Fortune Tellers Everywhere

A friend mentioned the other day that in November 2019, she chatted up a fortune teller who made a spectacular prediction: by the 2020 general election, the US would suffer the greatest economic downturn since the Great Depression. No visions of a dark, handsome stranger for her.

The financial industry has always employed economists and investment strategists in the role of market medium, advising investors on what securities to buy and sell. In fact, my own father, an energy economist of some renown, was consistently cornered at social gatherings for his prediction on the price of oil. He’d respond with some long-winded treatise on supply and demand and OPEC and blahdy, blahdy, blah. I once asked why he didn’t just tell the dude oil prices were going up or down.

“Because it’s a stupid question with no straightforward answer. Besides, I really can’t say with certainty.”

It was a stunning admission for a guy paid by oil companies to predict the price of oil.

So here we are, in the midst of an economic crisis that many did not predict. At least not to this extent. If you look back at reports from late last year, many economists were indeed predicting a recession by the November election (for example, here and here).

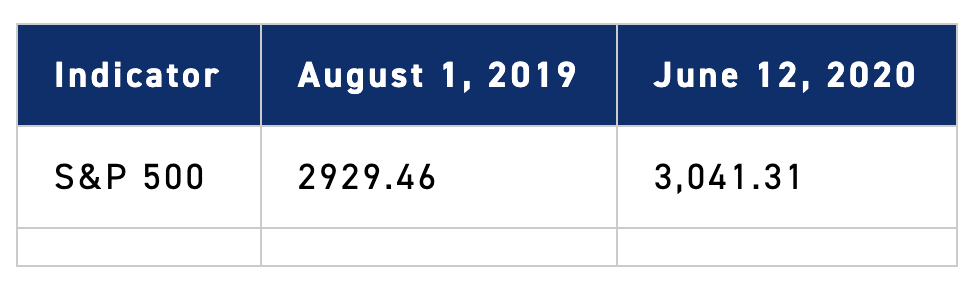

Let’s consider what we knew back when my friend’s fortune teller made her prediction and what we now today.

And then …

Yes, the S&P 500 is higher today than it was in August of 2019. What’s going on?

First, we must remind ourselves that the stock market is not the economy. And the S&P 500 is not representative of all stocks. The recent rally in the S&P 500 has been driven by large technology companies that investors presume will weather this crisis better than others.

But what are mainstream economic fortune tellers saying about the future of the economy?

“Fundamentals were strong going into this crisis so we should expect a quick recovery.”

“Stocks have already priced in the healthcare uncertainty, so we’ve likely hit the bottom.”

“We should be prepared for another bear market crash.”

And from the Oracle from Omaha, Warren Buffett: “We have not done anything because we haven’t seen anything that attractive.”

With so varied opinions, what’s the average investor to do? For most who don’t have the luxury to make a financial mistake, holding a globally diversified portfolio allocated to both stocks and bonds is critical to guarding against the current economic uncertainty.

And should you run into a fortune teller, steer the conversation away from the economy.

Related: Why Advisors Need to Appreciate Their Clients’ Situation Outside Analytical Assessments