In the world of investing, where facts supposedly reign supreme, stories play an outsized role in driving market behavior every day. It might seem counterintuitive, but the right narrative can outweigh even the best analysis.

Narratives have the power to amplify or to erase. Like a Jedi mind trick, the right story makes you see what you are meant to see. The right story can simplify complexities, evoke emotions, and influence decision-making. All of which can profoundly impact how investors perceive and value investing opportunities.

Whether you're chasing the next NVIDIA or steering clear of another Nikola, understanding (and seeing through) the significance of storytelling in finance is crucial to refining your investment strategy.

Stories Matter More Than Ever

Humans are hardwired to respond to stories. Neuroscience shows that compelling narratives engage our brains more deeply than raw data. In finance, where technical jargon and endless spreadsheets can intimidate even seasoned investors, stories cut through the noise. A 2022 Harvard Business Review study found that companies embedding compelling narratives into their financial reports saw a 6% higher boost in investor confidence compared to those sticking to dry facts. As the saying goes, never let the truth get in the way of a good story.

Consider Tesla. On paper, Tesla might look like just another car company who missed their sales and delivery targets in 2024. Yet its narrative still points to a dazzling future. Tesla thrives in bleeding edge, unproven markets for that very reason: no one can prove they are wrong yet.

Early on in Tesla's history, the company boldly promised innovation alongside a commitment to sustainability and a greener future. Today it still promises innovation, but not for consumer vehicles. Now the horizon is AI, robotics, and autonomous vehicles. A bolder vision for a bolder stock price and it works (the stock price, jury is out on the vision). This new direction allows the company to propel its valuation to heights beyond belief as it positions itself for success in new unproven markets.

As a car company, even a visionary one, the current business metrics struggle to justify the valuation. But that hasn’t mattered for anyone who has owned the stock for any length of time. Investors aren’t merely buying Tesla’s actual revenue or sales data. They are buying shares in the future of technology. Tesla’s rabid following claim what is essentially a call option on Elon Musk’s ability to turn dreams into reality. Regardless of whether the company ultimately delivers long-promised products, it has delivered stellar investor returns on the back of unshakable ambitions. That is enough to keep the shareholders happy and invested.

But stories are double-edged swords. While they can illuminate opportunities, they can also obscure risks. Tesla is expected to maintain its 20%-30% sales growth target into 2025 despite falling sales in 2024. Tesla’s biggest risk is investor impatience. At some point, aspirations will need to become reality. Elon can only delay and pivot for so long before the company ends up being valued on the business it is, instead of the business it wants to be.

Other risks are even more insidious. While Tesla has thus far beat the odds, creating a success story for long-time investors, cautionary tales are more common. Companies like Nikola, Theranos, or WeWork, where a charismatic vision masked fundamental flaws, ultimately cost eager investors billions.

