The sustainable investing movement and increasing prioritization of environmental, social and governance (ESG) principles is gaining momentum.

This is a seismic shift that's unlikely to revert anytime soon. It may never. Not when younger, up-and-coming investors are craving access to investments that reflect their personal values, many of which center around improving the climate change situation.

Overall, this tectonic shift is a positive for advisors because many clients know they want exposure to ESG-friendly concepts and climate-aware strategies, but they aren't aware of the potential benefits and drawbacks these strategies may have within their portfolios.

Indeed, climate change is a great value-add opportunity for advisors and excellent way to initiate client conversations while perhaps wooing younger, more climate-savvy prospects. Adding to the case is budding urgency around the issues of climate change and risk.

What the Experts Say

As advisors well know, BlackRock isn't just the largest issuer of exchange traded funds, it's one of the largest providers of ESG strategies. It's also been accused of “greenwashing” or getting a wee bit carried with tying climate issues to investment strategies.

That's the “take the following with a grain of salt” disclaimer for this piece and, yes, greenwashing is a real concept advisors need to be aware. However, so is climate risk and chances are clients are far more concerned with the latter than the former and there is some urgency on the matter, which could be a positive for advisors when engaging climate-aware clients.

“Severe climate events around the world this year have intensified debate around the effects of climate change and the risks they pose to portfolios. Investors should no longer view the transition to a low-carbon economy as a distant event only, in our view, as it is happening here and now,” says BlackRock. “Climate risk is investment risk, and the narrowing window for governments to reach net-zero goals means that investors need to start adapting their portfolios today, in our view.”

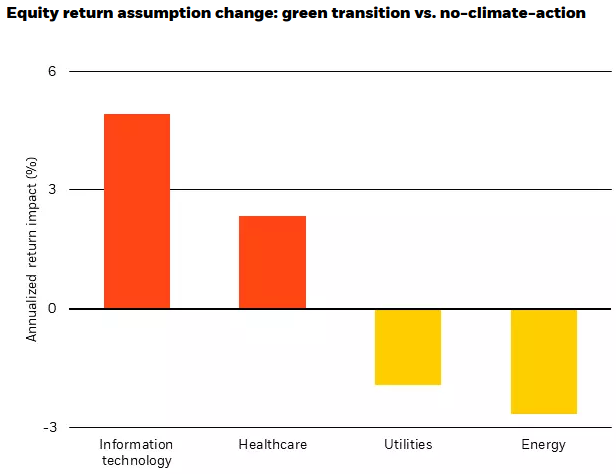

As the chart below indicates, there is something to be said for embracing climate-conscious sectors and avoiding those that may be vulnerable to climate risk.

Courtesy: BlackRock

On a related note, the latest report from the United Nations’ Intergovernmental Panel on Climate Change (IPCC) raised plenty of eyebrows and is likely an impetus for climate-savvy clients to further inquire about related investment strategies. Advisors can deliver some good news to clients: If BlackRock is correct, returns for climate-conscious companies and sectors will benefit investor outcomes.

“Our climate-aware return assumptions assume a successful transition to a low-carbon economy consistent with Paris agreement goals, and that will deliver an improved outlook for growth and risk assets relative to doing nothing,” said the asset manager. “We see climate-resilient sectors such as technology and healthcare likely benefitting the most from a 'green' transition, and carbon-intensive sectors with less transition opportunities such as energy and utilities likely lagging.”

Don't Fight It

Yes, ESG investing is becoming politicized and that's unfortunate. And as noted above, greenwashing is a real issue – one that fund issuers and index providers need to rapidly address because as ESG and sustainable investing draw more attention, more naysayers are likely to emerge.

Still, there's no denying policy and technology are shifting to grapple with climate change and many clients want exposure to those trends.

“We expect 'green' assets that are likely to benefit from the transition to a low-carbon economy to outperform during this shift. This is one reason for investors to keep tabs on the progress of climate change and that of climate transition. We see two key aspects in the climate transition: technology and policy,” according to BlackRock.

Advisorpedia Related Articles:

Try This for Sustainable Investing: Companies Employees Like Working For

Advisors, When it Comes to Sustainable Investing, You Don't Need to Indoctrinate this Demographic