Data confirm that advisors, institutional investors and retail market participants love investing in specific sectors – something they usually do with exchange traded funds.

Of the 100 largest US-listed ETFs, 11 are sector or industry funds. That says plenty of investors see value in the tactical expressions offered by industry and sector fare. Importantly, an array of sector ETFs are popular with end users, not just the funds representing the largest sectors in the S&P 500.

In fact, the current market climate is appropriate for increasing sector-specific allocations. Falling correlations across sectors and wider dispersions make that point.

“The current market environment appears highly conducive to sector investing based on two variables: correlation and dispersion,” says Matthew Bartolini, SPDR Americas head of research. “Simply put, a high dispersion of returns across sectors indicates opportunities to generate alpha by correctly over- and under-weighting certain market segments. And a low pairwise correlation across sectors, where assets are moving more independently from one another, means returns are not clustered around one driving market force.”

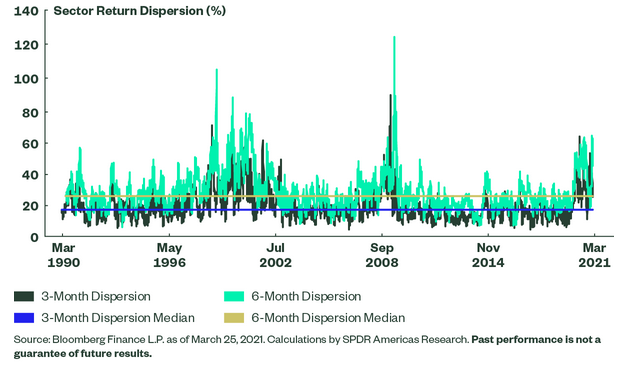

As the chart below indicates, sector dispersions aren't at all-time highs, but they are above-average today.

Courtesy: State Street Global Advisors

Dispersion Matters Today

As a quick refresher, dispersion gauges how similarly an index's components perform. However, that doesn't mean in that in the current environment, sector dispersion is being driven by one overt leader and a clear laggard.

Examining a top two/bottom two dispersion “illustrates a constructive dispersion environment for over- or under-weighting specific sectors. This differential sits in the 82nd and 96th percentiles, respectively,” notes Bartolini.

Wide dispersion is relevant to advisors because it can bring opportunities to deploy sector rotation strategies – low dispersion settings usually mean the importance of sector skill declines – as well as evaluating thinner sector slices, such as industry funds.

“This dispersion acts as the fuel for sector rotation strategies, as adaptive portfolios have the potential to capture the returns from stronger sectors while limiting exposure to weaker sectors, producing added returns over time,” according to Nasdaq Research.

Simple math explains why advisors should consider dispersion and why it can be an important talking even with novice clients. For the decade ending 2019, dispersion between the best- and worst-performing sectors – technology and energy – was wide at 360%. The potential for that type of width exists today because of the reflation and reopening trades, among other factors.

Compelling Correlation

Dispersion doesn't have the limelight all to itself. Correlations are adding to the case for sector investing today.

“Low correlations among sectors (pairwise correlations) and high return dispersion support the alpha argument,” adds Bartolini. “Sectors moving more indifferently to each other signify less of a clustered return environment where returns are being driven by a confluence of macro or fundamental variables — rather than by just one factor (e.g., beta).”

The outlook for interest rates also highlights correlation opportunities with rate-sensitive groups, such as bank stocks, and sectors that thrive when 10-year yields are low.

“The differentiated correlation environment can be partly attributed to the reflationary rate regime shift that we are witnessing, where higher rates are having a disparate impact on sectors based on how sensitive the firms within those markets are to the US 10-year,” says Bartolini. “This is evident when comparing the returns of two sector portfolios (a high rate- sensitive and low rate-sensitive) over the past few months. The high rate-sensitive portfolio contains Energy and Financials, while the low rate-sensitive portfolio contains Real Estate and Consumer Staples.”

Indeed, correlation and dispersion are “nerdy” topics, but these days, the pair are ways for advisors to add unexpected value within client portfolios and that's worth talking about.

Advisorpedia Related Articles:

Marvel at the Middle for Rising Rates Protection

Surprising Sector Destination to Lift Clients' Income Profiles