Environmental, social and governance (ESG) investing can no longer be dismissed as a fad. It's force to be reckoned with and it's fertile ground for advisors to add value in client engagement.

When it comes to ESG, advisors have a lot on their side and that's a ultimately a plus for clients. The audience is increasingly captive. There's more data and research emerging supporting the efficacy of, at the very least, some ESG exposure. The mainstream financial press is paying more attention to ESG, meaning many clients are hearing about it prior to talking about it with advisors.

Data confirms that ESG investing is indeed a rising force and one with a long runway to continue amassing assets at a rapid pace.

“Environmental social and governance (ESG) investing tends to land in the spotlight during extreme events like the global pandemic,” says Brie Williams, head of practice management at State Street Global Advisors. “However, the trend line is unmistakable: ESG investing has been growing for a while. Between 2017 and 2019, ESG investing grew by more than a third, to $30+ trillion, over a quarter of the world’s professionally managed assets. Some estimates say it could reach $50 trillion over the next two decades.”

Evaluating ESG Evolution

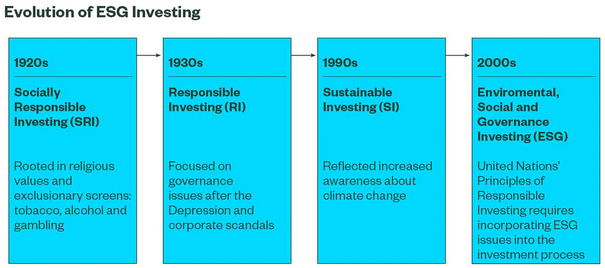

Many clients may not realize this, but the concept of ESG investing isn't new. It's actually several decades old and with age comes evolution. Gone are the days when ESG investing simply meant avoiding alcohol and tobacco stocks, fossil fuels producers and firearms makers. This evolution brings opportunity for advisors.

“ESG is about informing better decision-making by adding the assessment of material, environmental, social and governance issues to the investment process,” adds Williams. “It enriches traditional research like analyzing financial statements, industry trends and company growth strategies.”

Courtesy: State Street

For advisors, ESG presents a number of avenues for client discussion and engagement, including aligning portfolios with personal values, risk management and the pursuit of sustainable, long-term performance.

“Some of these objectives span different ESG strategies to varying degrees. And they are not mutually exclusive—multiple ESG strategies can be combined in a single investment vehicle to achieve the investor’s specific goals,” says Williams. “Whatever the client’s aim, financial advisors will need to optimize ESG investment opportunities across a range of asset classes and the risk spectrum.”

Areas of emphasis for advisors include determining how ESG fits into the confines of clients current portfolios and if material alterations are needed to accommodate ESG, ESG risk – the degree to which a portfolios should be allocated to this style, and emphasis on the long view. Viewing ESG as a long-term strategy is vital for clients because there will be times – weeks, months, even a full year – when pure beta approaches top ESG.

Speaking of Performance...

Advisors will surely field questions from clients regarding ESG performance. Fortunately, clients are likely to find the facts attractive from both a returns perspective and from a risk/reward perspective.

“Recent research highlighting long-term risk-adjusted returns and lower downside has challenged the notion that ESG investing could mean sacrificing returns,” notes Williams. “Additionally, State Street Global Advisors’ own research finds that 69% of ESG adopters say that pursuing an ESG strategy has helped with managing volatility. Seventy-five percent expect the same returns from those investments as they do from others.”

Ultimately, clients are increasingly in two camps pertaining to ESG. There are those that are already on board and those that are on the fence. Fortunately, advisors have the data and tools to satisfy both groups while adding value to client relationships.

Advisorpedia Related Articles:

Sustainable Investing Brings Big Opportunity for Advisors

Climate Risk Is Value-Add Opportunity for Advisors

Try This for Sustainable Investing: Companies Employees Like Working For

Advisors, When it Comes to Sustainable Investing, You Don't Need to Indoctrinate this Demographic