The Anatomy of a Story: The Good, the Bad, and the Overhyped

The Good: NVIDIA

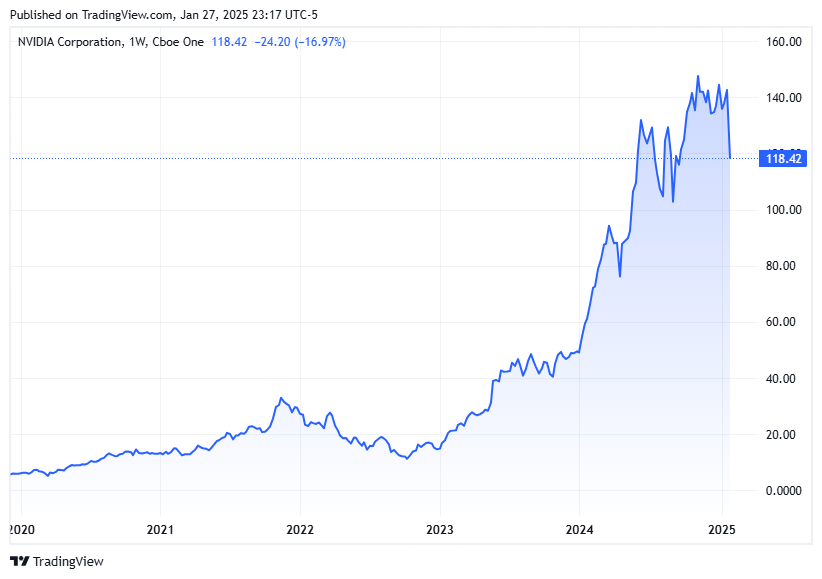

Since the beginning of 2023, NVIDIA’s stock soared over 900%, driven by the wild expansion of the artificial intelligence (AI) industry. NVIDIA is the backbone of AI. Its GPUs power AI systems across industries like healthcare, gaming, and autonomous vehicles. NVIDIA is at the center of the AI arms race, as hyperscalers like Amazon, Google, Meta, and Microsoft jockey for position within the market for delivering the best AI products. Unlike some overhyped stories, NVIDIA’s narrative aligns with robust fundamentals: record revenues, dominant market share, and a scalable business model promising high margins and high growth.

Investors aren’t just buying a chip stock. They are buying into the promise of an AI-driven future that depends on NVIDIA chips. This virtuous cycle of investor confidence fueled more capital inflows, which bolstered the company’s ability to innovate further. Here, the story wasn’t just hype; it was a clear reflection of reality.

NVIDIA, while still the undisputed leaders in chips for AI, is not the only player. While they have a sizable lead, they will need to maintain it or else they risk a flagging stock price. As one of the largest and most watched companies in the world, there isn’t much room for error.

For more on NVIDIA, check out my summary of CEO Jensen Huang’s CES Keynote Address.

Created with TradingView

[FYI: Obligatory notes on DeepSeek at the end.]

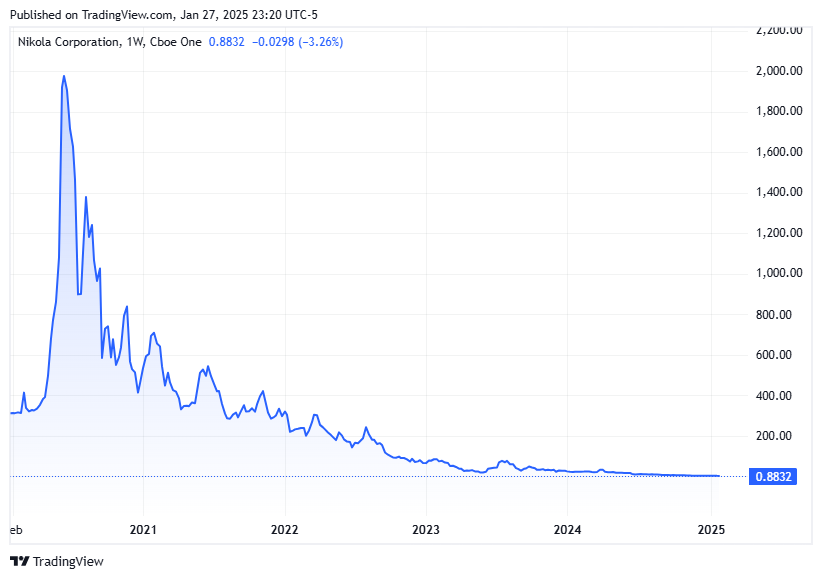

The Bad: Nikola Corporation

Riding the coattails of Tesla into the growing electric vehicle market was Nikola, which promised to revolutionize trucking with electric and hydrogen-powered vehicles. After going public during the pandemic-induced SPAC boom of 2020, Nikola proved to be a rolling disaster for investors.

Like many tech companies in 2020, Nikola’s narrative captured imaginations, sending its stock price soaring to a peak valuation of $21B in June 2020. But when investigative reports exposed fraudulent practices—including a prototype truck that was rolled downhill to appear operational—the story unraveled.

Negative announcements throughout the end of 2020 inevitably sunk the stock as the SEC announced investigations, founder Trevor Milton stepped down, and key partnerships with BP and GM fell apart. The stock plummeted, wiping out billions in investor wealth. Nikola’s downfall underscores the risks of chasing a vision untethered from reality.

