Written by: George Walper, Jr.

A friend of mine recently received a phone call from their financial advisor, telling them they had changed firms. The advisor asked them to move their business to the new firm.

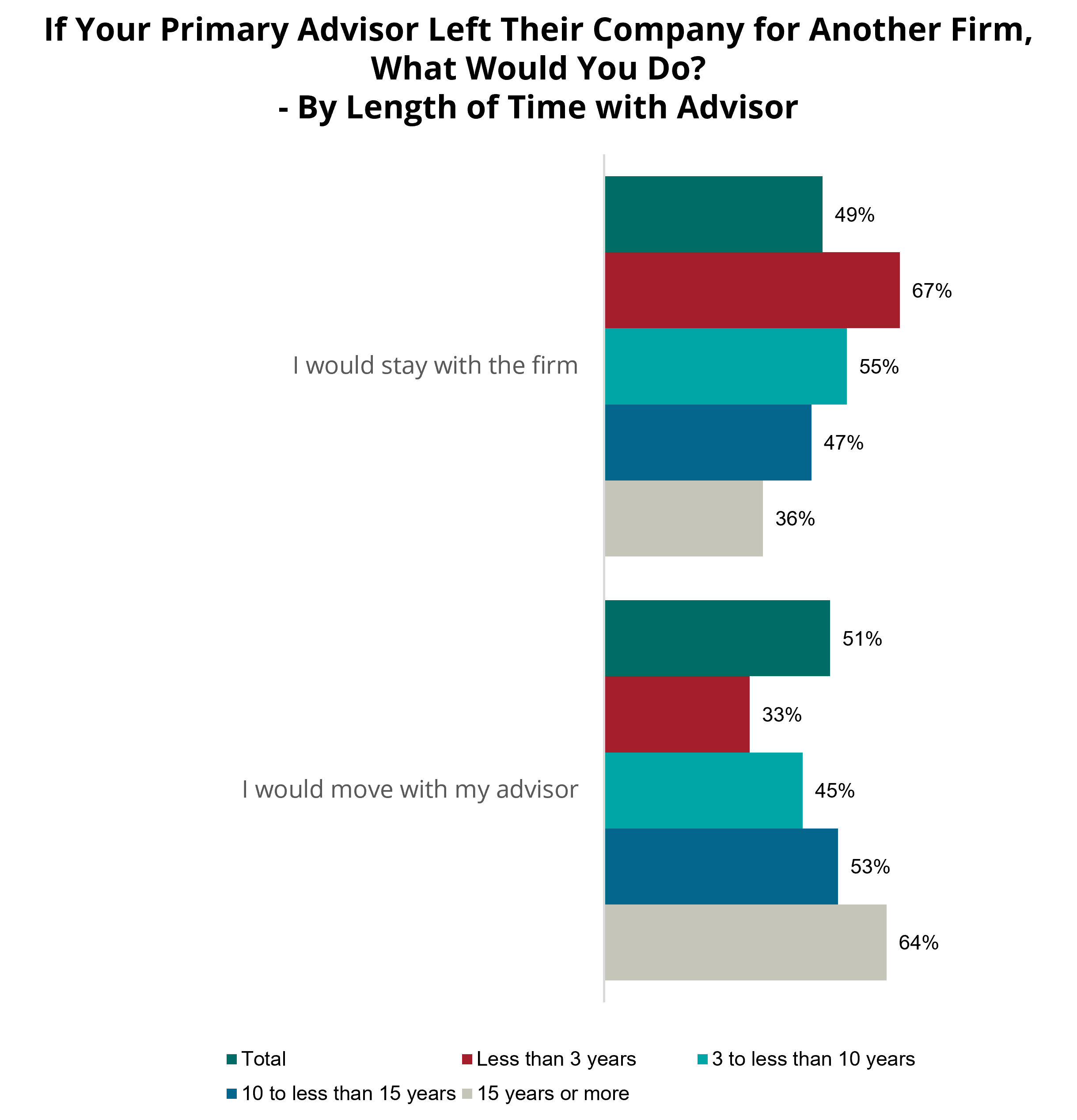

My friend had been with their primary financial advisor for seven years and had worked with them on funding a college education, a wedding, and an upcoming retirement. When faced with the decision of going with their advisor or staying at the firm they were currently working with, they struggled a bit with their decision but ultimately decided to stay with the provider. Their attitude was similar to 55 percent of wealthy investors that Spectrem Group recently researched who had been with their financial advisor for 3-10 years deciding to stay with the firm if their advisor changed firms.

This 3-10 year length of time with an advisor needs to be an area of focus for financial firms to ensure the client consistently sees the added value of the firm and not just the advisor. Financial firms need to be aware that the clients they are most likely to lose are those clients who have worked with the same financial advisor for over 10 years. As the length of time increases, so does the likelihood of the client moving with their financial advisor. Consistently providing added value that is not connected to the financial advisor will be important in creating a connection with the client that will make the client more likely to stay.

Financial advisors are unlikely to stop changing providers, so many wealthy investors will be faced with this decision at some point in their financial lives. Financial firms need to focus on those relationships that are in the mid-range, enhancing their communications and services to meet the needs of those clients and ensure the client doesn’t consider moving with their advisor.

Related: Satisfaction With Investment Performance Lagging in RIAs