Investors using an S&P 500 ETF to index have no choice but to own 250 COVID “loser” stocks.

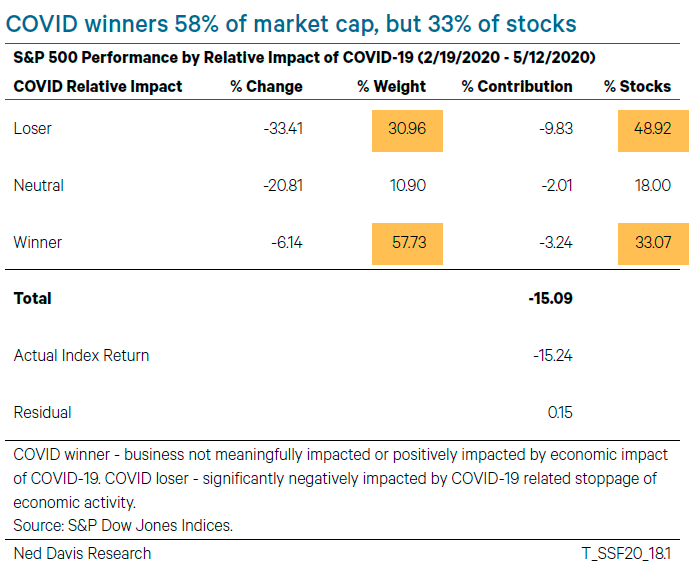

Take a look at this chart below published by Ned Davis Research on May 15th. Essentially what they did was classify each stock in the S&P 500 as a COVID “winner”, “loser”, or “neutral” based on how much impact the halted economy had on each company. Obviously, “winners” were the companies who were positively impacted by COVID…think Clorox (CLX). The “losers” were, well, losers…think Carnival Cruise Lines (CCL).

On a market-capitalization basis, winners make up 57.73% of the S&P 500’s market-cap, while only making up 33% of the total number of stocks, and only experiencing a -6.14% loss from February 19th through May 12th of this year.

Conversely, the loser stocks make up 30.96% of the S&P 500’s market-cap, 48.92% of the total number of stocks, and have experienced a -33.41% loss from February 19th through May 12th of this year.

Because the S&P 500 is a market-cap weighted index (the largest companies have the biggest impact on the underlying index level), the performance of the large companies is helping the index from declining – so the index does not look as bad as it actually is on a stock-by-stock basis.

If you think that we’ll quickly go back to the old, pre-COVID days, then this won’t be a big deal.

But to me, that’s a tough sell – just think through what flying will look like in the future. With all the lines and social distancing, arriving two hours before a flight will seem like a LUXURY!

As I’ve said before, I’m optimistic that we will one day emerge from this crisis and get the economy back on track…but there will be new industries, new companies and new winners. Meanwhile, those COVID losers, well, they are probably going to stay losers for a while, if not forever.

And no one will want to own the loser stocks, so I suspect this will bring back some interest in active investment management along with advisors who blend together rules-based individual stock portfolios, ETFs, and tax loss harvesting.

Keep looking forward.

This first appeared on Monument Wealth Mangement.

Related: Don’t Be an “Investi-Guesser”