Surging bond yields continues to weigh on tech stocks. When the 10-year yield pops by 20 basis points to reach a 1-year high, that will happen.

Tuesday (Feb. 23) saw the Dow down 360 points at one point, and the Nasdaq down 3% before a sharp reversal that carried to Wednesday (Feb. 24).

Thursday (Feb. 25) was a different story and long overdue.

Overall, the market saw a broad sell-off with the Dow down over 550 points, the S&P falling 2.45%, the Nasdaq tanking over 3.50%, and seeing its worst day since October, and the small-cap Russell 2000 shedding 3.70%.

Rising bond yields are a blessing and a curse. On the one hand, bond investors see the economy reopening and heating up. On the other hand, with the Fed expected to let the GDP heat up without hiking rates, say welcome back to inflation.

I don’t care what Chairman Powell says about inflation targets this and that. He can’t expect to keep rates this low, buy bonds, permit money to be printed without a care, and have the economy not overheat.

He may not have a choice but to hike rates sooner than expected. If not this year, then in 2022. I no longer buy all that talk about keeping rates at 0% through 2023. It just can’t happen if bond yields keep popping like this.

This slowdown, namely with the Nasdaq, poses some desirable buying opportunities. The QQQ ETF, which tracks the Nasdaq is down a reasonably attractive 7% since February 12. But there still could be some short-term pressure on stocks.

That correction I’ve been calling for weeks? It may have potentially started, especially for tech. While I don’t foresee a crash like we saw last March and feel that the wheels are in motion for a healthy 2021, I still maintain that some correction before the end of March could happen.

I mean, we’re already about 3% away from an actual correction in the Nasdaq...

Bank of America also echoed this statement and said, “We expect a buyable 5-10% Q1 correction as the big ‘unknowns’ coincide with exuberant positioning, record equity supply, and as good as it gets’ earnings revisions.”

Look. This has been a rough week. But don’t panic, and look for opportunities. We have a very market-friendly monetary policy, and corrections are more common than most realize.

Corrections are also healthy and normal market behavior, and we are long overdue for one. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017), and we haven’t seen one in a year.

A correction could also be an excellent buying opportunity for what could be a great second half of the year.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don’t think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Nasdaq- To Buy or Not to Buy?

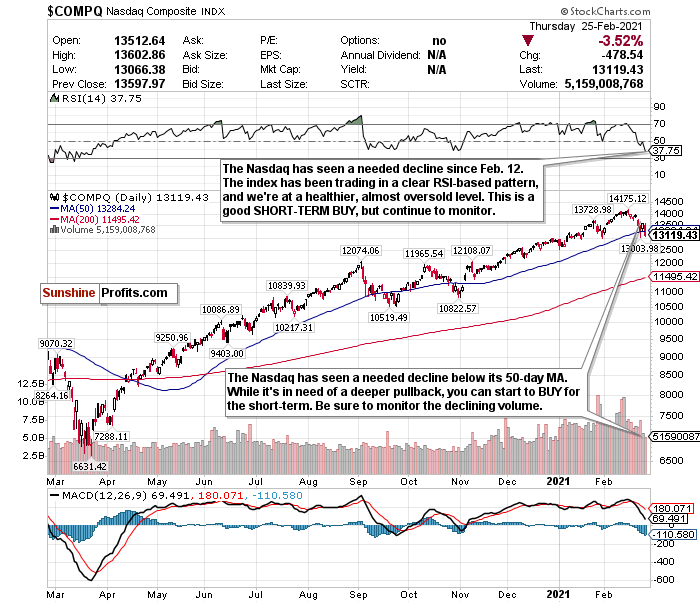

Figure 1- Nasdaq Composite Index $COMP

This downturn is so overdue. More pain could be on the horizon, but this road towards a correction was needed for the Nasdaq.

Before February 12, I would always discuss the Nasdaq’s RSI and recommend watching out if it exceeds 70.

Now? As tracked by the Invesco QQQ ETF , the Nasdaq has plummeted by nearly 7% since February 12 and is trending towards oversold levels! I hate to say I’m excited about this recent decline, but I am.

While rising bond yields are concerning for high-flying tech stocks, I, along with much of the investing world, was somewhat comforted by Chairman Powell’s testimony the other day (even if I don’t totally buy into it). Inflation and rate hikes are definitely a long-term concern, but for now, if their inflation target isn’t met, who’s to fight the Fed?

Outside of the Russell 2000, the Nasdaq has been consistently the most overheated index. But after its recent slowdown, I feel more confident in the Nasdaq as a SHORT-TERM BUY.

The RSI is king for the Nasdaq . Its RSI is now under 40, which makes it borderline oversold.

I follow the RSI for the Nasdaq religiously because the index is simply trading in a precise pattern.

In the past few months, when the Nasdaq has exceeded an overbought 70 RSI, it has consistently sold off.

- December 9- exceeded an RSI of 70 and briefly pulled back.

- January 4- exceeded a 70 RSI just before the new year and declined 1.47%.

- January 11- declined by 1.45% after exceeding a 70 RSI.

- Week of January 25- exceeded an RSI of over 73 before the week and declined 4.13% for the week.

I like that the Nasdaq is almost the 13100-level, and especially that it’s below its 50-day moving average now.

I also remain bullish on tech, especially for sub-sectors such as cloud computing, e-commerce, and fintech.

Because of the Nasdaq’s precise trading pattern and its recent decline, I am making this a SHORT-TERM BUY. But follow the RSI literally.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

For more of my thoughts on the market, such as the streaky S&P, inflation, and emerging market opportunities, sign up for my premium analysis today.

Related: Was That the Shortest Stock Correction Ever?

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.