Written by: David Lebovitz

Most investors believe that the reflation trade will define markets in 2021. This means that cyclical sectors should outperform defensive ones, international stocks should outperform their U.S. counterparts, long-term interest rates should rise, and the U.S. dollar should fall. However, more and more clients are asking us what could undermine this narrative and precipitate a market correction.

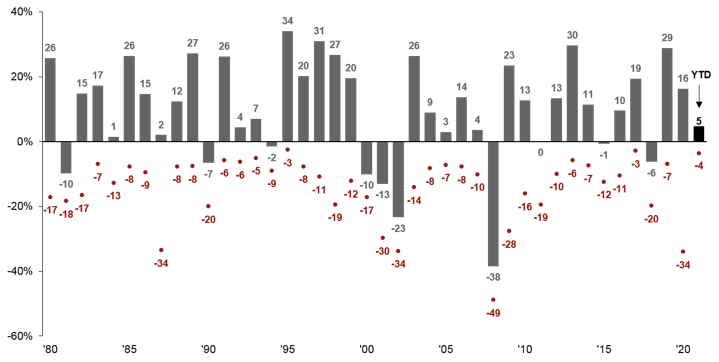

To start it is important to recognize that corrections, and more broadly, volatility, are normal occurrences in the capital markets. What is not normal is what we saw in 2017, when the S&P 500’s largest decline was a mere 3%. In fact, over the past forty-one years, the S&P 500 has seen an average peak-to-trough decline of 14.3%; however, in thirty-one of those years, the S&P 500 went on to finish the year with a positive return. At the end of the day, volatility is normal, but capital markets are resilient.

So the question is not whether or not we will see a correction, but when. In general, volatility tends to rise when investor expectations and reality become misaligned. Right now, investors are expecting that as the economy rebounds and corporate profitability improves, fiscal policy will continue to deliver and monetary policy will remain accommodative. This suggests that the biggest risks are tied to policy outcomes and the trajectory of growth. In the near-term, adverse developments related to the virus that delay economic re-opening would threaten expectations for an improving macro environment. Later this year, disappointment on the fiscal front or a Federal Reserve that changes its tune sooner than expected would both undermine the consensus view.

Complicating things in the current environment is the fact that both investor sentiment and valuations are elevated; this means that even small shocks have the potential to undermine markets. 2021 has started out on a positive note for risk assets, but there is still much road that needs to be traveled. As such, we would fade some of the exuberance that is beginning to manifest itself in markets, and maintain a balanced approach to investing in an effort to protect against bouts of volatility.

Volatility is normal, but markets are resilient

S&P 500 intra-year declines and calendar year price returns

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management.

Related: Is the Recent Outperformance of International Stocks Sustainable?