Undoubtedly, fear and greed are two of the most powerful emotions and financial markets act as daily laboratories to test that thesis.

Asset class or security isn't relevant. Human behavior rarely changes. Hence why market participants have a preponderance for piling into assets that are soaring (fear of missing out/greed for more upside) and seemingly fleeing for the exits all at once when an asset declines (fear of more losses).

Bitcoin, though young by the standards of financial assets, is a proving ground for the impact fear and greed can have on an asset's pricing and volatility. The largest digital currency notoriously giveth and taketh away in gut-wrenching fashion.

“The price fell more than 80% from the December 2017 high to the December 2018 low. Then, it rallied 800% from the March 2020 low to the January 2021 high. And that’s just the past 3 years,” writes Phil Pearlman of Osprey.

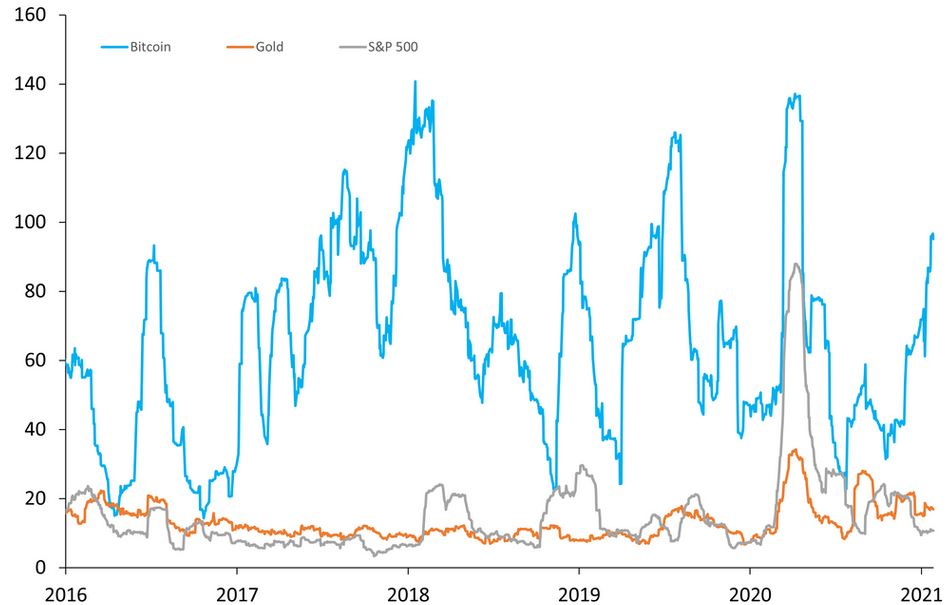

As the chart below indicates, bitcoin's rolling 30-day volatility over the past five years is significantly higher than that of the S&P 500 and gold – the traditional asset the crypto currency is most often compared to.

Courtesy: Osprey by REXShares

Broaching Bitcoin Subject With Clients

Although bitcoin and other cryptocurrencies are prone to dramatic moves, human nature being what it is, clients have a tendency to focus on reward potential (fear of missing out) not risk being incurred. Said another way, it's reasonable to surmise advisors are having more crypto-related conversations with clients following bitcoin's stellar 2020 performance.

This is a value add opportunity for advisors because owing to crypto's status as a relatively new asset class – bitcoin is just 12 years old – there's considerable debate regarding how much, if any, of a client portfolios it should command. There's no one-size-fits-all approach, indicating how advisors talk to clients about bitcoin largely revolves around expected holding periods.

“Bitcoin can play a role in diversifying a portfolio, but the impact of adding various weightings varies depending on the time period,” notes Morningstar analyst Amy Arnott.

Like gold, bitcoin and other digital currencies don't pay interest like bonds and there is no dividend. Still, buy-and-hold is actually a desirable strategy with bitcoin, particularly if it occupies a small percentage in client portfolios. After all, there's a reason HODL – hold on for dear life – is frequently use crypto vernacular.

“Nevertheless, hodling seems like a rational strategy to express a bullish fundamental thesis akin to long-term stock investors who stick to their plans, managing not just their wealth, not just their risk, but their fear,” says Pearlman.

Regarding Volatility...

Advisors can deliver some good news to clients regard bitcoin volatility. Last year, roughly a third of the stocks in the S&P 500 were more turbulent than bitcoin.

Additionally, digital currencies aren't highly correlated to equities, meaning portfolio volatility is dramatically affected by small allocations to the asset class.

“Because of its low correlation with the equity market, adding bitcoin didn’t increase volatility all that much. Even a 10% bitcoin weighting would have increased the portfolio’s standard deviation by a fairly moderate amount,” says Morningstar's Arnott. “From a portfolio perspective, higher returns more than offset the added volatility; Sharpe ratios increased in tandem with higher weightings in bitcoin.”

Related: Bitcoin Price Drops to Be Used as Buying Opportunity