Student Debt Is Horrifically Expensive and Dangerous

Please find below an excerpt from my book, Money Magic. Money Magic, is, according to the Association of Business Journalists (SABEW), worth reading. SABEW’s membership comprises the professional media’s universe of personal finance writers. In 2022, SABEW voted Money Magic the best personal finance book of the year.

I wrote chapter 8 — Don’t Borrow for College — to warn about the extreme dangers of Student and Parent Plus loans. Given today’s super-high federal Student Loan and Parent Plus Loan interest rates, borrowing large sums for college can spell lifetime penury. This is particularly true given that you a) can’t discharge your loans through bankruptcy, b) have a 40 percent chance of dropping out (i.e., borrowing for nothing), and c) can’t refinance your federal loans if interest rates fall. (Yes, you can try to refinance with private lenders. But private lending rates are invariably very high.)

Thus, if inflation were to fall to zero, today’s 6.5 percent Student Loan rate would mean borrowing from Uncle Sam at a 6.5 percent real rate — roughly three times the real rate at which Uncle Sam borrows from us (via Treasury Inflation Protected Securities, aka TIPS). The 9.0 percent Parent Plus loan rate would be 6.5 percent real.

These remarkably high rates are, effectively speaking, even higher once once incorporates the 1 and 4 percent loan-initiation fees Uncle Sam lets intermediaries charge on Student and Parent Plus “government” loans, respectively. Worse yet, unless your Student or Parent Plus loan is subsidized, interest begins to accrue when the loan is initiated, not when you graduate.

Don’t Borrow for College — an Excerpt

Several years ago, I taught a course at Boston University on personal finance. I started out discussing consumption-smoothing and other economics principals. Then I got into the weeds, laying out what people should do in practice. This included the message I’ve conveyed throughout this book – that paying off high-interest-rate personal debts, be they credit card balances, car loans, mortgages, or student loans, is the best investment going.

Since I was talking to college students, I focused on student debt.

Over two thirds of college students – and a higher percentage of minorities -- take out student loans to help finance their educations. Collectively, they owe a whopping $1.6 trillion. Their parents owe upwards of $100 billion on loans they have incurred on their children’s behalf. Half of those who borrow for college have outstanding formal student loans 20 years after graduation. Plus, there are informal loans between students and their parents, which the students are morally, if not legally obligated to repay.

To make things concrete, I asked my 50 students if they had any student loans. About 40 raised their hands. Next, I asked what interest rates their loans carried. Their answers ranged from high to very high to exorbitant. I asked everyone to raise their hands if they owed $10,000 or more. The same hands flew up.

“Ok, keep your hand up if you owe $30,000 or more.” Most hands remained aloft. I moved to $60,000 plus. Now only a third of the hands stayed airborne. I kept going down this dark path until I reached $100,000 or more. One hand – Madeline’s (not her real name) – remained raised, albeit at half-mast. The angle of her crooked arm shouted, “Please no!”

I should have stopped there. I’d already violated my students’ privacy. But I asked Madeline if she minded telling the class how much she owed. She said $120,000.

Dumbstruck, I shifted to my most professional economics parlance. “Well, humm, umm, gee, ouch, ugh, OMG, wow, that’s like kind of a lot.”

Next, I tried to rationalize Madeline situation. “I’m not surprised. Though it does provide lots of scholarships and grants, BU is one of the most expensive universities in the country based on its sticker price. Of course, you get to be taught by people like me.” That last bit fell particularly flat.

Then it was back to Madeline. “Would you mind telling me your major,” hoping it was in a lucrative field, like business.

“Art History.”

“Ah, Art History. Humm, umm, gee, ouch, ugh, OMG, wow. Not the highest paying field. And you’re a senior and on the job market?”

“Yes.”

At this point, I put both feet in it.

“Any prospects?”

Awkward silence punctuated by deep sighs leading to Madeline’s visage turning various shades of embarrassment, anger, and despair, culminating in uncontrollable sobbing. In between the flood of tears, Madeline relayed having sent off dozens of applications for a job in her field and receiving not a single offer. Most applications went unanswered.

