supply has been hard to come by from electronics to furniture to cars. Suppliers in the manufacturing and construction sectors have been reporting record slow delivery times since April, as measured by the global PMI suppliers’ delivery times index. The pandemic has been the main culprit:

- The Delta variant has driven consumer demand back towards goods and away from services, especially for home-related items. The good news is demand has been solid, as global consumers have the ability and willingness to spend.

- The issue is this strong demand has been met with issues on the production side, as some workers have remained on the sidelines of the labor market due to health, child care, and lifestyle concerns, and as Asia’s zero-tolerance approach to COVID has shut down some factories and ports there.

- Lastly, semiconductors in particular have been in short supply as production requires long lead times to ramp up to meet the strong demand for semiconductor-powered goods. The automotive industry has been hit particularly hard.

The result of the supply bottlenecks has been slower sales and inventory build-up than desired, depressing growth. In addition, the short supply of goods and services has led to higher prices, with input and output price indices accelerating at record speed this year. There are early signs of a turnaround, as supplier delivery times improved in September from record slow levels and as input and output prices have been accelerating less quickly since the summer. A turnaround in the pandemic seems to be the cause, with global COVID cases down 24% since late August. As vaccinations and natural immunity permit the global economy to adapt more fully to COVID, supply disruptions should continue to ease, re-accelerating growth and moderating inflation. An allocation to cyclical sectors and regions makes sense, while care with duration risk in fixed income is key.

Early signs of improvement in supply bottlenecks

Global PMI suppliers' delivery times index*

Related: What Is Behind the Rise in Volatility?

Source: IHS Markit, J.P. Morgan Asset Management. *Participants in IHS Markit's PMI business surveys, conducted in 44 countries, are asked: Are your suppliers' delivery times slower, faster or unchanged on average than one month ago?“. A reading of 50 = no change, >50 = faster delivery time, <50= slower delivery time. Index includes the manufacturing and construction sectors. Data are as of October 6, 2021.