Sector exchange traded funds are more than two decades old and the asset class continues appealing to increasingly wide audience.

What was once the territory of institutional investors and professional traders is increasingly home to assets allocated by registered investment advisors (RIAs) on behalf of clients and retail investors making their own individual industry and sector bets. Across the board, data confirm as much.

“During the trailing 12 months ended March 2021, the U.S. sector equity broad category group posted record inflows of more than $125 billion, while U.S. equity funds recorded outflows of $239 billion,” notes Morningstar. “While the inflows trend for sector funds has been slowly building over the past decade--sector equity funds outdrew U.S. equity funds in six out of the past 10 years--the change over the past 18 months has been dramatic. In the first three months of 2021, $56 billion went into sector funds.”

That's big money and evidence of a durable trend, indicating the time is right for advisors to discuss sector and industry strategies with clients, if clients themselves aren't already making related inquiries.

Sector Investing Beckons Now

The current market environment is conductive to sector investing with correlations and dispersion underscoring that point. However, momentum for sector ETFs was building long before this year, indicating that, not surprisingly, there's never a bad time for sector investing – assuming the end user makes the right wagers.

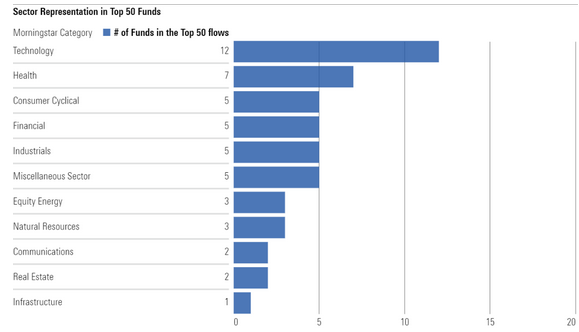

“Over the past decade there has been a clear shift toward ETFs in the sector equity category group,” notes Morningstar. “As of the end of the first quarter, there were with 44 ETF strategies among the 50 funds with the highest trailing 12 months' worth of flows. By contrast, there were 20 ETFs among the 50 funds with the greatest U.S. equity fund inflows.”

Nearly five months into 2021, market participants have the benefit of some hindsight, meaning we now that energy and financial services – thank your rising 10-year yields – are two this year's best-performing sectors. Conversely, once beloved communication services and technology are falling out of favor due to the longer duration cash flows of those sectors.

As the chart below indicates, tech sector ETFs were exceedingly popular for the 12 months ending March 31, 2021.

Courtesy: Morningstar

The chart could be instructive for another reasons. It may hold clues as to where at the sector level money managers my direct more capital. Considering all the talk about rising Treasury yields benefitn bank stocks and inflation reaching concerning heights, it appears as though money managers have plenty of room to increase exposure to financial services and natural resources ETFs.

Likewise, relatively muted flows to infrastructure ETFs could be a sign adviors and other pros don't believe the White House and Congress will come to terms on a substantial infrastructure spending package.

Big Deal for ETFs

There's always an active/passive debate somewhere and plenty of advisors split to the difference, using the two fund structures for different allocations.

However, regardless of one's personal feelings about one over the other, it's clear growing appreciation for sector strategies is a boon for passive investing, particularly ETFs.

“This trend has picked up in the past two years. Of the $56 billion of inflows into the category group for the year to date, on net, all were from ETFs, with open-end funds recording a small outflow,” according to Morningstar.

That's a positive for advisors because many of domestically focused sector ETFs come with low fees, making the assets even easier sells to clients.

Advisorpedia Related Articles:

Real Assets Strategies Are Really Useful Right Now

Gusher of Cash Funneling Into ETFs Could Turn Into Tidal Wave