Anytime someone pays a fee, they want to know what they will receive for the fee. Knowing what is covered or not covered is helpful in determining if the fee is a reasonable one or not. Investors have this same issue when evaluating the fees a financial advisor will charge them. The investor may also have predefined ideas about what types of services should be included in the fees they will be paying. Savvy financial professionals will ensure that the services they provide are the ones that wealthy investors want included in the fees being charged. What exactly are the services investors want to have included in the fees they pay their financial advisor?

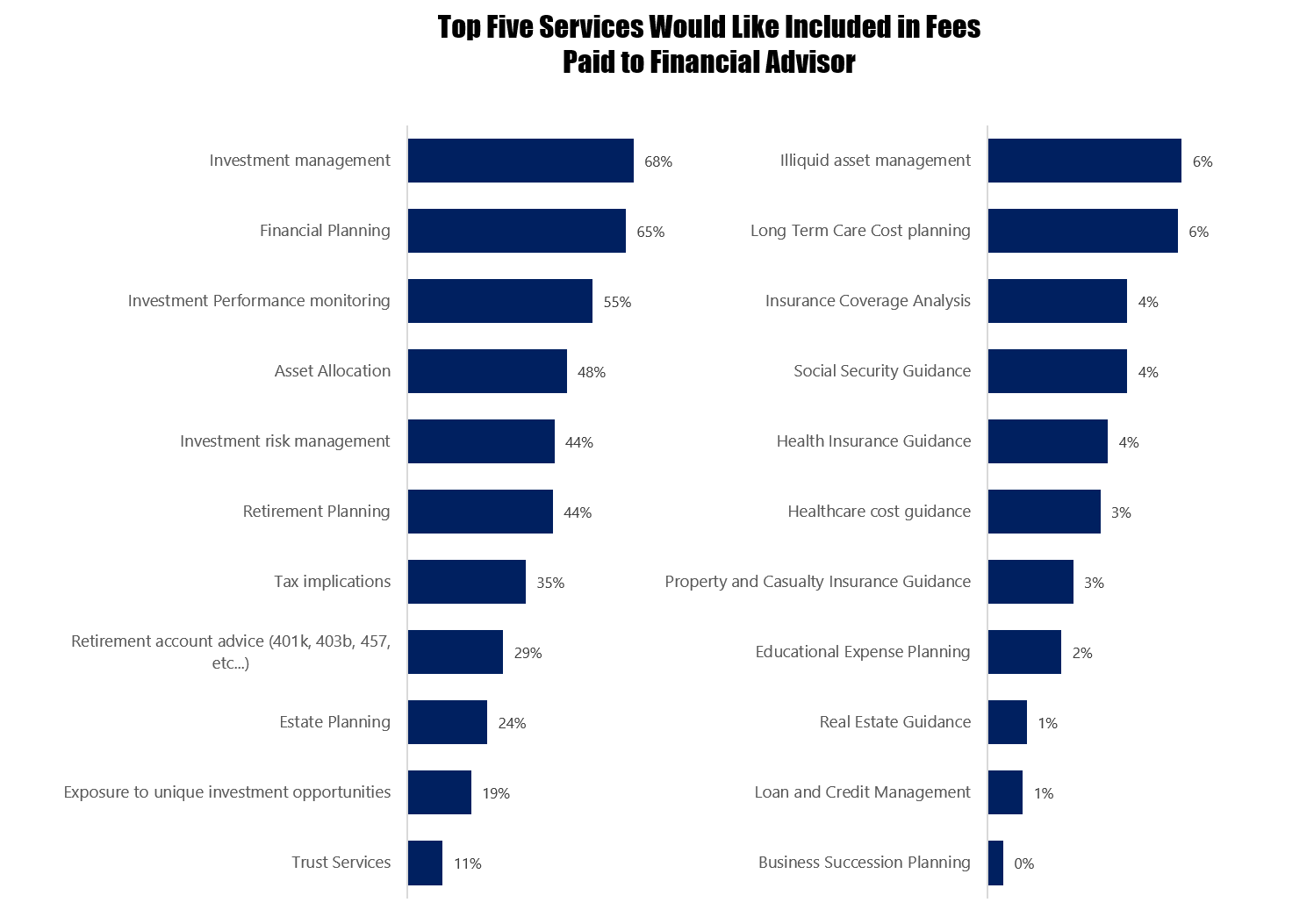

Investment management is among the top five services to be included in fees for 68 percent of wealthy investors, according to recent research on fees conducted by Spectrem Group. Understandable since investment management is a key component of the advisor/client relationship. Financial advisors receive various designations and ongoing education to ensure they can provide competent investment management so having that included in the fees that are being charged is a logical expectation.

Financial planning is in the top five services to be included in fees for 65 percent of investors. This one can be a bit trickier. While this is the second most selected topic to be included in the fees being charged, only 70 percent of investors have had the cost of their financial plan creation included in the overall fees they pay to their financial advisor. Only six percent have had to pay more than $2,500 for the creation of a financial plan, and 17 percent have created a financial plan for under $1,000. When considering working with a financial advisor it is beneficial to ask if a personalized financial plan will be included in the fees that will be charged, and if not, what the cost would be to create one.

Financial planning is far more than just the creation of the plan, it is also the ongoing management and consistent following of the plan that provides the benefit of a plan. Financial plans are less effective if they are never evaluated again or if they are not followed. Seventy percent of wealthy investors believe that an advisor helping ensure they follow their financial plan is valuable or beneficial. A similar percentage, 71 percent, prefer a financial plan that is ongoing vs one that is static.

Investment performance monitoring is third in the top five services that investors want included in their fees, with asset allocation and risk management being close behind. These topics for many individuals can be considered as a part of investment management however, so it is helpful to dig a bit deeper into other services investors would like included in their overall fees.

Retirement planning is a service that 44 percent of wealthy investors feel would be in the top five they would like included in their financial plan. Retirement planning is the reason 83 percent of investors initially set up a financial plan and can be a significant reason why investors would initially start working with a financial advisor. Since this can be the start of a relationship with an advisor, it is helpful for this service to be included in fees. Retirement account advice is something that 29 percent of investors feel are in the top 5 services to be included in the overall fees they pay to their financial advisor as well.

Wealthy investors are wise to ask questions when working with an advisor and make certain they are clear on the services that are included in their overall fee. This will allow for the advisor to discuss all of the various components of their services and will also help investors clearly understand what exactly they are paying for.

Related: What's the Value of an Advisor Outside Investments?