Excluding banks and financial services providers, no one likes fees, no matter how nominal those costs may be.

In the world of investing, fund fees, be they on exchange traded funds, index funds or actively managed mutual funds are facts of life. However, advisors and many clients have long since realized that the higher a fund's fee is, the further behind the eight ball the investor is and over time, doling out too much to fund issuers only hurts one party: The end user.

Fees, specifically, the low variety, explain in part the ongoing popularity of ETFs. Much of that is coming at the expense of higher fee mutual funds. Advisors and investors “voting” with their account statements so to speak are having an indelible, positive impact on fund fees, driving those costs lower.

As Morningstar's latest study on the matter notes, in 2020 “the asset-weighted average expense ratio across all mutual funds and exchange-traded funds (not including money market funds and funds of funds) was 0.41%.” That percentage has been more than cut in half since the start of this century.

Clients Are Winning with Low Fees

Not all investors are in tune with the importance of fund fees. Some may think 1% a year is a good deal. Of course, that's where advisors come in and there's compelling math which to educate novice clients on the importance of lower fund expenses.

“Asset-weighted fund fees fell to 0.41% in 2020 from 0.44% in 2019. While this might not sound like much, it amounted to $6.2 billion in savings for fund investors,” notes Morningstar's Ben Johnson. “And a few billion saved means more than a few billion earned in the years to come. Compounding investors’ 2020 fund fee savings at a rate of 0.71% (the 10-year expected return for a 60/40 stock/bond portfolio based on Morningstar Investment Management LLC’s forecasts of corporate and economic fundamentals) over the next 10 years would equate to just over $6.6 billion more in investors’ pockets come 2031.”

Not surprisingly, the fee conversation stokes the active vs. passive debate because the latter are low-cost leaders.

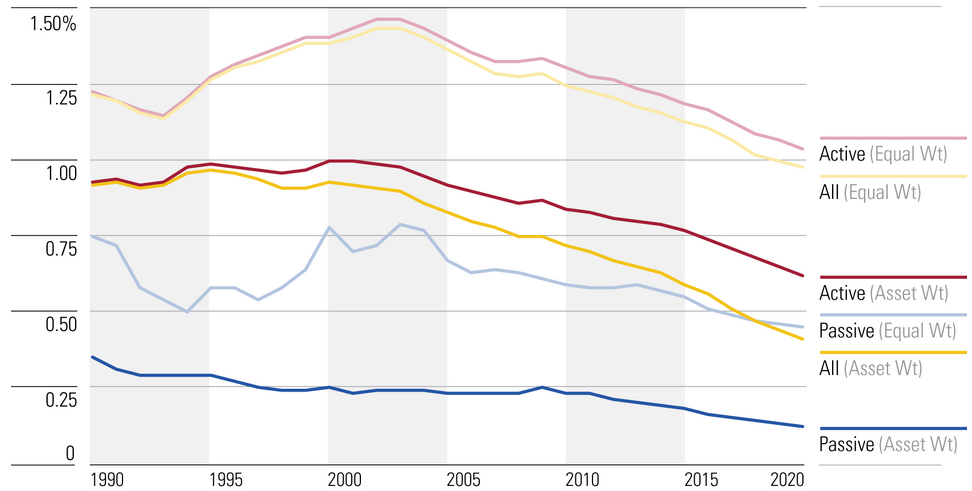

“These savings have disproportionately accrued to investors in passive funds. The asset-weighted fee across all passive funds has declined 66% since 1990, landing at 0.12% in 2020,” adds Johnson. “Meanwhile, the asset-weighted fee paid by investors in active funds stood at 0.62% in 2020--a 33% decline over the same period. The chart below may be one of the few line graphs where investors will be pleased to see a slow and steady downward trend depicted.”

Still, as the chart below indicates, active funds are making some contributions to declining fees.

Courtesy: Morningstar

For advisors, fund costs are conversation starters for another reason. In any given, not all cheap funds are “good” not all active funds are “bad.” For fee-conscious clients that like active management, the good news is that there are scores of attractive actively managed ETFs with decent fees.

What's Next for Fees

It's not unreasonable for clients to ask what's next for fund fees or how far those costs can dwindle. It's particularly relevant query regarding ETFs because, of the 100 cheapest ETFs, the most expensive group (22 to be precise) charge just 0.06% per year.

Another nine don't have any annual expense ratios at all. Yes, there are some temporary fee waivers in that group, but the point is fee compression is very real and unlikely to abate anytime soon.

“The bar will go lower. The downward pressure on fund expenses is unlikely to abate. Competition has driven fees to zero in the case of a handful of index mutual funds and ETFs,” says Johnson. “The same forces that spawned these zero-fee funds have begun to spread to other corners of the fund market, areas where there is still ample room for fees to fall further.”

Advisorpedia Related Artciles:

Amid Kerfuffle, ARK Disruptive Recipe Remains Compelling, Relevant

How to Keep Clients on the Right Disruptive Growth Track