Written by: Monika Carlson, CFA

One of the most crucial components of investing in commercial mortgage-backed securities (CMBS) is assessing the underlying collateral value. But what if investors are disregarding risks that threaten a property’s very existence?

By integrating environmental, social and governance (ESG) considerations in their routine credit analysis, investors can better assess CMBS risks. Of course, the lion’s share of risk to commercial properties comes from natural hazards, including severe weather events exacerbated by climate change. That’s not surprising, but investors may be surprised by the limitations of insurance in reducing these risks.

Insurance Isn’t Enough

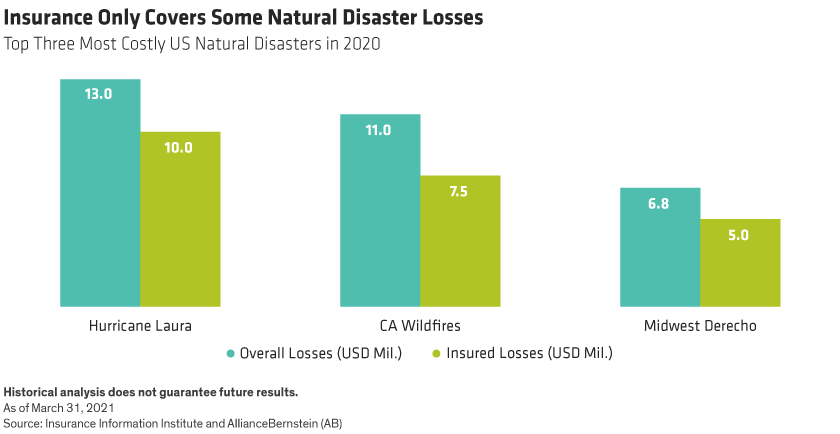

Whether caused by earthquakes, hurricanes, tornadoes, wildfires, floods or severe winter storms, the main dangers to CMBS are permanent property damage, which insurance may not cover, and business interruption, which impairs cash flow from tenants. Overall losses can be substantial. Even when a property is insured, total losses for catastrophes almost always exceed insured losses (Display).

Even though many commercial properties must carry hazard insurance in FEMA-designated flood zones, insurance isn’t enough. That’s because the value of federal flood insurance for commercial properties is usually nominal compared to the value of the property. Supplemental insurance is expensive, so many borrowers self-insure. Plus, recent storms have been more intense and frequent than in the past, and even areas not included in flood zones have suffered severe flood damage.

Flooding from rising sea levels is a concern for coastal areas, but even more so for hurricane-prone coastal regions that may also be in the path of storm surges. For example, when Hurricane Harvey slammed Texas in 2017, damages amounted to $125 billion. Since most of the damage was flood-related and outside of FEMA flood zones, only $30 billion of that damage was insured. Recent storms have shown that weather pattern changes can severely affect even inland areas, and most regions have overlapping concerns, such as the West Coast’s exposure to wildfires, droughts and earthquakes.

The problem is significant—and growing—as climate change drives more frequent and more catastrophic natural disasters. According to the National Oceanic and Atmospheric Administration, 2020 featured 22 separate billion-dollar weather and climate disasters, shattering the previous record of 16.

If property risks are worsening, and hazard insurance isn’t the answer, what is?

Realistically Assess Climate Risks

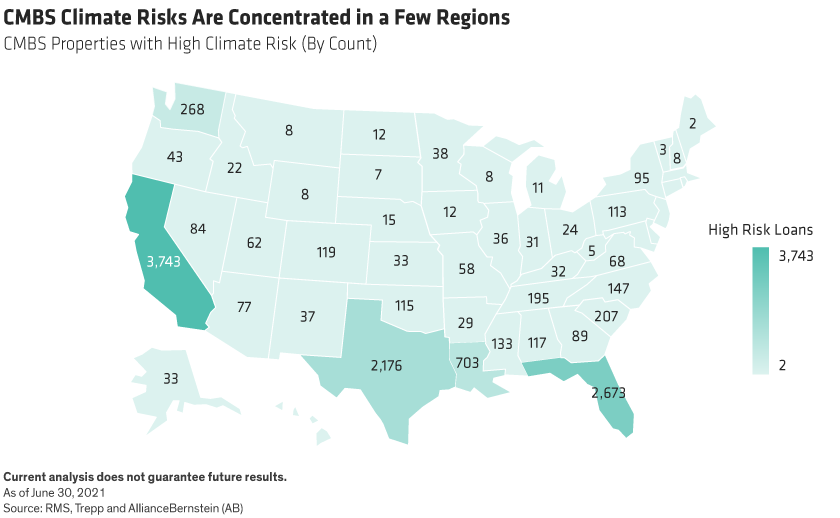

Avoiding all loans with climate risk exposure isn’t realistic, nor is screening out properties in states with elevated threats. California leads the nation with 3,743 properties that possess high climate risk scores, followed by Florida and Texas; these densely populated states represent over 25% of all CMBS deals (Display).

