I have known for many years that my children and I make decisions completely differently. The things that I feel are important components of a decision do not even make it on my kid’s list of considerations, and vice versa. They also interact with their finances in a different manner than I do. Conducting business entirely online is not uncomfortable but rather embraced in my children’s generation. When selecting a financial advisor to work with the differences are evident in my own life, as well as in Spectrem Group’s recent research report “How Advisors Can Increase Referrals and Satisfy Clients”.

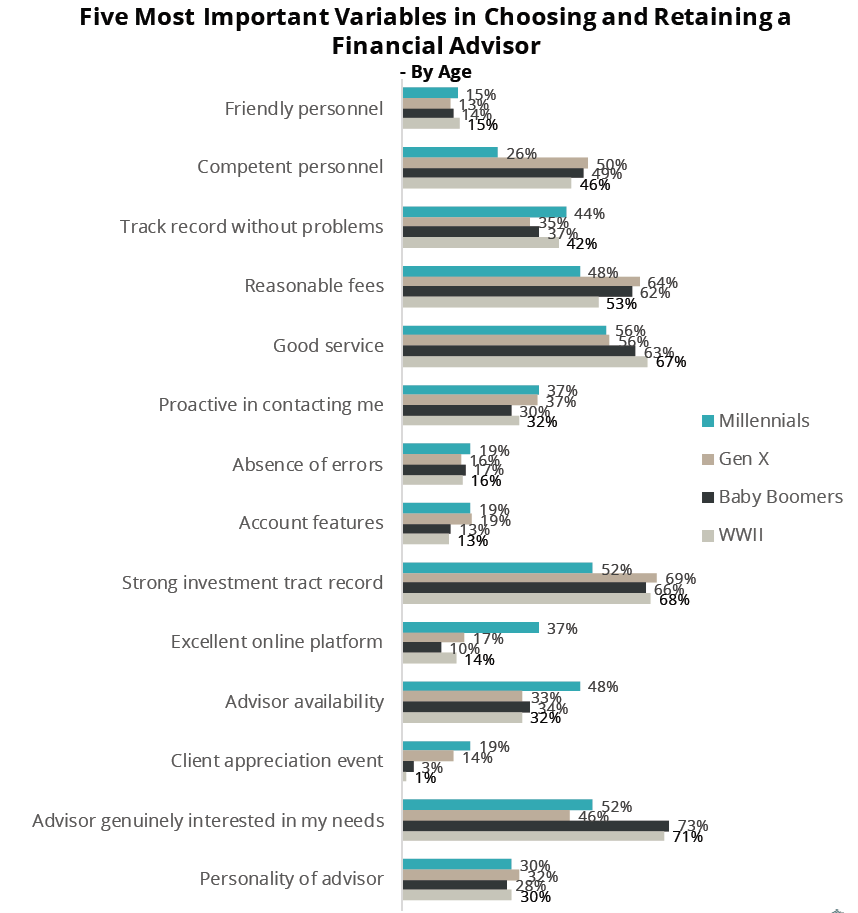

Spectrem sought to understand not only the referral process but also the traits that are most important in the selection process. When wealthy investors were asked to name the top five characteristics to be considered when choosing an advisor there were a few that were important to investors regardless of age. The advisor being genuinely interested in the client’s needs, good service, reasonable fees, a strong investment track record, and competent personnel round out the top five for most wealthy investors.

Now this is where my generation starts to differ from that of my children’s generation. Older investors are more interested in good service and for their advisor to be genuinely interested in their needs. This is not surprising since we grew up in a time where excellent customer/client service was an indicator of a superior experience. Millennials however focus more on the advisor having an excellent online platform as well as the advisor being available as they need. Millennials are used to having all desired information at their fingertips, literally. Online platforms or apps that function well on a mobile device is something that is critical to Millennials since they live their lives online much more so than older investors.

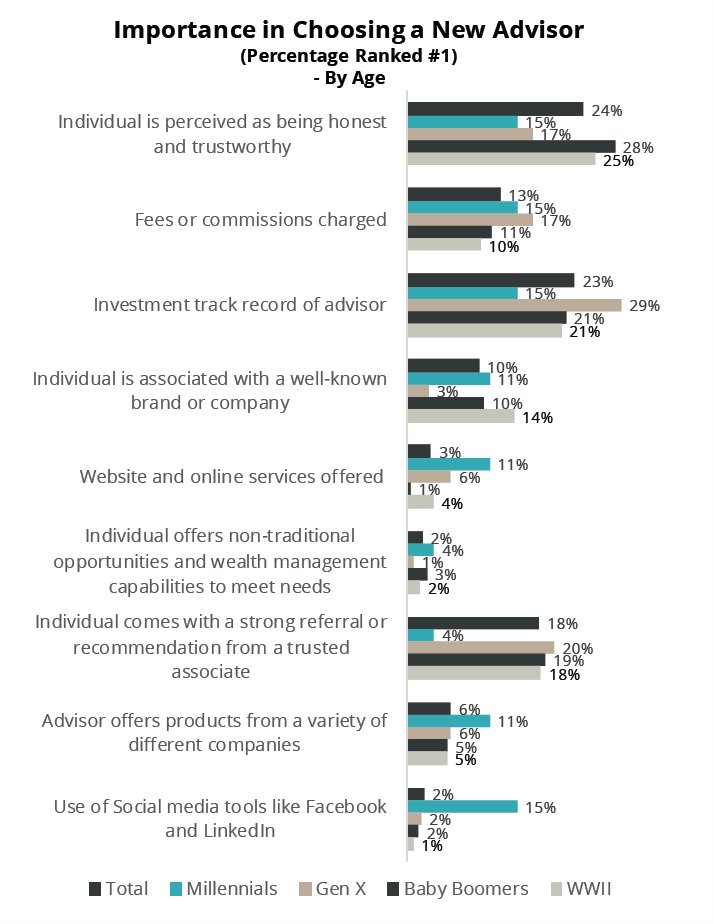

We took it one step further to understand what the most important component is in choosing a new advisor, and the results were somewhat expected, however still very interesting. Baby Boomers and WWII investors feel the most important component is that the financial advisor is honest and trustworthy. Gen X investors most important component in the decision process for a new advisor is the investment track record of the advisor. Finally, Millennials are split in terms of what is the most important component. There is a four-way tie between the advisor being honest and trustworthy, the fees or commissions they charge, the investment track record of the advisor, and finally the advisors use of social media tools like Facebook and LinkedIn.

Even though different generations make decisions so differently, it is easy to see why each of these age segments selected the characteristics the way they did. Gen X lived through multiple significant dips in the economy, so it is understandable that investment track records are so important to them. Millennials have more of an online presence than older investors so various components that address online activities and offerings will take priority for those younger investors.

How did your clients select you to be their primary financial advisor? Do you know what it was about you that caused them to make that final decision?

Related: Firm or Advisor: Who Are Your Clients Most Loyal To?