When it comes to deciding about allocations to U.S. and international developed market equities, advisors know a few things.

Chief among those is that, in bygone eras of investing, it was nice to have exposure to ex-US equities in developed markets for portfolio diversification purposes. Some clients may have even inquired about it without provocation.

Something advisors well know is that while diversification is nice, it's not worth embracing if it means leaving returns on the table and too often in recent years, taking on ex-US developed markets exposure via broad index funds and ETFs meant leaving something on the table.

Consider the following: For the six years ending 2020, the MSCI EAFE Index topped the S&P 500 just once on an annual basis – in 2017. That trend appears unlikely to break this year as the S&P 500 is up 19.8% as of Aug. 12, an advantage of 740 basis points over the developed international benchmark.

Those data points confirm why many client portfolios are likely underweight ex-US developed market stocks while also confirming advisors were right to take that approach.

Signs of Hope...Maybe

Something else advisors know is that for close to a decade they've heard how inexpensive the MSCI EAFE Index is relative to comparable U.S. benchmarks, but they also know – the date bear this out – that valuation alone isn't a reason to get involved. These days, however, international developed is really cheap. Really, really cheap.

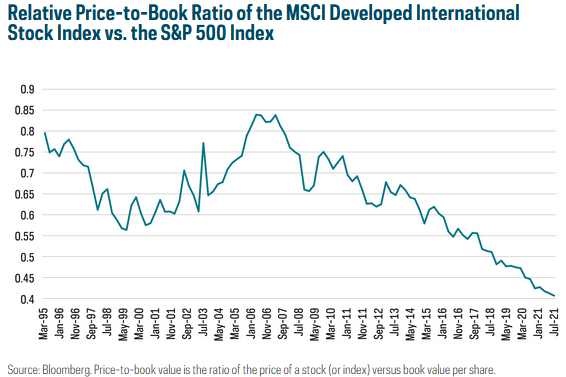

“The valuation case is quite clear: Years and years of underperformance have pushed the MSCI EAFE index down to less than 50% of the price-to-book ratio of the S&P 500, which is an all-time low,” says ProShares Global Investment Strategist Simeon Hyman.

The chart below paints a picture of just how deeply discounted MSCI EAFE is against the S&P 500.

Courtesy: ProShares

Something else advisors know about, and this relevant regardless of geography, is that there are big differences between stocks offering good value and value traps. It appears MSCI EAFE is in the former category because companies in that index are doing well on the earnings front.

“Valuation, of course, has not been a sufficient condition to drive international equities this century. However, consider this: With just over half of companies reporting, MSCI EAFE earnings are running nearly 32% ahead of estimates—almost double that of the S&P 500. Year-over-year growth (admittedly a pandemic-depressed comparison) is over 180%, which is also roughly double that of the S&P 500,” according to Hyman.

Don't Need to Rely on Valuation

Of the major geographic exposures in the MSCI EAFE Index, perhaps only U.K. (weight of 14.53%) is on par with the U.S. in terms of coronavirus vaccinations. That says other developed markets have some catching up to do and as they do, that could be a catalyst for stocks.

That's a variable and it could take time to play out, but in the meantime, ex-US developed market dividends are growing and MSCI EAFE yields 2.26%. Japanese companies (weight of 22.68%) are cash-rich and boosting buybacks and payouts – obvious quality traits.

Bottom line: Advisors don't need developed market stocks to be cheap to take a gander at the asset class, but this time around, valuation may finally payoff.

Advisorpedia Related Articles:

Growth Comeback to Be Built on Foundation of Declining Treasury Yields

Passive Savings Are Still Savings

How to Score Dependable Dividends on the Cheap

There's Still Momentum for Cyclicals, But There's Shelflife, Too