Written by: Diana Lee and Michelle Dunstan

Executive pay packages are facing increased scrutiny from investors. Finding the right formula to align compensation with performance is a complex exercise. But companies that integrate environmental, social and governance (ESG) goals with pay incentives are more likely to deliver on their responsibility pledges to stakeholders.

Executive pay is a powerful motivating factor. But investors need to consider whether executive pay incentives are fully aligned with the goals of the business. Today, ESG factors are widely recognized as essential to a proper evaluation of the risks and opportunities facing a company. For that reason, AllianceBernstein (AB) believes it’s vital to incorporate ESG both into our investment research process and into executive compensation metrics. In this way, the full spectrum of risk, opportunity and goal-setting can be viewed in proper perspective. We find that companies with meaningful ESG goals embedded in their executive compensation schemes tend to have a better understanding of the ESG factors that are material to their business, use specific key performance indicators (KPIs) and are more likely to achieve goals.

Effective Pay Structures Need Appropriate Goals

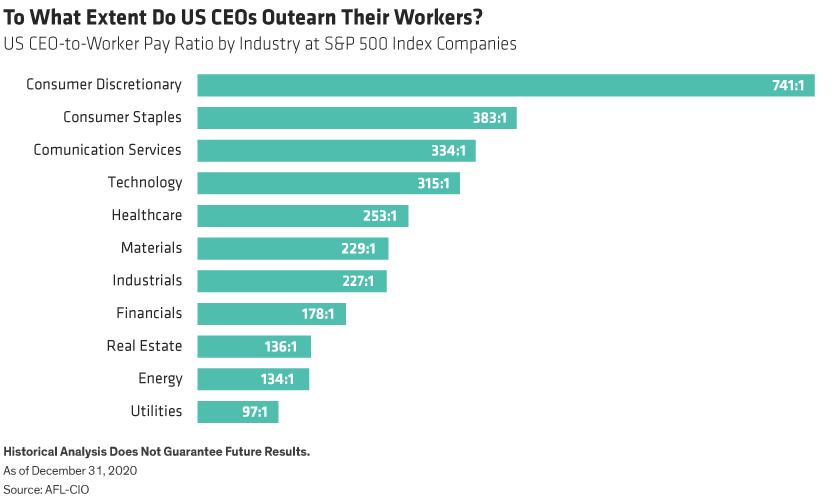

Total executive compensation has increased steeply over recent years, particularly in the US (Display, below), where the pay ratio between CEOs and the typical worker surged over twentyfold since 1965.* Skeptics point to several perceived failings in the remuneration process, including: a cycle of upward-only peer reviews by compensation committees; inconsistent/self-serving use of financial metrics; and the incorporation of nonfinancial metrics such as vaguely defined strategic goals or individual objectives. These nonfinancial metrics are also often combined into a scorecard which is hard for investors to evaluate.

The CEO pay ratio itself has several weaknesses, although its disclosure is mandated by the US Securities and Exchange Commission (SEC). Notably, both workers’ median pay levels and company size vary widely across sectors. For instance, the consumer discretionary sector includes Amazon, a global giant with many low-paid distribution staff. Additionally, companies have flexibility in selecting the median employee to measure against the CEO’s pay level. “The SEC allows companies to use statistical sampling, reasonable estimates, or just choose to use certain pieces of compensation that are easily identifiable (for instance, payroll or W-2 compensation), as long as the methodology is ‘reasonable’ and disclosed in the proxy statement,” according to Pearl Meyer, an executive compensation consulting firm. Such disparities make meaningful comparisons hard.

It’s clear that several factors have driven the long cycle of executive pay inflation. For today’s investors, the key issue is to ensure that executive pay is linked to the right targets.

Clear Objectives Drive Positive Performance

Metric-based executive compensation has a simple rationale: pay should be linked to performance that enhances a company’s long-term value. But to be effective, executive compensation schemes need clear objectives underpinned by specific KPIs that are aligned with the company’s strategic direction.

Our review of 2020 earnings per share (EPS) for companies in the Russell 3000 Index highlighted the importance of clear objectives. This analysis compared actual 2020 EPS versus the absolute target EPS in executive compensation schemes. We found that the top 1% of performers in the index achieved actual EPS that was not materially different to target EPS (approximately 5% difference on average). The inference is that outperformers tend to have a clearer idea of their strategic direction and that this is reflected in their KPIs. Conversely, the bottom 1% of performers in the index had a greater disparity between actual and target EPS (greater than 200% difference on average, as in most cases actual 2020 EPS was significantly lower than target).

In the same way, through our firm-wide engagement campaign, we’ve found that companies with a clear understanding of ESG factors that are material to their business set specific and meaningful executive compensation targets that are more effective in taking them to the next level. For instance, we have met with companies that have created a combined target for employee retention and diversity and inclusion (D&I). This demonstrates the companies’ desire to create and maintain a genuinely diverse and inclusive workforce, rather than simply exerting a one-time effort to hire more minority workers. Likewise, utility provider American Electric Power Company has set executive compensation targets for growing its non-greenhouse gas (GHG) emitting capacity as a percentage of total generating capacity on a three-year basis. This very concrete approach contrasts with industry peers that set multi-year or indefinite targets that are nonspecific about the action steps they must take.

