Written by: Jack Manley

As the Millennial generation grows in both size and wealth, the financial services industry is paying closer attention to their needs and challenges. Understanding how to properly navigate conversations with Millennials is one important step in building a successful relationship with the next generation of wealth; but to make those conversations fruitful, it is important to recognize the unique challenges that face younger investors today.

Of course, individuals are more than their generational brand, and as a result there is rarely a one-size-fits all descriptor that will accurately encapsulate any one particular person. Nonetheless, research has shown that there are a handful of hurdles faced disproportionately, either in frequency or in magnitude, by younger investors – these hurdles, more often than not, can keep potential investors on the sidelines, and so addressing them is of paramount importance. Below are some of those most pressing ones:

- Student debt and cash flow constraints

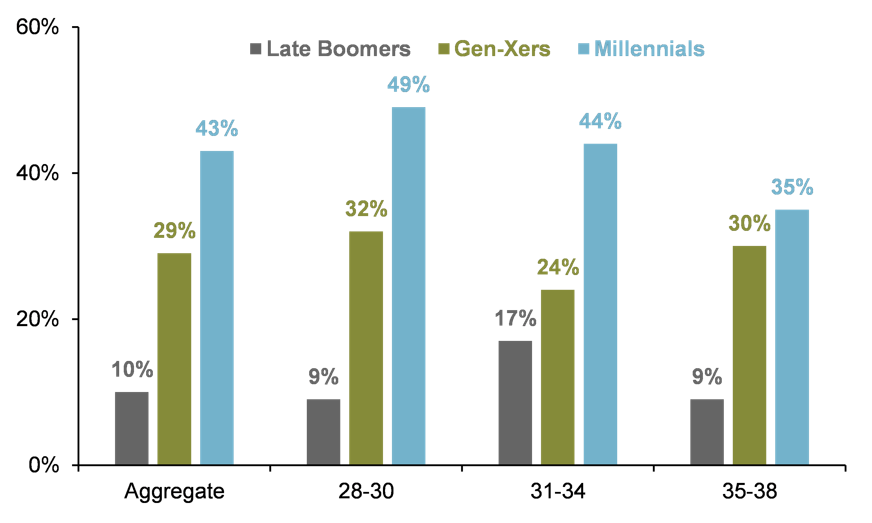

For many young Americans, student debt can be crushing. An estimated 40% of Millennial households are burdened with student debt, and that burden averages out to roughly 40% of annual income. Perhaps more interestingly, this challenge appears to be unique to younger Americans – the student debt burden is higher for Americans aged 28 to 38 now, compared to Baby Boomers or Gen X in the same age bracket years ago1. This has placed these investors at a systematic disadvantage, hampering wealth accumulation and causing cash flow disruptions. - Disillusionment with the financial system

Many Millennials came of age during the Global Financial Crisis (GFC), either entering the workforce during a recession or watching friends and loved ones lose jobs and savings; many in Gen Z had a similar experience with the COVID-19 recession, and watched the stock market roar back to life while unemployment remained elevated at multi-decade highs. These experiences have led, at least for some, to a disillusionment with the financial system – a view that “Wall Street can’t work for me.” - Markets are expensive

A multi-decade period of strong equity market performance and falling bond yields has left a 60/40 portfolio more expensive than ever in history. As a result, future returns are likely to be dampened. These elevated valuations are of course a headwind for all investors, but for those that must spend decades accumulating wealth – Millennials and Gen Z, in particular – this inopportune starting point is particularly troublesome.

The combination of these issues, compounded with a general lack of knowledge surrounding money management, can often times lead to decision paralysis. For this reason, should the financial services industry hope to better serve younger clients, the role of advice is critical – for example, the prioritization of debt repayments, or the decision to buy versus lease a first car, may be as important topics as actual asset allocation. By building relationships through this advice model and expanding the conversations beyond brokerage, both the industry and its clients should flourish.

Millennials have a higher student debt burden than older generations

Student debt-to-income ratio, ages 28-38

Source: Center for Retirement Research at Boston College, Federal Reserve Survey of Consumer Finances, J.P. Morgan Asset Management. Data are as of July 13, 2021.

Related: Navigating Conversations With the Next Generation of Wealth

1 Center for Retirement Research at Boston College, Federal Reserve Survey of Consumer Finances