The world is full of contentious debates and while it's often believed that the truly ornery among us reserve their vitriol for political discourse, there's some heat in the fund industry kitchen.

Alright, so there's some hyperbole in there, but as index funds and exchange traded funds keep pilfering assets from mutual funds, the active vs. passive debate intensifies. As advisors well know, there are some important realities in this debate, not the least of which is there are times when active management serves investors and many well-built portfolios feature a blend of active and passive strategies.

Advisors also know (many of their clients know it, too) that active management is hard. Really hard. So difficult in fact that data confirm many active managers struggle to beat benchmarks.

“In the 20 years ending in 2020, 94% of all large-cap U.S. managers lagged the S&P 500®. Mid- and small-cap results were almost equally disappointing,” writes Anu Ganti, S&P Dow Jones Indices senior director, index investment strategy. “A notable consequence of these shortfalls in active performance has been the rise in passive investing, one of the most significant trends in modern financial history.”

To be fair to active managers, those running bond funds did very well in the first half of 2021 with many beating benchmarks.

Fees Matter or Do They?

Earlier this week, State Street Global Advisors (SSGA) released a survey chock full of interesting, relevant tidbits for advisors. Among the more noticeable is data suggesting clients aren't prioritizing fund fees the way used to.

In fact, the study indicates those polled say 0.61% per year is the line in the sand for an ETF being “cheap.” The reality is it is 0.10% or less. However, while fund fees aren't foremost on clients' minds, there's still a value add opportunity for advisors here because math doesn't change and the math favors low-cost investments, most of which are passive.

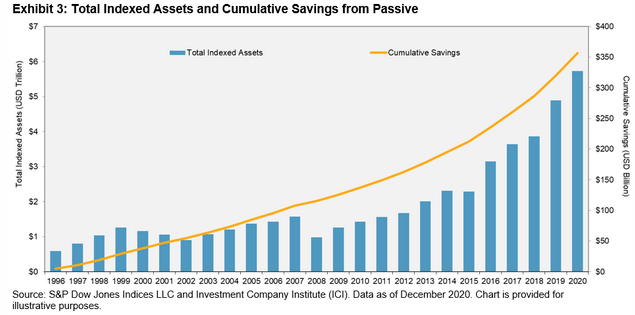

“We can estimate the fee savings each year by taking the difference in expense ratios between active and index equity mutual funds, and multiplying this difference by the total value of indexed assets for the S&P 500, S&P 400 and S&P 600. When we aggregate the results, we observe that the cumulative savings in management fees over the past 25 years is $357 billion,” according to S&P's Ganti.

A picture is worth 1,000 words as highlighted by the chart below.

Courtesy: S&P Dow Jones Indices

To put $357 billion in savings into context, that figure is more than $15 billion in excess of Home Depot's (NYSE:HD) market capitalization as of July 29.

Settling the Debate

An unfortunate result of the way the world is today is people are pigeonholed in various circumstances and contrasting styles are often seen as combatants.

That shouldn't be the case in investing. There's room at the inn of portfolios for both active and passive strategies and with many clients needing income and something more than bland aggregate bond exposure, active could be the way to go in the fixed universe.

For equity exposure, advisors have data on their side and clients are going to love the cost savings whether it's top priority for them today or not. At the end of the day, active vs. passive shouldn't be a heated argument. As advisors know, there's no debate about the ultimate objective: Better client outcomes.

Advisorpedia Related Articles:

How to Score Dependable Dividends on the Cheap

There's Still Momentum for Cyclicals, But There's Shelflife, Too

Pair of New Indexes Make it Easier to Harness Dividend Growth