Skeptics see ESG-related KPIs as a distraction from the primary goal of enhancing companies’ long-term value. We disagree. A proper understanding of the importance of ESG factors to the long-term future of a business can improve the clarity and effectiveness of executive compensation targets. From our perspective, it’s not ESG that muddies the waters around executive compensation. Our Russell 3000 analysis shows that the bottom 1% performers not only failed to achieve their predefined earnings targets and other financial metrics about 80% of the time; they also found ways to juice their annual executive bonuses through other nonfinancial metrics such as strategic or operational goals that aren’t necessarily linked to ESG.

Four Components of an Effective Compensation Program

Based on our proprietary data analysis and engagement activities, we think there are four key components of an effective executive compensation program.

- Accurate incentive metrics—that reflect the company’s strategic focus and direction.

- Real executive effort required—the underlying KPIs need to be sufficiently robust and challenging to require extraordinary effort from executives in return for performance pay.

- Safeguards against “windfalls”—or other excessive payouts. These should include comprehensive clawback provisions in cases where touted success has proven to be illusory, and limits to payouts in the event of a change of control.

- Clear benchmarks—must be applied, based on robust methodology for comparing executives’ pay with relevant peers. This should ensure that compensation committees do not simply board an upward-only escalator powered by the latest and highest awards.

Putting a Ceiling on Executive Pay

Pay equity is a vexed question. In practical terms, investors have few mechanisms to impose limitations on executive pay. For instance, in the US, despite a “say on pay” shareholder vote, there is no regulated limit on the absolute dollar amount that companies can pay senior management. The SEC’s requirement to report the CEO-to-worker pay ratio is intended to highlight anomalously high pay—but cannot directly control it.

That’s why it’s so important for investors to assess the efficiency of compensation practices in terms of cost and talent management, and to insist on performance pay alignment with clear, specific goals. The ability to influence executive compensation programs is one of only a few tools investors can use to exert pressure. And they should use that ability to ensure businesses are managed both effectively and responsibly, and with a long-term horizon. Long-term success, by nature, integrates the interests of various stakeholders including shareholders, employees and customers. Neglecting these stakeholders ultimately raises an existential threat for the company itself.

Incorporating ESG into Executive Pay Structures

Recent research from NYU Stern Center for Sustainable Business (Stern) supports our views on the importance of incorporating ESG targets and KPIs into executive pay structures.

Stern’s 2020 meta study (aggregating evidence from more than 1,000 studies published between 2015 and 2020) found a positive correlation between financial performance and active integration of material ESG factors into investment strategies (as opposed to portfolios with negative screening only). Their research showed a positive relationship for 58% of the underlying corporate studies, focused on operational metrics such as return on equity, return on assets, or return on stock price. Stern reported that 13% of the studies showed a neutral impact, 21% showed mixed results (with the same study producing various positive, neutral or negative results) and only 8% showed a negative relationship.

Our own proprietary screening of sample companies that use ESG-related metrics in their executive compensation programs reinforces Stern’s findings. We looked at a range of US and UK companies with varying market capitalizations across different market sectors to identify those that integrated ESG metrics into their programs in a specific and strategic way. Then, we contrasted them with companies that adopted vague ESG-related KPIs. The results showed that companies with specific and actionable ESG targets paid a lower percentage of revenues to named executive officers (NEOs) relative to companies with vague ESG KPIs (0.31% versus 0.40% respectively). This highlights responsible expense management on the part of the companies that were more ESG-aware.

Good Examples Lead to Best Practice

AB’s firmwide engagement campaign has produced some notable examples of good practice in ESG target-setting.

Gerresheimer: AB started asking about Gerresheimer’s plans for incorporating material ESG metrics into its executive compensation program in 2020 as part of our firm-wide engagement campaign. Following up in 2021, the company shared its plans to incorporate ESG as a modifier in its short-term incentive formula, with one metric for each of E, S and G with clearly defined action steps and targets. We will continue to engage with the company in assessing the rigor of the ESG metrics as well as their impact on overall executive pay.

Danaher Corp: We asked the company management how they planned to achieve their current GHG emissions reduction target. They already had high-level plans to utilize their internal Danaher Business Systems (DBS) analytics to measure specifically energy and waste minimization. We suggested that the long-term targets around GHG reduction using their DBS analytics would be an example of more meaningful metrics that could be part of their qualitative goals under the annual incentive plan to encourage a more strategic approach to ESG integration.

XPO Logistics: Partly in response to our feedback from AB’s 2020 engagement, the company upgraded their ESG metrics to a highly specific scorecard approach. This represented a 25% weight in its long-term incentive awards—80% of which consisted of quantitative metrics. The remaining 20% of non-quantitative metrics “require achievement of pre-determined hurdles or binary milestones in order to be certified.”

ESG Incentive Metrics Will Continue to Evolve

Aligning executive pay packages with ESG targets is a work in progress. Some sectors—including asset management—are behind the curve. But by starting with the right goals and learning from best practice across industries, the catching-up phase should be rapid and effective. At AB, we have already included D&I-related goals in our executive pay programs and are on track to evolve the plan as we advance our own governance on material ESG areas. We are confident that many others will follow.

Related: China’s Green Reforms to Clean Up Dirty Industries Creates Opportunity

Robert Keehn, Proxy and ESG Engagement Associate from AB’s Responsible Investing team, contributed to this analysis.