Written by: Dan Roarty

The coronavirus pandemic has prompted massive changes for countries, societies, people and businesses. Interconnected environmental, social and governance issues have reinforced the role of sustainable investing strategies as an indispensable part of investor allocations for a post-COVID-19 world.

When the history of COVID-19 is written, the pandemic period will be seen as more than just a health and economic crisis. Both contributed to a social reckoning, with a growing focus on inequality around the world, while the intensifying global climate crisis has added new and unpredictable threats.

Taken together, these four pandemic-era trends have fueled a conceptual change in the purpose of investing. Before the pandemic, traditional investing viewed economic and social issues as largely distinct spheres; companies existed to enrich their owners—the shareholders. Now, those spheres are intertwined. You can’t fully understand the economics of a business without understanding how a company interacts with customers and society. Powerful social forces affect businesses and are fundamental to gaining investment insight into a company’s growth path and return potential. Here are four lessons that we think will endure long after the world has healed from COVID-19.

1. Sustainability Issues Are Far-Reaching—and Very Personal. The pandemic made “sustainability” personal for many people. COVID-19 is more than a health crisis—it’s a sustainability crisis. While sustainability means different things to different people, we know it encompasses social issues like poverty, hunger, healthcare and education, as well as economic issues like employment, financial security and inclusion. These issues are tightly linked.

How did COVID-19 become a multifaceted sustainability crisis? In countries that are members of the Organisation for Economic Co-operation and Development, unemployment doubled to about 10% by the end of 2020. The International Labour Organization estimates that the number of working hours lost to the pandemic was equivalent to a staggering 100 million job losses globally. According to UNESCO, 90% of children who were in school around the world had their education disrupted. Border closures and trade restrictions increased food insecurity. And the pandemic was also a gender crisis, with a disproportionate burden falling on women, who were much more likely to lose their jobs. Poorer people were disproportionately affected by all these problems, further widening social inequalities. The impact of these simultaneous challenges put unprecedented pressure on people, companies and communities around the world.

In our lifetimes, there has never been another megaevent that highlighted how sustainability issues are interconnected in such a personal way. Sustainability can no longer be dismissed as somebody else’s problem.

2. Companies Must Engage with Diverse Stakeholders to Succeed. Large, publicly traded companies are incredibly influential players in sustainable development. They employ the most people, use the most natural resources, generate the most pollution and are the most politically connected entities on the planet. Global sustainable development isn’t possible without the private sector.

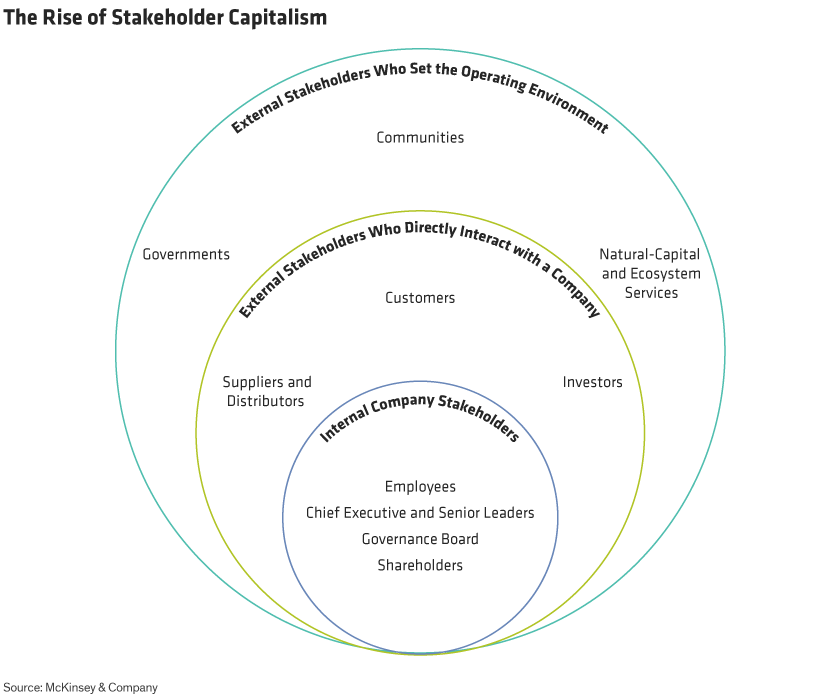

Thankfully, in recent years, we’ve witnessed the rise of stakeholder capitalism—the notion that corporations create greater economic value when they consider the needs of all stakeholders, rather than just shareholders (Display). Companies should be more economically successful when they support the social and environmental well-being of the communities in which they operate and embrace sustainable business practices.

The pandemic put that theory to the test. Some manufacturers diverted capacity to produce critical medical supplies such as masks and ventilators. Others provided temporary financial assistance to struggling customers and employees. And all companies were expected to create safer working environments for their employees.

