Spend enough time on FinTwit (Financial Twitter) or watching CNBC and you're sure to hear something about Cathie Wood's ARK Investment Management.

Wood's firm is breathing new life into active management – five of ARK's seven exchange traded funds are actively managed – while proving daily disclosure of an active managers “secret sauce” doesn't harm performance as previously believed.

And if you've been hearing about ARK and Wood, you're likely getting somewhat familiar with the firm's flagship fund – the ARK Innovation ETF (NYSEARCA: ARKK). At the very least, there's a better-than-fair chance some clients are inquiring about ARKK.

“Companies within ARKK include those that rely on or benefit from the development of new products or services, technological improvements and advancements in scientific research relating to the areas of DNA technologies ('Genomic Revolution'), industrial innovation in energy, automation and manufacturing ('Industrial Innovation'), the increased use of shared technology, infrastructure and services ('Next Generation Internet’), and technologies that make financial services more efficient ('Fintech Innovation'),” according to the issuer.

It's reasonable to say advisors are fielding ARKK inquiries because the fund hauled in $9.49 billion in new assets last year on its way to more than doubling and becoming the largest actively managed ETF. Less than two months into 2021, ARKK momentum is hardly abating as asset allocators poured another $5.63 billion into the fund – a total surpassed by just the Vanguard S&P 500 (NYSEARCA:VOO).

Understanding ARKK Benefits, Risks

Part of ARKK's potency is sourced through concentration and focus. As in the fund holds just 54 stocks and its top 10 holdings including a 9% allocation to Tesla (NASDAQ:TSLA), combine for about 47% of the roster. While ARKK is one of the purist iterations of a disruptive growth ETF, it is not, however, heavily dependent on technology stocks.

“In contrast to many growth-driven managers, Wood hasn't loaded up on technology stocks,” writes Morningstar analyst Amy Arnott. “Instead, nearly a third of the fund's assets are in healthcare stocks, including a 17.8% stake in biotech issues. Communication services also looms large thanks to holdings such as Roku (ROKU), Spotify (SPOT), and Twilio (TWLO).”

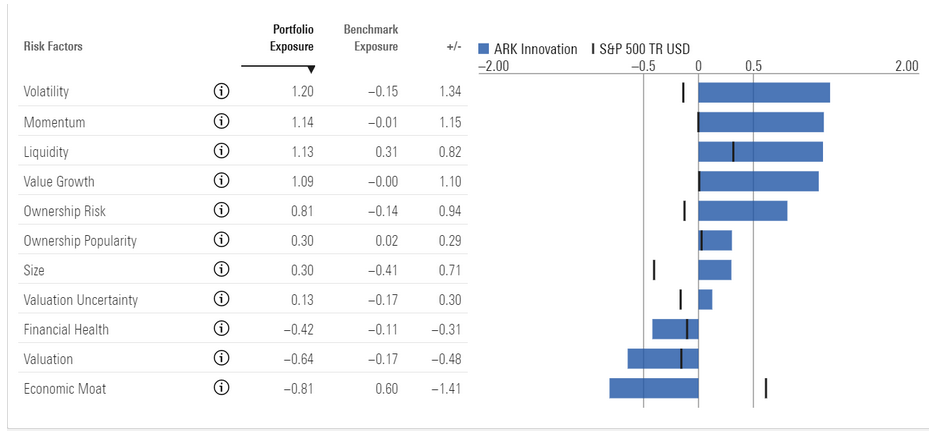

ARKK has an enviable track record, which is sure to lead to more advisor/client conversations. Over the past three years, the fund is up almost 288% compared to just 88.3% for the Russell 1000 Growth Index. That doesn't mean the ARK fund is perfect. As the chart below indicates, the ETF scores well on some risk metrics and just so-so on others.

Courtesy: Morningstar

Ownership risk is one area that's receiving more attention as it pertains to ARK funds. As assets pour into the firm's offerings, it has to either find more names suitable for inclusion its in funds, buy more of current holdings or both. Obviously, number two is easier to execute than number one, explaining why ARK is the largest, or among the top, shareholder in many of the stocks found in the firm's active ETFs.

“The ownership risk factor defines a stock's risk level based on the company it keeps. We gauge ownership risk by looking at the risk profiles of the funds that own shares in the same security,” notes Arnott. “If funds owning the stock tend to have high risk profiles, we assign a higher ownership risk score. Ark Innovation's holdings score well above average on ownership risk, with positions such as Invitae, Editas Medicine (EDIT), and Organovo (ONVO) scoring particularly high.”

Assessing ARKK Audience

As advisors well know, not every ETF on the market is suitable for every investor. Despite its stellar performance, and it is rather remarkable, the same is true of ARKK.

Owing to a combination of no restrictions on market capitalization of components, lofty valuations on others and lack of profitability on others, ARKK isn't appropriate for retirees or an older client with a single or fixed income.

“Investors caught up by the fund's chart-topping returns should remember that what goes up must eventually come down, and it's likely that more of the portfolio's underlying risk factors will eventually come to the fore,” adds Morningstar's Arnott.

That's not necessarily an inaccurate assessment, but pinpointing exactly when any security will decline is difficult and betting against many ARKK holdings has been a fool's errand with Tesla's massacre of short sellers a prime example.

As for clients for whom ARKK is an appropriate portfolio position in the right doses, the field is potentially expansive. Putting it in demographic terms, advisors can credibly discuss ARKK with Gen X, Gen Z and millennial clients.

Related: Tips for Transacting in Small ETFs