Written by: David Lebovitz

In our 2022 Long-term Capital Market Assumptions, we posited that alternatives would continue to transition from an optional portfolio allocation to an essential one over the course of the coming years. However, with the pandemic weighing on economic activity, inflation still elevated, Federal Reserve policy set to tighten and equity valuations rich, what is the outlook for alternative investments in 2022?

To start, 2022 should see higher market volatility than 2021; last year, the S&P 500’s peak-to-trough decline was a mere 5%, about one-third of the long-run average. This higher volatility, coupled with elevated levels of stock and factor dispersion, should be a tailwind for hedge fund performance; furthermore, elevated dispersion will support relative value and arbitrage strategies that focus on identifying price discrepancies among securities with similar characteristics.

Against this backdrop of higher volatility, we expect inflation will remain elevated and interest rates will gradually rise. However, the need for income and diversification will remain paramount, suggesting real assets will continue to play an essential role in portfolios. Infrastructure investing is becoming increasingly common, providing not only lower volatility returns and a low correlation to equities and bonds, but also inflation protection. At the same time, these assets provide an opportunity for steady income throughout a market cycle.

Meanwhile, limited transportation supply growth at a time of strong demand for goods has created headwinds for supply chains but tailwinds for transportation assets. Ongoing growth in e-commerce and strong consumer demand will be key, but even after pandemic-related supply chain constraints ease, a tight supply of transportation assets may endure. Importantly, uncertainty around the future asset designs that will be necessary for decarbonization has further slowed new orders. Along similar lines, demand is rising for timber, a more sustainable and renewable building material than cement or steel. At the same time, recognition is growing that working forests can sequester carbon – a natural solution for generating carbon offsets. These assets will be essential for meeting global and corporate greenhouse gas (GHG) emission targets, while simultaneously providing inflation protection, income and diversification.

Real estate should benefit from above-trend inflation, although not all industry sectors or geographic regions will be treated equal. Office occupancy patterns in urban centers continue to experience pressure, and demand for specific sectors is high and rising, creating shortages in some asset types and opportunities in others. In 2022 quality will be key, and we expect that many asset owners will have the flexibility to increase rents at or above the inflation rate in those sectors characterized by moderate supply and robust fundamentals. Conversely, sectors with high vacancy rates and excess supply pipelines may see revenues fall below the inflation rate unless rents keep pace.

Turning to private equity and private credit, we continue to find opportunities. In credit, borrowers are looking to the private markets due to their relatively greater speed and certainty of execution, after many were burned by public markets and banks pulling back capital during more uncertain times. On the demand side, the global search for yield continues but today also includes a demand for assets that can hedge inflation and protect capital in still unknown market environments. As a result, investors continue to increase their allocations to private credit given relatively high spreads over public markets, stronger covenants, floating rate or asset-based inflation protection, and low volatility.

Private equity markets are experiencing a rapid pace of activity. Investor demand continues to be strong and distribution volume remains high, while fundraising timelines are getting shorter and target fund sizes larger. Record levels of dry powder have kept pace with robust deal volume and velocity, and valuations are elevated and competition is intense in a market that has not seen a prolonged pullback in over a decade. However, there continue to be ample and compelling investment opportunities for those managers with differentiated sourcing and value creation strategies.

At the end of the day, there are plenty of opportunities across the alternative investment landscape. However, any allocation to alternatives should be outcome-oriented. Put differently, the first thing to understand when allocating to alternatives is the problem you are looking to solve. From there, you can back into the asset which will provide the intended solution. That said, it will be essential for investors to embrace alternatives as they navigate a world characterized by muted expected returns, historically low interest rates and elevated volatility over the course of the years to come.

Alternatives continue to require an outcome-oriented approach

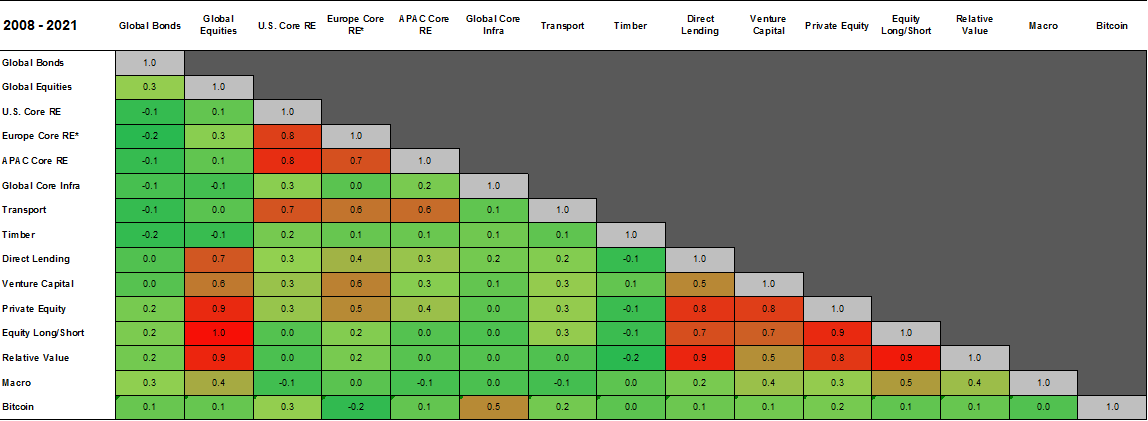

Public and private market correlations, quarterly returns

Related: Gold Outlook for 2022: Which of These Opposing Forces Will Drive the Gold Price?

Source: MSCI, Bloomberg, Burgiss, NCREIF, Cliffwater, HFRI, J.P. Morgan Asset Management. *Europe Core RE includes continental Europe. Private Equity and Venture Capital are time weighted returns from Burgiss. RE – real estate. Global equities: MSCI AC World Index. Global Bonds: Bloomberg Global Aggregate Index. U.S. Core Real Estate: NCREIF Property Index – Open End Diversified Core Equity component. Europe Core Real Estate: MSCI Global Property Fund Index – Continental Europe. Asia Pacific (APAC) Core Real Estate: MSCI Global Property Fund Index – Asia-Pacific. Global infrastructure (Infra.): MSCI Global Quarterly Infrastructure Asset Index (equal-weighted blend). U.S. Direct Lending: Cliffwater Direct Lending Index. Timber: NCREIF Timberland Property Index (U.S.). Hedge fund indices include equity long/short, relative value, and global macro and are all from HFRI. Transport: returns are derived from a J.P. Morgan Asset Management index. All correlation coefficients are calculated based on quarterly total return data for the period 6/30/2008 – 6/30/2021, except correlations with Bitcoin which are calculated over the period 12/31/2010 – 6/30/2021. Returns are denominated in USD.

Data is based on availability as of November 30, 2021.