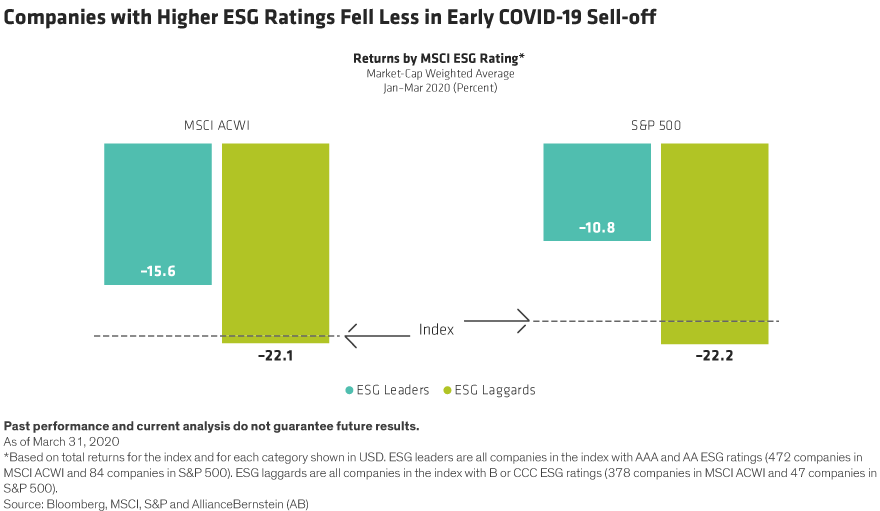

In 2020, a study by Harvard Business School professor George Serafeim and three researchers from State Street Associates showed how companies that used their power for good during the pandemic were rewarded in the stock market. Using natural language processing, the study evaluated stakeholder-friendly actions taken by companies in areas such as labor management, supply-chain management and operations. It found that firms with stakeholder-friendly behaviors enjoyed stronger institutional money flows and better returns. Our research, too, indicates that companies with higher ESG ratings were more resilient during the early COVID-19 market selloff in the first quarter of 2020 (Display). Even shareholders are starting to acknowledge the power of stakeholder capitalism.

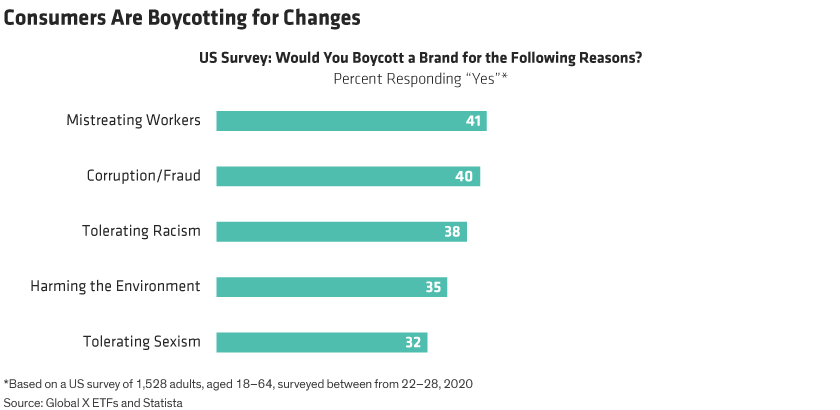

3. People Can Effectively Punish Bad Corporate Behavior. This can be done through consumer choices, investment preferences, employment decisions and boycotts. The confluence of crises—health, economic, social and climate—was a tipping point for people to speak out against corporate power. Social media has amplified individual voices around the world, enabling boycotts of companies that mistreat workers, tolerate racism or sexism, or harm the environment (Display).

Workers are increasingly unafraid to quit when their employers act unsustainably. And more consumers are making purchasing decisions based on how a company scores on sustainability. COVID-19 was a wake-up call for people to tell the private sector what they care about. Companies must listen and respond—or face the consequences from consumers and investors.

4. ESG Is Here to Stay for Investors. Investors are assimilating these lessons. Today, it’s clearer than ever that investors can no longer dismiss companies’ environmental and social decisions. ESG issues were once considered risks to be avoided. For many investors, ESG portfolios were about passively excluding industries perceived as particularly problematic, such as tobacco or weapons.

Not anymore. The pandemic has proved that ESG issues can present opportunities too. It highlighted a raft of sustainability issues like access to healthcare, medical innovation, food security, water scarcity, financial security and inclusion, and gender equality. And investors got to see the potential for the private sector to provide solutions to these massive global challenges. Diagnostics companies produced COVID-19 tests. Drugmakers invented vaccines. Communications companies enabled us to virtualize our lives so we could work, learn, shop and exercise from home. Fintech companies helped businesses get online.

The conversation about sustainable investing has changed. While challenges remain, from regulating ESG disclosures to weeding out greenwashing, we believe investors must incorporate sustainable issues into their processes because they are so widespread and affect every company. By integrating the strategic lessons of the pandemic into fundamental company research, backed by effective engagement with management, investors will be able to deliver better outcomes for clients, while supporting positive change for companies that deliver tangible benefits to society.

Related: ESG in Action: Encouraging Effective Executive Pay Structures