Nikola is now valued at roughly $77M; Created with TradingView

The Overhyped: NFTs and The Metaverse

Offering the promise of a transformative future, the idea of digital ownership took the world by storm in 2021. Non-fungible tokens (NFTs) and the growth of virtual worlds in the Metaverse sparked the imagination of millions of excitement-starved investors during the Covid pandemic. These products demonstrate a prime example of how a strong narrative and a little momentum can spark mania before settling into disaster and incinerating billions of dollars in only a few years time.

Blockchain technology, and cryptocurrencies with it, were still searching for a utility beyond speculation. Many artists and other creators locked onto the idea that NFTs could be a way to broaden their audience, make money, and maintain a stake in their work as it changed hands or grew in popularity. The idea was a novel one, and headlines about multimillion dollar sales followed. Beeple’s $69 million piece pushed the market into overdrive. At its peak the NFT market reached $25 billion.

Similarly, the sci-fi-worthy idea of immersive digital worlds gained traction as Facebook made a huge bet on this concept being the company’s future. Other companies like Roblox were well positioned to capitalize on the gold rush. As celebrities like Snoop Dogg and luxury brands like Louis Vuitton bought “land” in numerous digital worlds, investors grew excited that owning a piece of the metaverse was like owning a piece of undeveloped Malibu beachfront. McKinsey, offered their own take in 2022, estimating Metaverse investments could reach $120 billion annually by 2025.

McKinsey’s bullish report may have marked the height of the madness. As technology stocks and frothy pandemic-era schemes crashed in 2022 amid rising inflation, the NFT and Metaverse marketplaces crashed with them. NFT trading volumes fell by 90% as the hype could no longer paper over the scams, rug pulls, and shady operations. The Metaverse, with only slightly more legitimacy, faced the hard limitations of current technology. It wasn’t as easy as it seemed to create a Matrix-like world for people to live in so brands quietly shuttered their grand plans in the digital world. Meta stock was severely punished for its all-in bet with a 76% drop from its all time high, bottoming in November 2022.

Created with TradingView

[Side Note: For those paying attention, Meta’s acquisition of a ton of GPUs to build their metaverse ambitions put them at a huge advantage to jump into the next growth narrative: AI. Meta stock is now nearly 2x higher than its 2021 peak.]

How Stories Shape Investor Behavior

The influence of a compelling narrative, especially one that may be fuzzy on facts, isn’t accidental. It taps into three key psychological dynamics:

-

Simplifying Complexity: Financial markets and the businesses themselves are intricate and often hard to understand, but stories distill them into digestible narratives. For example, “Electric vehicles are the future of transportation” is far easier to grasp than poring over earnings reports, cost-of-ownership data, sales figures, or battery chemistry.

-

Triggering Emotions: A well-told story stirs feelings of hope or excitement. Tesla inspires optimism; GameStop’s 2021 meme-stock saga evoked rebellion against Wall Street; The Metaverse triggered dreams of Ready Player One and other sci-fi ambitions.

-

Herd Mentality: When an investment gains traction and begins to produce steady gains, it often triggers FOMO. Bitcoin’s rise as a symbol of financial sovereignty and an alternative to traditional finance is a textbook case. Phrases from investors like “WAGMI" or “have fun staying poor” not only reinforced the resilient “in-group" ethos of the crypto community, but challenged outsiders for not joining. FOMO-fueled buying can lead to bubbles and painful corrections as confirmation bias reinforces the bubble on the way up. When or if a narrative breaks down, buyers become sellers quickly. As momentum turns negative, losses lead to panic selling fueling a spectacular fall.

A very recent example of this was the rapid growth of quantum computing stocks following the positive news from Google about their Willow quantum computing chip. Investors piled into companies associated with quantum computing such as $IONQ or $RGTI and rode them to huge gains. That is until NVIDIA founder and CEO Jensen Huang made a few offhand comments which decimated the stocks overnight.

Navigating the Narrative-Driven Market

Investing in story stocks requires balancing skepticism with strategic insight. By the time a faulty narrative publicly fails, it's already too late to get your gains back. Here’s how to approach them:

-

Evaluate the Narrative: Ask whether the story aligns with measurable business outcomes. Apple’s story of powerful customer-centric innovation is backed by decades of groundbreaking products and market dominance but their innovation lately is lacking. Is Apple still the king?