We believe the answer is to quantify the risk for individual properties based on models that consider specific types of potential disasters region by region. Through this in-depth analysis, investors can better understand CMBS risk exposure and either demand better pricing on riskier deals or avoid them altogether.

For a single loan, the evaluation can usually be completed using publicly available data. Many investors actively seek investments in properties that are Leadership in Energy and Environmental Design (LEED) certified, as the market considers those securities green. LEED provides a framework for healthy, highly efficient and cost-saving buildings, and the LEED rating depends on the level of sustainability.

While green investment opportunities can be compelling, it isn’t enough. A LEED certification on a property is only a starting point for climate-related investment analysis and can camouflage other climate threats. After all, even LEED-certified buildings are still subject to the environment around them.

Consider a LEED-certified property in Florida, a transportation hub promoting rail service, encouraging less car usage and fewer emissions. The underlying property carried storm and storm surge coverage when the security was issued, which covers hurricane damage. The building is not in a FEMA-designated flood zone, making it a seemingly sound green investment at first glance.

Further analysis, however, revealed that the building owner has the right to drop the insurance for any reason; the loan agreement doesn’t require flood insurance since the building isn’t in a designated FEMA flood zone. Plus, floods disrupt tenants and their businesses, hindering both cash flow and future leasing prospects. Some investors might find these risks worth taking, especially for a LEED-certified property. But in this case, the valuation didn’t compensate for those risks.

Assessing Climate Risks in Bulk

Incorporating ESG analysis with credit analysis is an easily manageable process for a single loan, but most CMBS are much more daunting packaged bundles of 40 to 70 loans.

Most investors—indeed, many managers—aren’t equipped to broadly assess these underlying CMBS risks. Those wishing to get ahead of the pack need to deploy property-specific hazard information that may be available from data providers, and then model those property analyses across complex deals that include dozens of property loans.

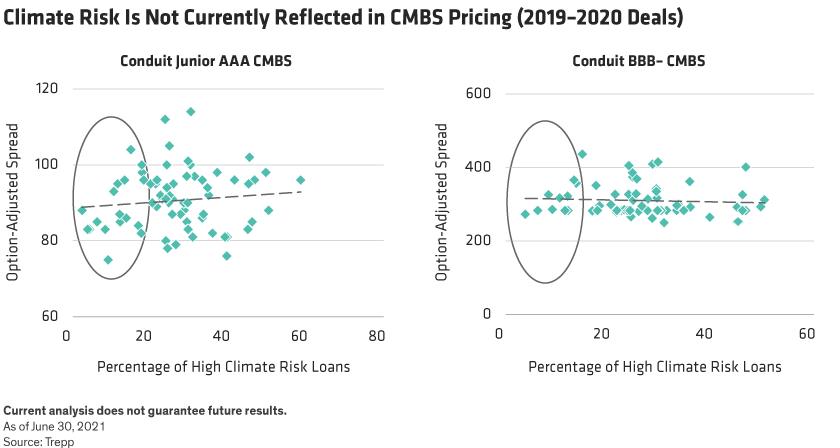

A better understanding of those risks may not be fully rewarded today, because the CMBS market doesn’t price in those risks, either broadly or individually. In fact, there’s little to no pricing difference based on climate risk (Display). However, until this changes, investors who accurately assess environmental risk can get a step ahead by choosing bonds that have less climate risk without sacrificing yield spread.

The Future of CMBS Analysis

As awareness of the importance of ESG factors in CMBS investing increases, investors who start the hard work of assessing environmental risks today will be ahead of the curve once inherent climate risks begin to show up in CMBS prices. Now is the time to ask the hard questions, devise effective measurement methods and start tracking the effects of specific climate vulnerabilities.

CMBS investors who fully understand the ESG implications within their investments not only will be better positioned to avoid specific hazards and have a better chance to guard against climate-related losses, but in the end, we believe they’ll also be fairly compensated for the risks they choose to take.

Related: China’s Green Reforms to Clean Up Dirty Industries Creates Opportunity