Investors value many different things in a financial advisor. Assistance with retirement planning, financial planning, investment management, and asset allocation are all services that a financial advisor can provide which could be of benefit to wealthy investors. What about all of the services that are not directly about investing? What non-investment related services can an advisor provide that wealthy investors would find either beneficial or valuable?

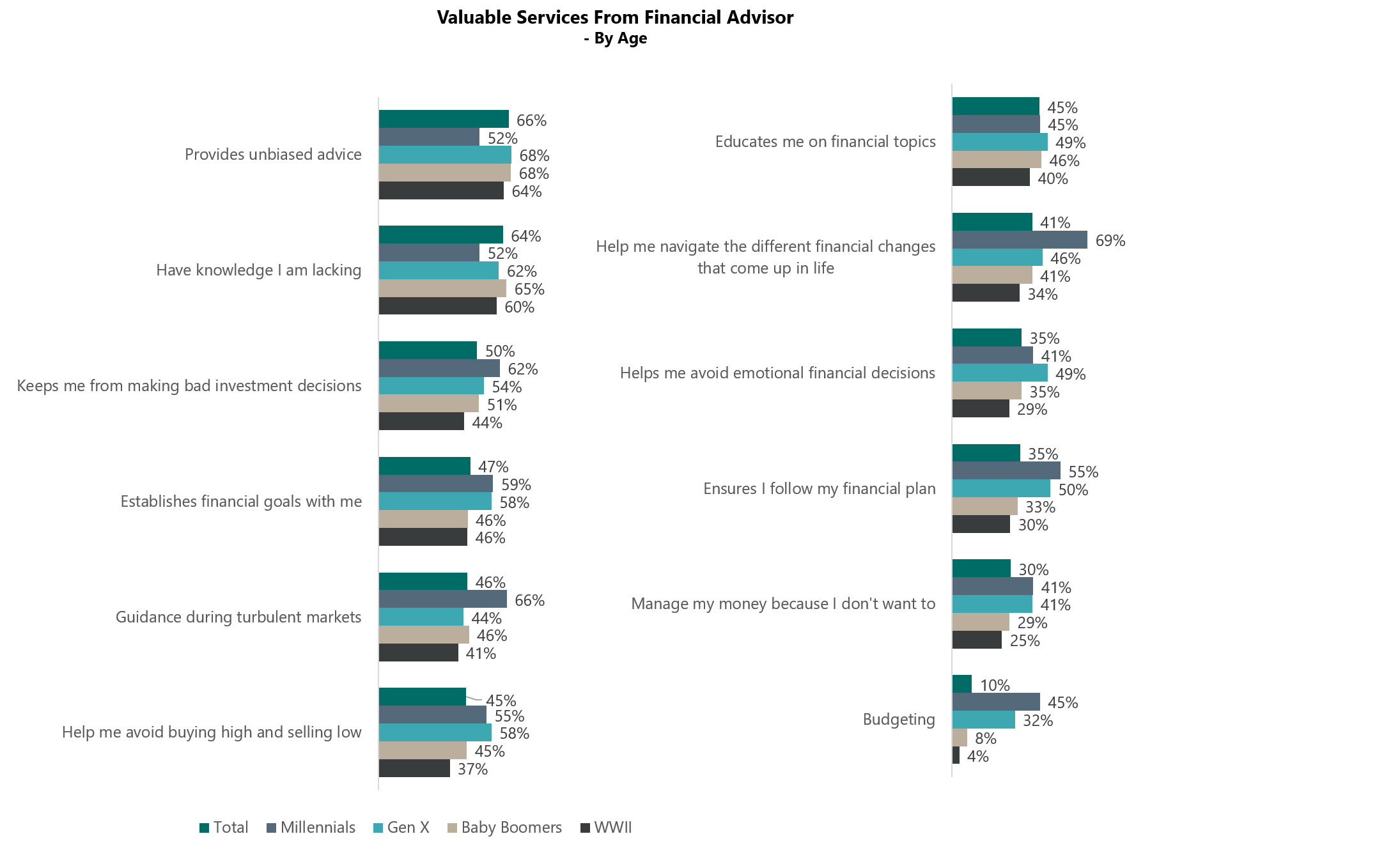

Unbiased advice is the non-investment related service an advisor could provide that 66 percent of wealthy investors find valuable according to recent wealthy investor research from Spectrem Group. It is important for investors to feel as if their financial advisor is only concerned with the investor’s financial picture, not profit for themselves. This desire for unbiased advice is something that investors have been seeking for some time, with many feeling that hiring an advisor who is a fiduciary provides some of that peace of mind. It is important for investors to be aware if their advisor is a fiduciary or not, as many investors think their advisor is a fiduciary, when in reality they are not.

This unbiased advice requires knowledge. An advisor having knowledge that the investor is lacking is considered a valuable service among 64 percent of wealthy investors. That jumps up to 77 percent of investors who are not very or not at all knowledgeable who feel that the advisor having knowledge they are lacking as a valuable service. This knowledge can also help investors from making bad investment decisions, another valuable service according to 50 percent of wealthy investors. Millennials value the avoidance of bad investment decisions even more than other age segments.

Another service that is valued by 46 percent of investors is guidance during turbulent markets. Financial advisors had the opportunity to showcase their value in 2020 with how turbulent the stock market was over the course of the year. More knowledgeable investors are slightly less likely to feel this service is of value to them, while 66 percent of Millennials feel this is a valuable service.

An advisor helping investors from buying low and selling high is another highly valued service for 45 percent of investors. Millennials and Gen X are more likely to value this service from an advisor than older investors. Another service that Millennials and Gen X value more is helping them navigate the different financial changes that come up in life. This is likely because Baby Boomers and WWII investors do not anticipate as many changes for the remainder of their lifetime as younger investors.

While values can vary by age, wealth, gender, and a number of other variables, most investors want a financial advisor who is going to put the needs of their client first and help them throughout their financial lives. Investors looking for an advisor should be asking about these types of services that are not investment related to ensure that the financial advisor will provide everything the investor is looking for.