This week began with a risk-off tone. On Monday, the S&P 500 logged its worst day since May and the STOXX 600 saw its largest daily decline in 2021. COVID-sensitive assets were hit the hardest, as airlines, banks and energy stocks all fell sharply. Against this risk-off backdrop, the 10-year U.S. Treasury yield fell to its lowest level since February as both inflation breakevens and real rates moved lower, the yield curve flattened, and the U.S. dollar strengthened.

It is difficult to pinpoint exactly what drove this sell-off – in our view, it was a function of a number of factors. To start, rising case counts in the U.K., driven by the delta variant, serve as a reminder that the return to normal may not be as easy as some had assumed. At the same time, recent research from the San Francisco Fed and U.C. Davis has highlighted that in contrast to wars, pandemics induce labor scarcity, more precautionary savings, and put downward pressure on the natural rate of interest. Furthermore, the announcement that the pandemic-induced recession clocked in at just two months (ending in April 2020, making it the shortest on record) has led some investors to question if we are already late cycle, just one year into this expansion. And on top of that, a new set of economic projections from the Congressional Budget Office (CBO) point to below-trend growth taking hold by 2023.

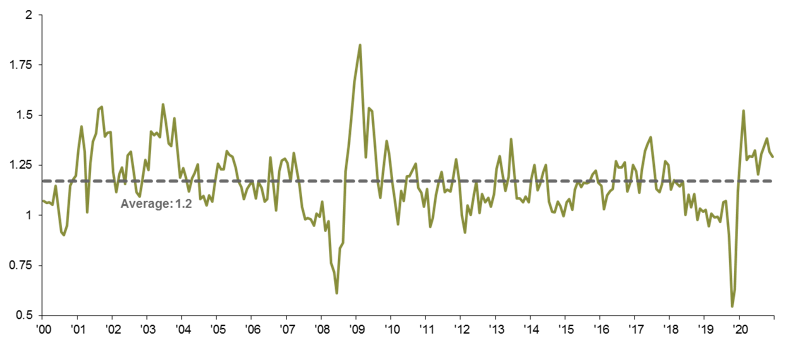

It is reasonable to believe that at some point we will see the U.S. economy return to a trend pace of growth, and furthermore, it would not be surprising for the recovery to be a bit more uneven than was originally anticipated. However, we see reasons to remain optimistic. To start, consumer banking data still points to the presence of substantial reserves, which should provide a tailwind for consumer spending (which is 68% of GDP) as the economy reopens. While the research on post-pandemic behavior highlighted above suggests that consumers may be cautious, substantial support from the federal government suggests the consumer is in a very different place than is usually the case emerging from a pandemic. At the same time, the past 12 months have seen very robust consumption of goods, rather than services – this has led inventories to decline substantially, and the rebuilding process should provide solid support for growth over the coming quarters.

People always debate whether the stock market or bond market is correct. In this case, they both seem to be wrong, but the stock market seems to be “more right.” The current level of the 10-year U.S. Treasury yield suggests negative real growth over the coming year; this is possible, but not probable. Meanwhile, equities rebounded smartly on Tuesday as investors took a deep breath. While we would not be surprised to see volatility remain elevated through the end of the summer, we continue to embrace cyclicality in portfolios through allocations to value, small caps, international equities, and high yield credit.

Net inventories point to rebuilding in the coming quarters

New orders/inventories, ratio

Related: The Unique Challenges for Millennial Investors

1 Jorda, Singh and Taylor. Longer-run economic consequences of pandemics. Federal Reserve Bank of San Francisco, University of California, Davis. February 2021.