Considering that the exchange traded funds industry is nearly three decades old in the U.S., there's a still a lot of lingering misinformation floating around in the market.

Much of it pertains to new ETFs. For advisors and clients, this particularly important because, despite talk that “all the good ideas are taken,” issuance remains brisk. Last year, approximately 300 ETFs came to market – an annual record. Through the first four months of 2021, the pace of issuance is impressive at approximately 120.

Some new ETFs come to market with ample seed capital, making their assets under management tallies stand out. Others organically gain followings in swift fashion while others will struggle and ultimately head to the ETF graveyard. Alas, that's a conversation for another day.

The issue here regarding new ETFs is twofold. First, many of the clearing and trading platforms advisors use don't allow access to ETFs with less than $100 million in assets under management – a metric that applies to plenty of new and old funds.

Second, many advisors – for that matter ETF users of all stripes – simply have mental blocks against new ETFs. They want to wait for assets and volume to trickle. As if ETFs are slabs of meats, investors want the new ones to become “seasoned.” History shows this isn't always a recipe for success with rookie ETFs.

On-Screen Volume Isn't the Most Important Gauge

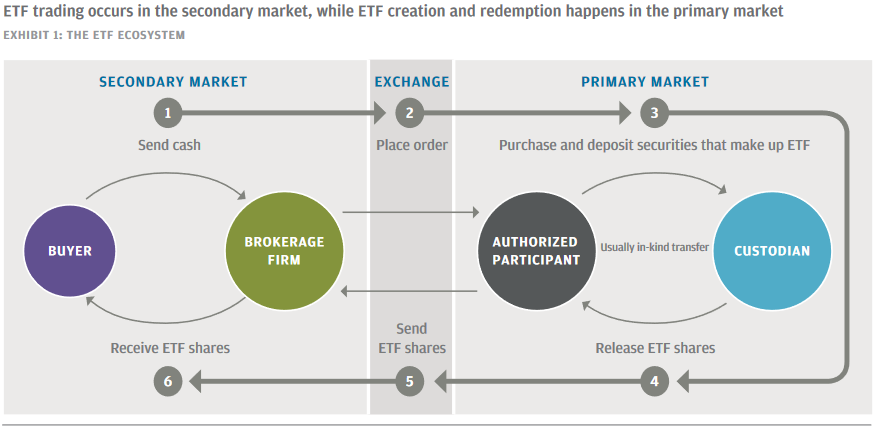

As if new ETFs are a beauty contest, advisors and investors frequently focus on superficial metrics – namely AUM and on-screen volume. However, due to the creation and redemption process, the volume advisors see on their screens is far from the most important ETF evaluation metric.

Courtesy: J.P. Morgan Asset Management

Actually, many new ETFs are betrayed by on-screen turnover and offer more robust liquidity than many advisors realize.

“In fact, many newly minted ETFs offer deep liquidity, much of it unseen on a typical trading screen. Average daily volume (i.e. the number of shares traded on an exchange) is not the ultimate representation of an ETF’s liquidity,” says Victory Capital's Mark Van Meter. “Rather, it’s an incomplete figure, and sizable ETF trading activity may actually be taking place off exchanges altogether. Sometimes called OTC trading (over-the-counter), this activity is generally not reflected in the volume data provided by stock exchanges. Thus, without seeing consolidated trading information, you can’t accurately assess an ETF’s true daily trading liquidity.”

It's crucial to understand – and advisors already know this – that an ETF's performance is determined by its underlying holdings. Likewise, those components go a long way in determining an ETF's liquidity. A new ETF can have scant volume, but if it's heavy on stocks like Apple, Microsoft and Tesla, it's likely to have strong liquidity. A fund full of Nigerian credit default swaps? Not so much.

“Ultimately, liquidity is not based solely on the number of ETF shares traded, but rather on the underlying securities that are held by the ETF and the frequency with which those are traded. So, if a new ETF tracks an index of liquid securities, it’s likely to have ample liquidity and be able to handle sizeable trades with ease,” adds Van Meter.

Naivety Has Costs

Look, we live in a world of conjecture, misinformation and speculation being taken for fact. That cannot penetrate client portfolios and outcomes.

“The perception that it’s too risky to buy newly issued ETF is naïve, in my opinion,” notes Van Meter. “If a blanket statement like that were applied universally it would preclude investors from benefiting in any innovative product.”

With the right amount of due diligence and less focus on superficial metrics, advisors are likely to unearth compelling opportunities with new ETFs as those funds become available on their platforms. And that's to clients' benefit.

Advisorpedia Related Articles:

Telemedicine Is Right Post-Pandemic Healthcare Prescription

Forget Floaters. Consider Rate-Hedged ETFs Instead.

Broadening Healthcare Sector Horizons Can Pay Off for Clients

Amid Coinbase IPO Fervor, New ETF Could Be Attractive to Clients