Prepare yourself. March Madness could be here. No, I’m not talking about the college basketball tourney either.

Stocks will be hanging onto Jay Powell’s every word and every breath on Wednesday (Mar. 17) and scrutinize his thoughts on interest rates and inflation.

Pretty much, we’re the Fed’s hostages until this thing gets some clarity. Even if Powell says nothing, the markets will move. That’s just how it’s going to work.

Rick Rieder, BlackRock’s CIO for global fixed income, echoed this statement. “I think the last press conference, I think I watched with one eye and listened with one ear. This one I’m going to be tuned in to every word and the markets are going to be tuned in to every word. If he says nothing, it will move markets. If he says a lot, it will move markets.”

Jay Powell is the biggest market mover in the game now. What’s coronavirus anymore?

So far, it’s been a relatively tame week for the indices. The Nasdaq’s continued playing catch-up and has outperformed, while the Dow and S&P are still hovering around record highs.

The wheels are in motion for pent-up consumer spending and a strong stock rally. Plus, we have that $1.9 trillion stimulus package heating up the economy and an army of retail traders with an extra $1,400 to play with.

Inflation fears and surging bond yields are still a concern and have caused significant volatility for growth stocks. But let’s have a little perspective here. Plus, jobless claims beat estimates again and came in at 712,000. This is nearly the lowest they’ve been in a whole year. Last week’s inflation data also came in more tamer than expected.

But bonds yields still remain the market’s biggest wild card. Yes, yields are still at a historically low level, and the Fed Funds Rate remains 0%. But depending on how things go around 2 pm Wednesday (Mar. 17), yields could potentially pop again, reinvigorating the rotation into value and cyclical plays and out of tech and growth plays.

Time will tell what happens.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

There is optimism but signs of concern. The market has to figure itself out. A further downturn is possible, but I don’t think that a decline above ~20%, leading to a bear market, will happen any time soon.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

Russell 2000- Lessons Learned

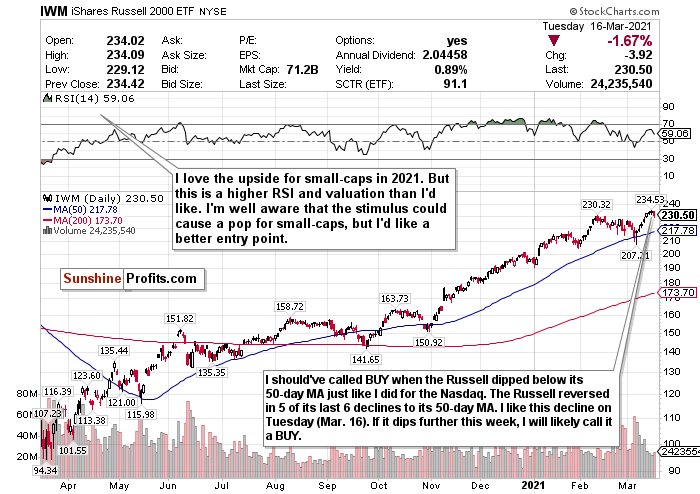

Figure 1- iShares Russell 2000 ETF (IWM)

The Russell 2000 was the biggest laggard on Tuesday (Mar. 16). I think I’m starting to figure this index out, though, for a solid entry point.

I have been kicking myself for not calling BUY on the Russell after seeing a minor downturn when the markets got rocked in the second half of February. I may have broken my own rule about “not timing the market” also. I’ve wanted to buy the Russell 2000 badly forever but never thought it dipped hard enough (whenever it did). I was waiting for it to at least approach a correction.

But I think I figured out a pattern now. Notice what happened with the Russell almost every time it touched or minorly declined below its 50-day moving average. It reversed. Look at the above chart. Excluding the large crash and subsequent recovery in late-March and April 2020, 5 out of the last 6 times the Russell did this with its 50-day, it saw a sharp reversal. The only time it didn’t was in October 2020, when the distance between its 50-day and its 200-day moving average was a lot more narrow.

Now, look at the index. As tracked by iShares Russell 2000 ETF (IWM) , its rally since November and year-to-date have been mind-blowing. Pretty much, this is the one reason why I’m more cautious about buying the index.

Since the market’s close on October 30, the IWM has gained about 51.04% and more than doubled ETFs’ returns tracking the more major indices.

Not to mention, year-to-date, it’s already up 19.12% and around at an all-time high.

With that $1.9 trillion stimulus package set to greatly benefit small businesses, the Russell 2000 could pop even more.

Unfortunately, I’m keeping this a HOLD. But I am monitoring the Russell 2000 closely.

Aggressive stimulus, friendly policies, and a reopening world bode well for small-caps in 2021. I think this is something you have to consider for the Russell 2000 and maybe overpay for. The next time the index approaches its 50-day moving average, I will be a little more aggressive.

For more of my thoughts on the market, such as tech, if small-caps are buyable, inflation, and emerging market opportunities, sign up for my premium analysis today.

Thank you for reading today’s free analysis. I encourage you to sign up for our daily newsletter - it's absolutely free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to the premium daily Stock Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Related: Big Trading Week for Stock Markets

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.