This episode still haunts me. I apologized to Madeline profusely, in and after class. But the damage was done, and not just because she had broken down in front of the class. I realized that Madeline was in a world of financial hurt. The average salary in Art History at the time was about $35,000. Madeline was averaging about 5 percent interest on her various loans. Paying them off over 20 years would require handing over $10,000 per year to her federal and private lenders. Yes, the repayment was nominal and would be watered down, over time, by inflation. Still, it would represent a major share of Madeline’s after-tax Art History-career earnings. Short of moving in with her folks, marrying someone with deep pockets, or an act of divine intervention, Madeline had borrowed so much for a career in Art History that she couldn’t afford a career in Art History.

How Dangerous Is Borrowing for College? A MaxiFi Planner Illustration

Many readers of my newsletter are also MaxiFi Planner users. MaxiFi does economics-based financial planning. It can help people at any age make literally any financial decision. This speaks to the scope and power of modern computational economics. In particular, MaxiFi can help 18 year-olds decide what college to attend taking into account not just the attractiveness of the tour guide, but the amount they can afford to borrow given their likely major. It can also help parents decide how much they can afford to help their children cover college expenses.

Let me illustrate MaxiFi’s value added for a hypothetical case — that of an 18 year-old who I’ll call Sarah. Sarah lives in Anchorage, Alaska, but is dying to live in New York — at least during college. Indeed, her heart is set on attending New York University.

NYU is no Boston University, but it’s a great university. You can tell this from its $87,000 per year full-fare price — the price that Sarah faces given that her parents make too much money for her to receive a break on tuition, let alone on room and board. When Sarah opened, with trembling hands, her NYU acceptance letter, she broke into tears at the word “Accepted.” She was also gratified to read the section of the letter spelling out NYU’s student aid award. This section spelled out her and her parents’ borrowing options. (Calling this an “award” is financial malfeasance, but let me not digress.)

“Our Daughter Got NYU!” — Sarah’s Parents Crow at their Weekly Bridge Game

Sarah’s parents, Jean and Joe, were besides themselves with pride when Sarah received her acceptance letter. NYU is an elite school, accepting only 8 percent of applicants. Yet, when Jean and Joe realized that Sarah could only borrow $31,000 a year — the federal student-loan maximum, they told her they’d lend her the remaining $56,000 per year for all four years.

They’d take out Parent Plus loans on her behalf. But Jean and Joe made clear that “on her behalf” meant Sarah, not they, would need to repay these loans to them — with their far higher interest rates and initiation fee — so they’d have to funds to repay Uncle Sam.

Jean and Joe told Sarah that they love her more than life itself. But they have expensive travel plans for their retirement, including lots of pricey trips to visit her in New York and attend musicals, which they love almost as much as life itself. Sarah, they reminded her, was 18 and from here on out, she needed to stand on her own financial two feet. But gee were they thrilled she was going to NYU! So was everyone at bridge.

Moreover, they assured her, she’d have 20 years to repay both her Student Loans and their Parent Plus Loans. Also, they said she could manage their rental apartments after college and earn $80,000 a year —significantly above the average pay for property managers in Anchorage and, indeed, the average pay of college grads. Finally, Jean and Joe would rent her one of their two-bedroom rental units in tony South Anchorage for $2,000 a month — far below the $4,000 they could receive on the market.

Finally, they told Susan they’d invited 100 friends and family members to celebrate her amazing success. When and where? Next weekend at Anchorage’s luxury hotel — Hotel Captain Cook.

Running the NYU Option through MaxiFi Planner

Sarah’s uncle Jack (nickname, UJ) was at the bridge game when he heard the great news. He too was thrilled. Sarah was his favorite niece out of the ten his sibs and sibs-in-law had compiled. But, as a long-time user of MaxiFi Planner, UJ worried that Sarah was jumping into hot, if not boiling financial water. So, he purchased a $109 license to MaxiFi for Sarah, registering the license under her name using her email address.

He then helped Sarah run the NYU option and her parents’ job offer through MaxiFi. UJ and Sarah specified she’d start earning $80K in today’s dollars at graduation, but that she’d also need to start paying back her loans — loans they entered in the tool as Special Expenses. The initial year’s repayment, again valued in today’s dollars, was, they calculated, $33K. It would, however, decline in real terms each year as their assumed 2 percent inflation — the current implied market rate — eroded its real cost.

