Just a couple of days ago, I highlighted reasons why advisors shouldn't shy away from new exchange traded funds simply because those products are in their infancy.

I'm not in the business of taking victory laps, but a new product may soon justify my thesis that some rookie ETFs don't need to sit on the shelf for awhile before investors jump in. That new ETF is the WisdomTree Alternative Income Fund (HYIN).

HYIN, which debuted on Thursday, checks a couple of important boxes. First, with new ETFs, timing is important. It can be a headwind or a tailwind and it can go along way toward charting a rookie ETF's future success.

Second, on something of a related note, new ETFs should fill an investor need or void in the marketplace. HYIN does that because, as its name implies, it fills the income void – one that's getting wider and more difficult to close by the day owing this treacherous fixed income environment.

Income Opportunity Right for the Times

HYIN makes good on the alternative income advertised in its name, but that doesn't mean advisors and clients are required to embrace excessive risk or take leaps of faith into unfamiliar asset classes.

Rather, the latest addition to the WisdomTree stable of ETFs is comprised of beloved income-generating assets – namely business development companies (BDCs), closed-end funds and real estate investment trusts (REITs). While REITs have a bond-like characteristics, all three asset classes can provide lower correlations and higher levels of income relative to traditional aggregate bond funds and they're each relevant in today's low-yield world.

“Whether the investment focus is here in the U.S. or on a global scale, investors are still dealing with historically low rates, and in some cases, the readings are either at zero or in negative territory,” said Kevin Flanagan, WisdomTree head of fixed income. “In addition, corporate bond spreads have returned to pre-pandemic readings, and do not offer as much in terms of relative value. Equity markets are near all-time highs as well.”

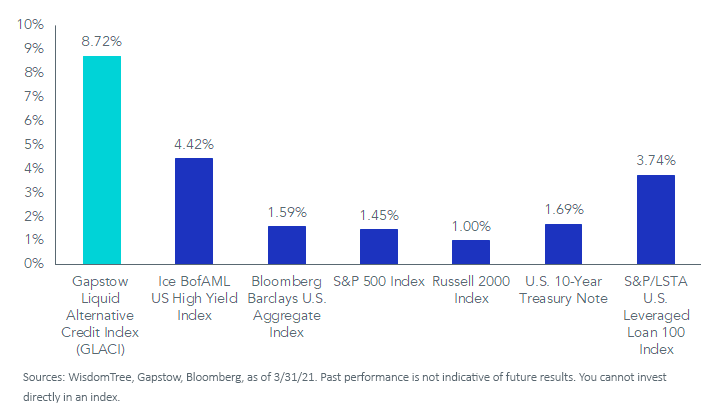

HYIN follows the the Gapstow Liquid Alternative Credit Index (GLACI), which as the chart below confirms, delivers a far higher level of income than an array of heavily embraced income assets.

Angles on Alternative Credit

At its core, the new HYIN is a spin on the concept of alternative credit. As the chart above shows, the yields associated with alternative credit are downright tantalizing, but advisors should alert yield-seduced clients to the risk/reward proposition here.

“Alternative credit consists of debt and debt-based securities that have a higher risk-return profile than traditional high-yield bonds,” said Flanagan. “Historically, this investment space has been primarily limited to institutional or ultra high net worth investors through private fund instruments. However, publicly traded alternative credit vehicles (PACs) offer another way of access for a wide range of alternative credit sectors on an intra-day basis.”

Risks with PACs include closed-end trading well above or below net asset values (NAVs), REITs acting too much like bonds and being sensitive to changes in interest rates and credit and dilution risk at BDCs.

Acknowledging those risks, HYIN still has a broad audience among advisors' client bases, particularly with those clients with long runways before retirement comes along.