Written by: David Lebovitz

At the start of the year, we predicted that U.S. equities would generate moderate returns against a backdrop of elevated volatility. During the past nine months, however, the stock market is up almost twice as much as we expected but has only seen a peak-to-trough decline of 4%. This volatility backdrop is abnormally quiet – the average peak-to-trough decline for the S&P 500 has been 14.3% over the past forty one years.

However, the past few weeks have seen markets become a bit jittery. While many pointed to the situation with Evergrande as a catalyst for this recent choppiness, issues in the Chinese property market have been brewing for the past few months. Rather, it seems that concerns around fiscal policy, monetary policy and the economic recovery have taken hold; this, coupled with a sharp rise in interest rates, has put downward pressure on risk assets.

To start, Congress is yet to pass either infrastructure bill, and the debt ceiling is now being used as a bargaining chip in Washington. At the same time, we have seen a meaningful deceleration in the pace of economic activity during the third quarter, with consumption hit by the spread of the delta variant and higher rates of inflation. On top of all of this, the Federal Reserve (Fed) released a new set of economic and interest rate forecasts; as growth has disappointed and inflation has run hot, a Fed which now expects to conclude tapering by the middle of next year and begin hiking rates at the end of next year has caught some investors by surprise.

Interest rates have risen sharply, reflecting a more hawkish Fed but also an upcoming reacceleration in the pace of economic growth. In reality, the Fed will likely move more slowly than their forecasts suggest, and economic growth will remain above trend. The bigger question is whether inflation will be transitory? It may be a bit stickier than expected, but it seems unlikely we are embarking on a period similar to the 1970’s.

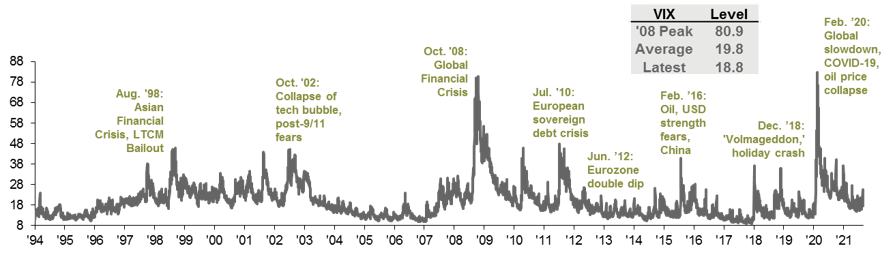

At the end of the day, rising volatility reflects a broader distribution of outcomes – clearly, the events of recent weeks have forced investors to broaden their horizons and embrace a wider range of scenarios. However, we remain constructive on the outlook for the economy, as well as for risk assets, and expect that equities can move higher into the beginning of 2022.

Volatility has increased as the distribution of outcomes has risen

Sources: VIX Index; Data are as of September 27, 2021