Sarah and UL Learn, to their Horror, that NYU Is Completely Unaffordable

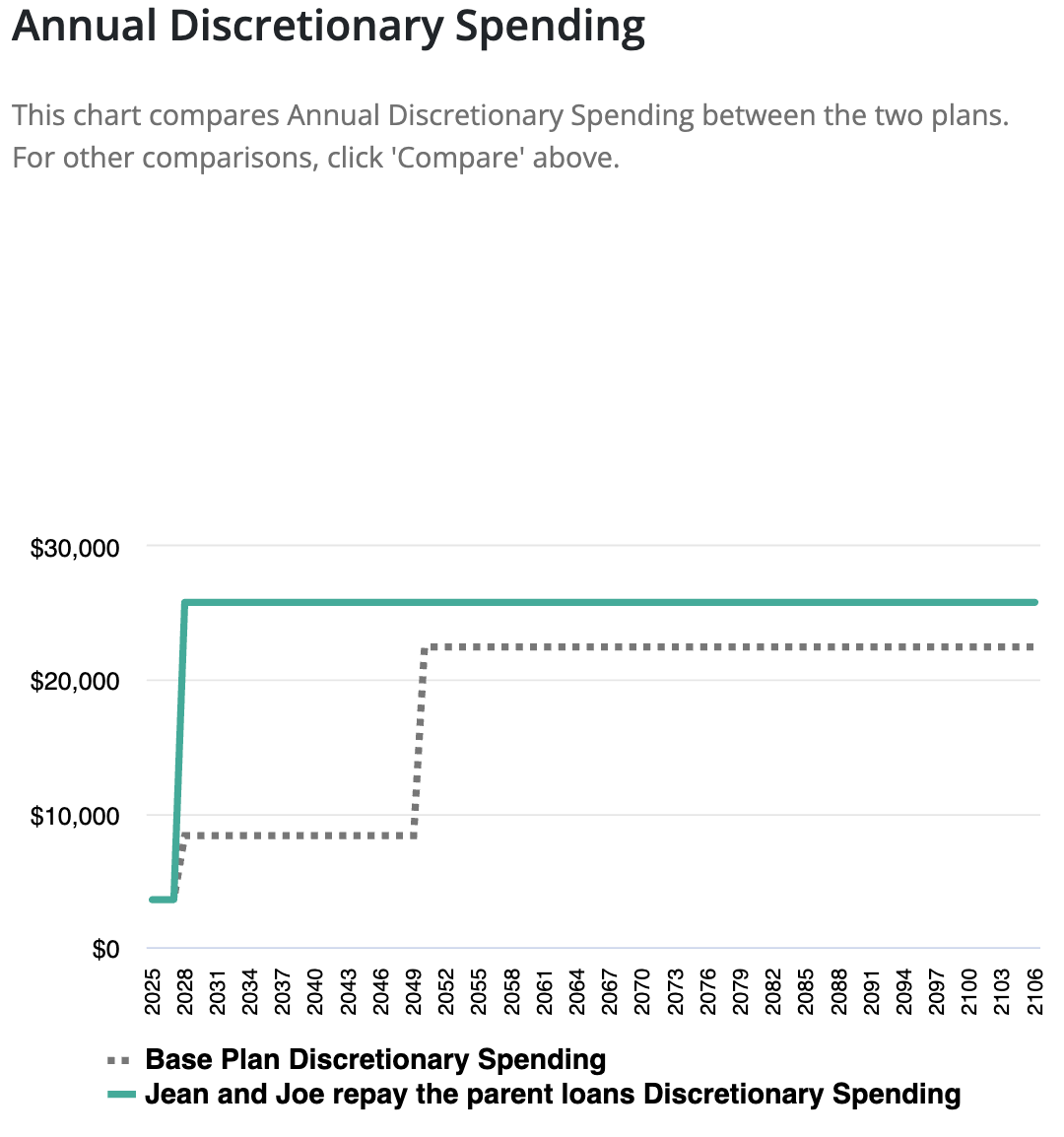

MaxiFi finds Sarah’s smoothest possible path of discretionary spending subject to her not going further into debt. I.e., MaxiFi accounts for Sarah’s cash-flow constraints. The green bars in the MaxiFi chart below show, in today’s dollars, Sarah’s discretionary spending if she attends NYU. Sarah’s discretionary spending equals her total spending less her fixed spending on taxes, housing, and special expenses, including her Student and assigned Parent Plus loans.