-

Scrutinize Fundamentals: Separate the story from the numbers. Tesla’s ambitious vision is compelling, but its long-term success is rooted in growing revenues and expanding production and services. Can they achieve what the stock price is baking in? Whether that may be human-driven cars, autonomous cars, robots, or whatever the next hot thing is.

-

Assess Management Credibility: A strong narrative often hinges on trustworthy leadership. NVIDIA’s success, for example, is tied to CEO Jensen Huang’s proven ability to execute a bold vision. Will sales growth follow?

-

Position Size Strategically: Treat story stocks as speculative plays, allocating smaller portions of your portfolio to them. Diversify with more stable investments to mitigate risks. The media is awash with stories of someone striking it rich with a well-timed bet on a ripping stock or investment. Rarely does the media cover the hordes of people who lost money doing the same thing with different results.

-

Monitor Public Sentiment: Some stocks often gain traction on platforms like Reddit or Twitter before moving markets. Staying attuned to these discussions can offer early insights—but always anchor decisions in data, not hype. Wall St. Bets demonstrated that the people do have the power, but maybe only fleetingly.

Investor Takeaways

In 2025 and beyond, storytelling isn’t just a marketing tool—it’s a market force. Companies with compelling narratives can attract capital, shape perceptions, and even influence their own fundamentals. But for every AI transformation, there is a Metaverse flop; for every Tesla, there’s a Nikola.

By understanding the psychological dynamics of investing, market participants can try to capitalize on the power of strong narratives without falling prey to their pitfalls. The key lies in balancing a disciplined research process with tactical risk taking. Taking a long view of your future investing timeline can help clarify the level of risk necessary to succeed. Even average returns for an above average length of time can make you a stand-out investor.

-

Leverage Stories to Spot Trends: Recognize that narratives drive markets. Charismatic founders capture investor imaginations like no other. Identifying emerging characters and stories early can help you get ahead of the curve.

-

Beware of Overhyped Narratives: If a story feels too good to be true, dig deeper. Companies making grandiose claims without solid fundamentals may implode eventually. Shape a thesis around durable trends, not temporary events or hype.

-

Diversify: Spread your investments across multiple sectors and risk profiles to protect against narrative-driven volatility. You shouldn’t bet big in a concentrated portfolio on narrative alone.

-

Balance Emotion with Analysis: While stories can inspire, discipline and due diligence separate successful investors from those who chase FOMO-fueled bubbles. It's important to remember that these are companies first, not just stocks. Independent validation, transparency, and access to resources are key components of a winning company.

Thanks for reading and good luck out there.

Related: How New Administration Policies Are Impacting All-Time Market Highs

Definitions:

Call Option: A financial contract that gives the buyer the right to purchase a stock at a predetermined price within a certain time period.

Hyperscaler: Large cloud service providers, such as Amazon, Google, or Microsoft that provide services such as computing, storage, and data management at enterprise scale.

SPAC (Special Purpose Acquisition Company): A shell corporation that raises money through an IPO to merge with a private company within two years. SPACs might otherwise be known as "blank check companies".

Postscript: NVIDIA and DeepSeek Drama

I held off on publishing this piece last week as I contemplated rewriting the section on NVIDIA or reworking the elements of how a narrative can move prices given the reactions to the news. Ultimately, I mostly left it alone but I’d be remiss if I didn’t at least acknowledge how damaging this new development is for chips and AI companies, especially in the US. Talk about a curveball.

I guess that’s Jensen’s karma for badmouthing quantum computing stocks at CES.

I talked about herd mentality above and NVIDIA felt the impact on Monday, falling nearly 17%. When or if a narrative breaks down, buyers and holders become sellers quickly. The stock has largely been trading sideways since October and buyers dried up over the weekend amid the shock of DeepSeek’s spectacular claims of low training cost. The question is, does the AI industry need as many chips as it thought it did a week ago? There are a lot of questions, including what is real?

Sell first, ask questions later.

This revelation out of China challenges future expected sales figures which were heavily baked into the priced-for-perfection stock price. Does this suddenly make NVIDIA unworthy of its current place in the business hall of fame? No, but it potentially changes the narrative investors clung to. Investors and speculators are trying to adjust accordingly.

As of today, NVDA is still up ~875% from January 2023 so, you know, not bad.