What a day that was. What started off looking like a sea of red not seen in months ended with the Dow and S&P in the green.

It was an overdue plummet- at least that’s what I thought at the start of the day. The Dow was down 360 points at one point, and the Nasdaq was down 3%.

But by the end of the day, Jay Powell played the role of Fed Chair and investor therapist and eased the fears of the masses.

The Dow closed up, the S&P snapped a 5-day losing streak, and the Nasdaq only closed down a half of a percent!

You really can’t make this up.

The day started gloomily with more fears from rising bond yields.

Sure, the rising bonds signal a return to normal. But they also signal inflation and rate hikes from the Fed.

But Powell said “not so fast” and eased market fears.

“Once we get this pandemic under control, we could be getting through this much more quickly than we had feared, and that would be terrific, but the job is not done,” Powell said .

He also alluded to the Fed maintaining its commitment to buy at least $120 billion a month in U.S. Treasuries and agency mortgage-backed securities until “substantial further progress is made with the recovery.

While the slowdown (I’d stop short of calling it a “downturn”) we’ve seen lately, namely with the Nasdaq, poses some desirable buying opportunities, there still could be some short-term pressure on stocks. That correction I’ve been calling for weeks may have potentially started, despite the sharp reversal we saw today.

Yes, we may see more green this week. But while I don’t foresee a crash like we saw last March and feel that the wheels are in motion for a healthy 2021, I still maintain that some correction before the end of Q1 could happen.

Bank of America also echoed this statement and said, “We expect a buyable 5-10% Q1 correction as the big ‘unknowns’ coincide with exuberant positioning, record equity supply, and as good as it gets’ earnings revisions.”

With more earnings on tap for this week with Nvidia (NVDA) on Wednesday (Feb. 24) and Virgin Galactic (SPCE) and Moderna (MRNA) on Thursday (Feb. 25), buckle up.

The rest of this week could get very interesting.

Look. Don’t panic. We have a very market-friendly monetary policy, and corrections are more common than most realize. Corrections are also healthy and normal market behavior, and we are long overdue for one. Only twice in the last 38 years have we had years WITHOUT a correction (1995 and 2017), and we haven’t seen one in a year.

A correction could also be an excellent buying opportunity for what could be a great second half of the year.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

While there is long-term optimism, there are short-term concerns. A short-term correction between now and the end of Q1 2021 is possible. I don’t think that a decline above ~20%, leading to a bear market, will happen.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Nasdaq- To Buy or Not to Buy?

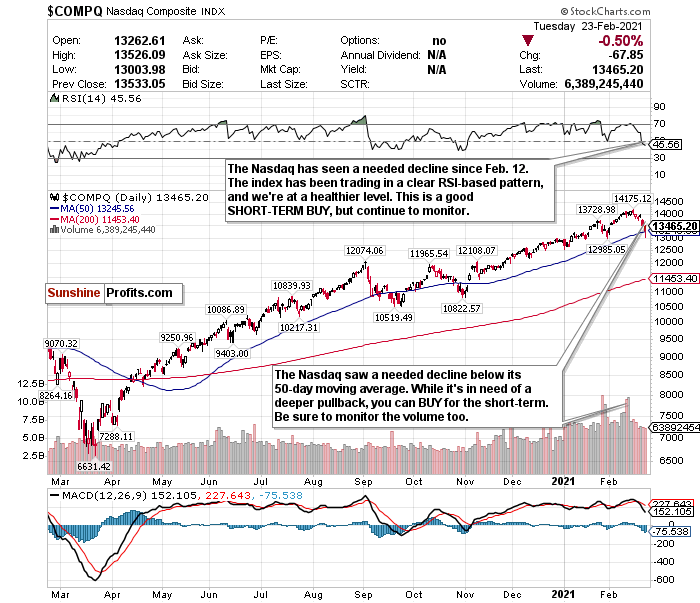

Figure 1- Nasdaq Composite Index $COMP

What a difference a few weeks can make!

Before, I was talking about the Nasdaq’s RSI and to watch out if it exceeds 70.

Now? As tracked by the Invesco QQQ ETF , the Nasdaq has plummeted by 4.5% since February 12 and is trending towards oversold levels! I hate to say I’m excited about this recent decline, but I am. This has been long overdue, and I’m sort of disappointed it didn’t end the day lower.

Now THAT would’ve been a legit buying opportunity.

While rising bond yields are concerning for high-flying tech stocks, I, along with much of the investing world, was somewhat comforted by Chairman Powell’s testimony. Inflation and rate hikes are definitely a long-term concern, but for now, if their inflation target isn’t met, who’s to fight the Fed?

Outside of the Russell 2000, the Nasdaq has been consistently the most overheated index. But after today, I feel more confident in the Nasdaq as a SHORT-TERM BUY.

But remember. The RSI is king for the Nasdaq . If it pops over 70 again, that makes it a SELL in my book.

Why?

Because the Nasdaq is trading in a precise pattern.

In the past few months, when the Nasdaq has exceeded 70, it has consistently sold off.

- December 9- exceeded an RSI of 70 and briefly pulled back.

- January 4- exceeded a 70 RSI just before the new year and declined 1.47%.

- January 11- declined by 1.45% after exceeding a 70 RSI.

- Week of January 25- exceeded an RSI of over 73 before the week and declined 4.13% for the week.

I like that the Nasdaq is below the 13500-level, and especially that it’s below its 50-day moving average now. I also remain bullish on tech, especially for sub-sectors such as cloud computing, e-commerce, and fintech.

But the pullback hasn’t been enough.

Because of the Nasdaq’s precise trading pattern and its recent decline, I am making this a SHORT-TERM BUY. But follow the RSI literally.

For an ETF that attempts to directly correlate with the performance of the NASDAQ, the Invesco QQQ ETF (QQQ) is a good option.

For more of my thoughts on the market, such as the streaky S&P, inflation, and emerging market opportunities, sign up for my premium analysis today.

Related: The Yield Harbinger for Stocks

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.