Sarah’s affordable discretionary spending for the twenty years after college is a meager $8,839 per year! (And this ignores the immediate accrual of interest and the two loan-initiation fees.) As a quick chat with ChatGPT reveals, $8,839 per year is not enough for three square meals a day at McDonald’s.

How can $80K disappear so quickly? Easy. Sarah’s federal income and FICA taxes (Alaska is one of nine states with no state income tax), when she starts working will total $13K. Her rent will equal $24K. And her loan repayments, to repeat, will start at $33K. That’s $70K in off-the-top/fixed spending or 7/8ths of Sarah’s pre-tax salary.

NYU is Not Remotely Affordable

Amen for UJ. Had he not intervened, Sarah would have blithely landed in a world of pain. Indeed, she’ll surely would have defaulted on her student loan payments after graduating. That would have meant her unpaid balance would have accumulated at the two loans’ terribly high interest rates. Sarah could easily have ended up with more college debt in retirement than she originally borrowed. Actually, that’s not unusual. Some 3.5 million Americans over 60 have yet to pay off their student loans. For many, what they owe exceeds what they borrowed.

What If Jean and Joe Take Responsibility for the Parent Plus Loans?

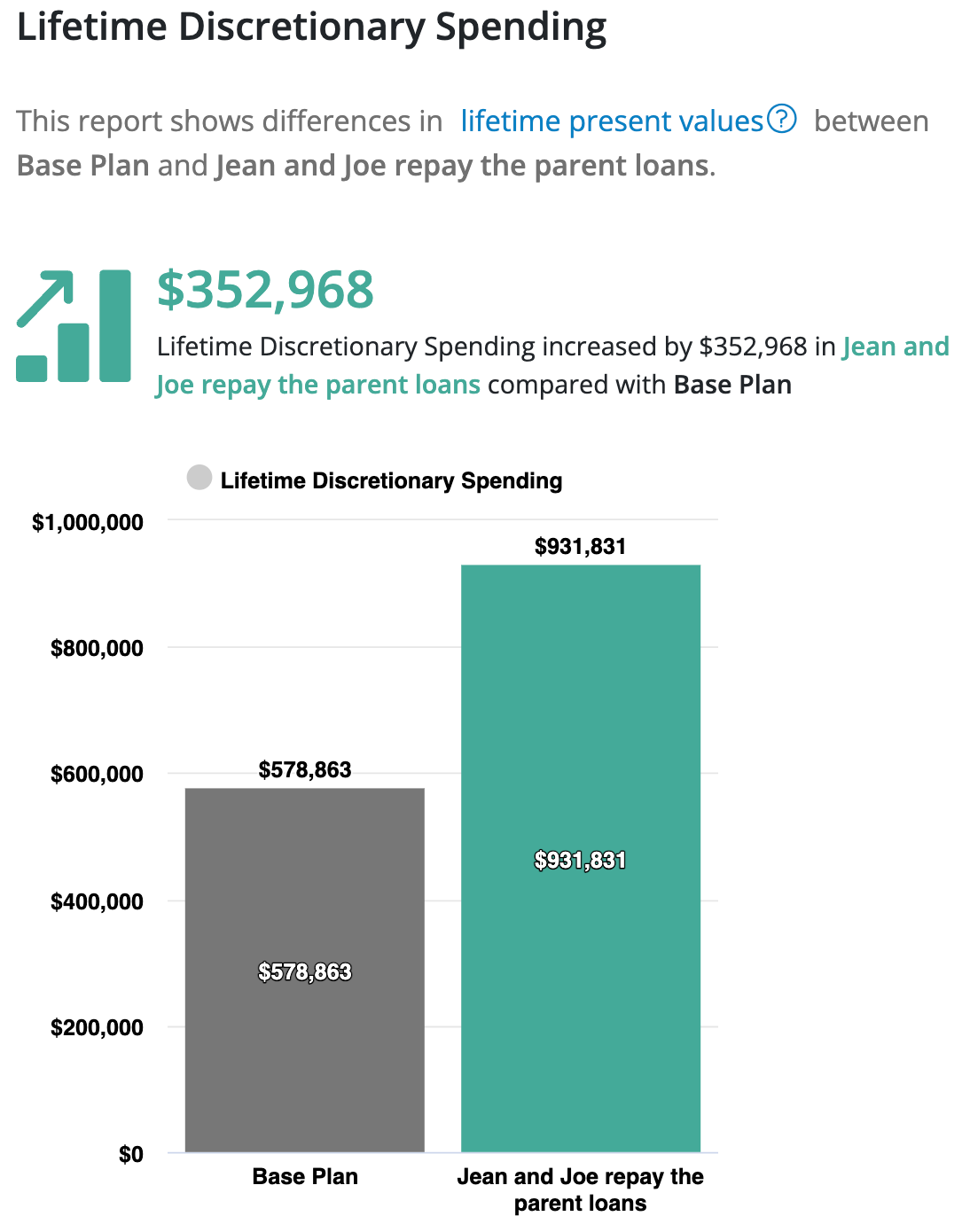

Sarah tells her parents to cancel the party. There’s no way she is going to indenture herself to Uncle Sam for the rest of her life. But J&J, as their bridge buddies call them, are aghast. Cancel the party and publicly admit that they aren’t helping their daughter pay for college? They quickly commit to paying the Parent Plus loans — not passing the cost to Sarah. Then they ask Sarah to rerun MaxiFi again — without the burden of repaying them. Here’s what MaxiFi shows.

Clearly, Sarah will be able to afford many more Big Macs. But her $25,800 in annual post-NYU discretionary spending isn’t a lot to write home about — even if it results, as the next chart shows, in a $352,968 increase in lifetime discretionary spending.

UJ Suggests Changing Majors

When Sarah and UJ think things over, dawn breaks over Marblehead (an old New England expression). NYU is simply too expensive even with her parents covering much of the costs.

At this point, UJ suggests Sarah forget majoring in her passion, Art History, at NYU and major instead in computer science? After all, UJ said, “You already speak five computer languages.” In this case, UJ continued, “You’ll likely earn $105,000, raising your annual discretionary spending to almost $40,000.”

Sarah’s still hesitant. As she points out, there’s no guarantee that software engineers will be needed in four years. AI, after all, is highly proficient in writing code.

