Written by: Heather Beamer

For decades, investors have battled volatility and emotion when making investment decisions. Time and time again, investors get caught up in the good times and buy an asset when its price is inflated, only to turn around and sell it once optimism has receded and the price has fallen. This has been particularly apparent in U.S. equity markets over the past two years, as the speed with which markets have gyrated has led many investors to chase performance and buy “what is working” in their portfolios.

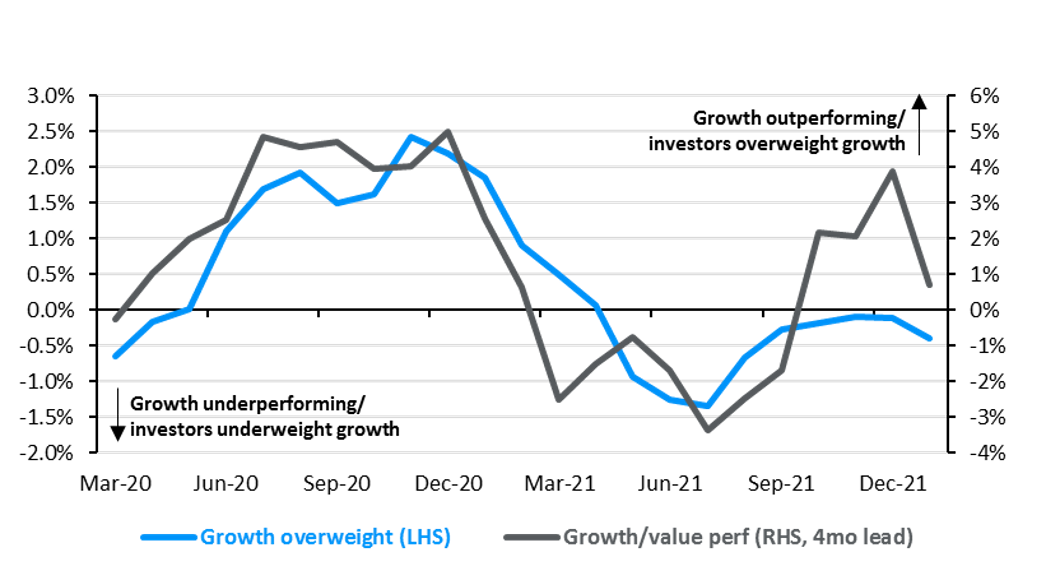

To quantify this, we leveraged internal data on investor allocations. The blue line in the chart below shows whether investors are overweight or underweight “growth” as a style, and the grey line shows the relative performance of the Russell 1000 Growth and Russell 1000 Value. Importantly, we applied a 4-month lead to the relative performance data to illustrate that most investors focus on the present, rather than the future, when allocating investment portfolios. Put differently, only after a period of outperformance has been observed do investors tend to embrace those investments.

When asked why he was such a good hockey player, Wayne Gretzky replied that it was because he would “skate to where the puck is going, not where it has been.” This same logic applies to investing. If the value of an investment is based on its discounted future cash flows, investors should be looking to the future when making investment decisions. This is always important, but will be particularly so in 2022 as the cross currents of rising interest rates, sticky inflation, and a fading pandemic make markets increasingly difficult to navigate.

At the end of the day, investors will be well-served by removing emotion from their allocation decisions, and instead focusing on how their perception of the future aligns (or fails to align) with what the market is pricing in. Furthermore, as we transition from a world of beta to a world of alpha, investors will need to increasingly focus on fundamentals. By our lights, this approach suggests there is still opportunity in value-oriented sectors with high levels of fixed costs, as these businesses stand to generate solid earnings against a backdrop of robust nominal growth.

Investors chase performance when allocating portfolios

Growth overweight (%), growth/value relative performance (%), 3mma

Sources: Russel, FactSet, J.P. Morgan Portfolio Insights, J.P. Morgan Asset Management.

Data are as of February 10, 2022