The universe of thematic investment is expanding at a rapid pace meaning advisors are sure to be discussing topics such as artificial intelligence (AI), e-commerce, electric vehicles and genomics, among others, with clients.

This investment, which is highly accessible via exchange traded funds, is of particular interest to advisors on a demographic level because many of the concepts and technologies bearing the thematic labels are familiar to and widely used by clients in the Gen X, millennial and Gen Z groups – all demographics coveted when it comes to the oft-discussed transfer of wealth.

As noted above, what's considered thematic is a broad, expanding universe and within that space, not all the concepts are of interest to clients or suitable for inclusion in their portfolios. One of the more tried and true and credible thematic investment segments is fintech.

Arguably, fintech is one of the more durable of the disruptive investment segments because traditional banking, loan-making and trading services are ripe for dramatic alteration. Additionally, it's approachable for both advisors and clients because they're undoubtedly familiar with using PayPal, Zelle, a smartphone on a point-of-sale receiver or the ‘buy now’ button on an e-commerce platform.

However, this a fast-changing landscape and one with ample opportunity for risk-tolerant, alpha-seeking investors. Here are some fintech preparedness tips for advisors.

New Fintech Phenomenons

Of the course of discussing fintech with clients, advisors are likely to some level of familiarity due to the aforementioned factors, such as PayPal and “buy now” buttons, but clients may not be aware of emerging concepts such as refreshed approaches to old school credit cards, including the iteration of “buy now, pay later” (BNPL).

“In a dramatic contrast to credit card lending rates, BNPL often features 0% APR for consumers, which can make BNPL a good option for consumers with low or nonexistent credit,” notes Global X analyst Pedro Palandrini. “Consumers only incur fees if they’re late on their payment schedule. Late payments can hurt a consumer’s credit score or their chances of qualifying for another BNPL loan. For merchants, BNPL may lead to higher sales. Some studies show that half of consumers spend 10–40% more when they use a BNPL service instead of a credit card. American BNPL firm, Affirm, estimates that BNPL solutions increase by 20% conversion rates and 87% in average order value for retailers.”

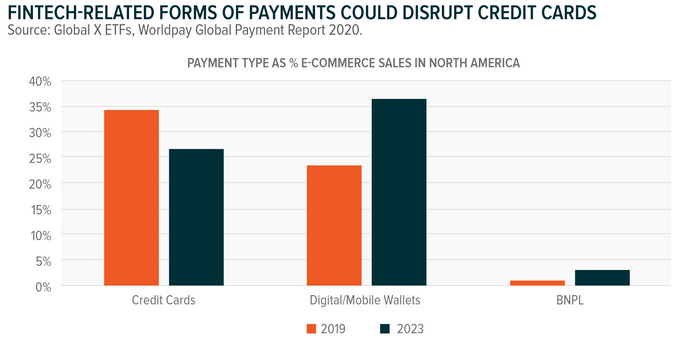

What's interesting about BNLP is that it currently represents a scant percentage of overall U.S. e-commerce sales – just 1% – but that percentage could triple in just two years, cementing this niche's status as a potentially sizable disruptor to traditional credit cards.

Courtesy: Global X

Another area of fintech discussion, particularly with younger clients, is cryptocurrency. The synergies here are palpable as purveyors of digital wallets – think Square's CashApp and PayPal's Venmo – make it easy for users to buy, sell and hold bitcoin all while creating new, potentially lucrative revenue streams for equity investors.

“The FinTech firms behind digital wallets continue to add products that can drive higher customer lifetime value. Cryptocurrency is one vertical that is proving adept at accelerating top-line revenue growth for companies,” adds Palandrini. “For example, Square launched Bitcoin trading through its CashApp in 2018. Cumulative revenue generated through its Bitcoin offering since then totals $3.5 billion, including $1.6 billion in Q3 2020 alone.”

Important Intersection

An attractive part of the thematic investment proposition and one that often goes overlooked is how various disruptive themes mingle with each other.

For example, cloud computing and fintech are intertwined because some fintech companies are purveyors of cloud technologies that are used by, believe it or not, traditional banks. This relationship is relevant for multiple reasons, including younger demographics not seeing a need to enter costly bank branches forecasts indicating global banks will spend $112 billion on cloud solutions this year.

“More than just digital payments, the next generation of disruptive FinTech includes services like BNPL, digital wallets, and powerful cloud solutions that can improve the banking experiences,” says Palandrini. “These are a few of the trends in the FinTech ecosystem that we expect to increasingly test the financial service industry’s traditional norms and create investment new opportunities.”

Bottom line: There's a lot happening in fintech and many of those goings on offer long runways for growth that are palatable and beneficial to clients. Translation: Brush up on fintech as a new age value add for superior client engagement.

Related Advisorpedia Articles:

Assessing Bitcoin's Role in Portfolios, Store of Value Traits

Netflix and Chill Isn't Just for Friday Night. A New ETF Says It's for Investors, Too.