Last week went a lot better than the week before. Especially if you’re a Nasdaq bull and bought the dip ( like I recommended Feb 24 ).

The real story, though? We’ve still got the Dow, S&P, and Russell firmly at record highs.

This week should be full of excitement for the indexes. Will we see more record highs? Will the Nasdaq catch up and recover? How will the newly signed $1.9 trillion “America Rescue Plan” impact the market? Will inflation fears and accelerating bond yields spook investors again?

As you can see, there are clearly questions right now for stocks- despite the wheels in motion for pent-up consumer spending and a strong stock rally. Plus, we’ll start having many retail investors with an extra $1,400 to spend looking to have a little fun.

Inflation fears and surging bond yields are still a concern and have caused significant volatility for growth stocks. But let’s have a little perspective here. Bond yields are still at a historically low level, and the Fed Funds Rate remains 0%. Plus, jobless claims beat estimates again and came in at 712,000. This is nearly the lowest they’ve been in a whole year. Last week’s inflation data also came in more tamer than expected.

So what should you pay attention to this week?

More inflation data, jobless claims, and consumer sentiment will be released throughout the week, for one.

But pay incredibly close attention to the Fed. Bonds still remain the market’s biggest wild card. With the Fed meeting Tuesday and Wednesday, bond yields could take their cue from what they say. No action is expected to be taken, and the Fed is expected to indicate more substantial growth. Fed officials are also not expected to alter their interest rate outlook and may stick to the plan of keeping rates this low through 2023.

If this goes as expected, bond yields could potentially pop again, reinvigorating the rotation into value and cyclical plays and out of tech and growth plays.

Time will tell what happens.

My goal for these updates is to educate you, give you ideas, and help you manage money like I did when I was pressing the buy and sell buttons for $600+ million in assets. I left that career to pursue one to help people who needed help instead of the ultra-high net worth.

With that said, to sum it up:

There is optimism but signs of concern. The market has to figure itself out. A further downturn is possible, but I don’t think that a decline above ~20%, leading to a bear market, will happen any time soon.

Hopefully, you find my insights enlightening. I welcome your thoughts and questions and wish you the best of luck.

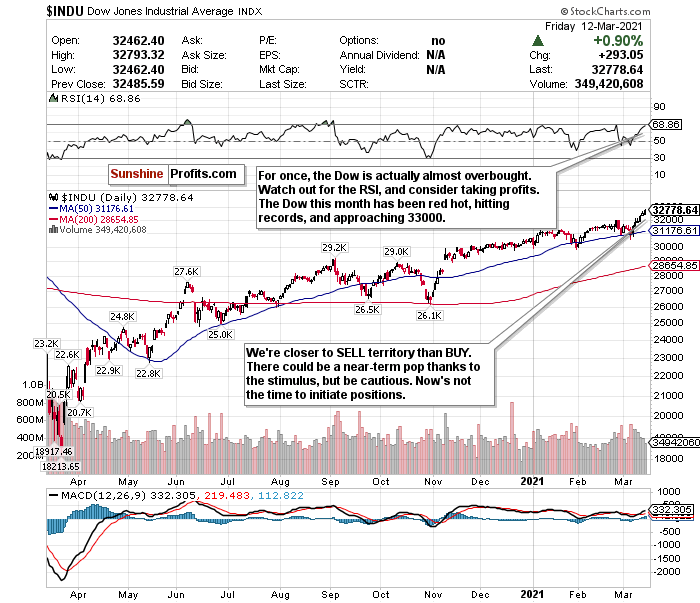

Is the Dow *Gulp* Overbought?

Figure 1- Dow Jones Industrial Average $INDU

Not much new to report on this. Except for that, it keeps ticking up towards overbought territory and hitting record highs. Year-to-date, we’re now up about 7.1%- almost double what the S&P and Nasdaq have done so far this year.

It also managed to gain over 4% this past week.

I don’t feel that we’re buyable at all right now. If you have exposure, HOLD and let it ride. Maybe start to consider taking some profits too.

The index could greatly benefit from the stimulus package due to all of the cyclical stocks it holds. I can definitely foresee some pops in the index as investors digest the unprecedented amount of money being pumped into the economy, coupled with reopening excitement. But you can’t expect the index to keep going up like this and setting records every day. Plus, the RSI is almost 69 and showing overbought signs.

So, where do we go from here?

Many analysts believe the index could end the year at 35,000, and the wheels are in motion for a furious rally. But you could do better for a buyable entry point.

From my end, I’d prefer to stay patient, assess the situation, and find better buying opportunities.

My call on the Dow stays a HOLD, but we’re approaching SELL.

For an ETF that aims to correlate with the Dow’s performance, the SPDR Dow Jones ETF (DIA) is a reliable option.

For more of my thoughts on the market, such as tech, if small-caps are buyable, inflation, and emerging market opportunities, sign up for my premium analysis today.

Related: Stock Records Were Made to be Broken

The views and opinions expressed in this article are those of the contributor, and do not represent the views of IRIS Media Works and Advisorpedia. Readers should not consider statements made by the contributor as formal recommendations and should consult their financial advisor before making any investment decisions. To read our full disclosure, please click here.