UJ Suggests Starting at Alaska State University and then Transferring to NYU

UJ has another idea. Live at home for two years, attend Alaska State, where tuition is $8.5K per year, and then transfer to NYU in your junior year. This, MaxiFi tells them, certainly helps, but not dramatically. It raises Sarah’s post-college discretionary spending by $1,300. That constitutes a $48K increase in the present value of lifetime discretionary spending. Why such a small impact? The answer is that under the new scenario, Sarah saves, through time, the money she’d otherwise spend in repaying Student loans. This means higher future assets, higher future asset income, and higher future taxes on that asset income. In present value, the extra federal income taxes total almost $18,000.

Opting for Alaska State

Sarah is on the fence between heading to NYU or simply attending Alaska State for all of college and taking a job in New York after graduation. UJ has pointed out that her parents would likely save much of the money they’d otherwise spend on her college. Yes, they talk about traveling. But he doubts they’d do so. They are, in his mind, skinflints. This means that having them pay for most of NYU would, in the end, come out of her pocket in the form of a smaller inheritance. After mulling this over, Sarah decides to bag NYU and remain in North to the Future, which, as everyone knows, is Alaska’s state moto.

UJ to the Rescue

At this point, UJ who is sick of Anchorage and is dying to have an excuse to see Broadway musicals in New York tells Sarah. “No, you’re going to NYU. I’m going to pay all the costs. I have enough money — more than your parents — and I want to see your dream come true. Plus, I’ll have someone to go with me to the musicals.”

Sarah is overwhelmed at UJ’s generosity. But she also realizes that UJ’s reputation is at stake. If they cancel the party, everyone at bridge will start asking why UJ didn’t step up to support his prized niece. Sarah also figures out that the more money UJ spends on NYU, the less he’ll have to leave to her. Thus, Sarah comes to understand that no matter who hands NYU the money in the short run, it’s ultimately coming out of her pocket. And its a massive investment with lots of risk.

The Party

A week later, all the guests are at Captain Cook’s feasting on reindeer sausage and Bering Sea King Crab. Sarah walks up to the mic and thanks everyone for attending. Then she explains that she’s, after careful consideration, decided to turn down her parent’s and uncle’s generous offers of financial support and head over to Alaska State for two years. At this point, she’ll decide whether to transfer to Boston University and study economics.

Related: Trump, Ukraine & Europe: A Turning Point for the Atlantic Alliance?