Written by: Christian Polanco

As we usher in a new year, the countdown to college is well underway for millions of students nationwide. Amidst the anticipation, it’s important to know about the changes coming to the 2024-2025 version of the Free Application for Federal Student Aid (FAFSA) and how the updated FAFSA might impact the process and amount of aid awarded to your household.

Let’s unravel the key modifications to shed some light on what you need to be aware of.

Which FAFSA Form Should You Complete?

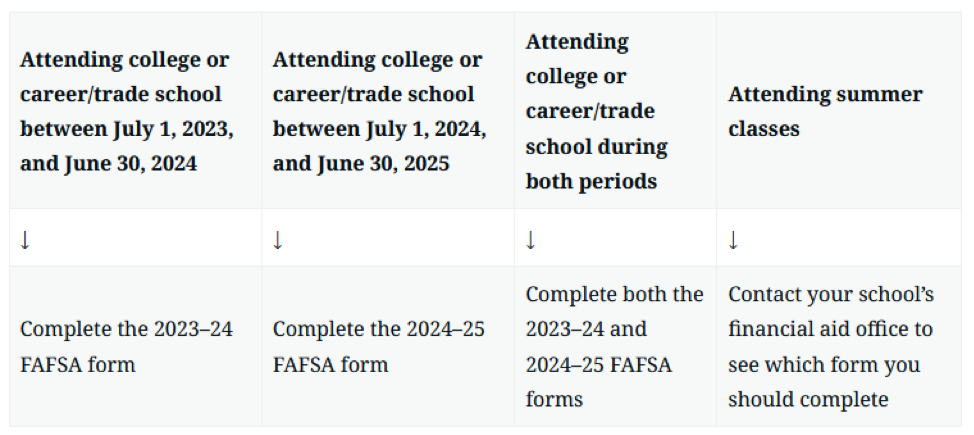

Below is a chart explaining which version of the FAFSA you should complete based on when your student will begin attending school. The main thing to remember is that updates to the FAFSA will apply to students whose academic year starts between July 1, 2024 and June 30, 2025. Prior to this date, you should complete the 2023-2024 FAFSA.

Contributors and Aid Eligibility

The term “Contributor” is introduced in the 2024-2025 FAFSA, encompassing you, your spouse, and biological or adoptive parents. Contributors provide information, consent, and approval for automatic IRS data transfer to the FAFSA form. Notably, grandparents, foster parents, legal guardians, siblings, and aunts or uncles aren’t contributors, unless legally adopting. Being a contributor doesn’t imply financial responsibility for education costs.

If a student is considered a dependent, the parent becomes a contributor. For parents who are divorced, the parent who provides the most financial support will be listed as a contributor. Independent students must identify their spouse as a contributor only if married and not separated. Contributors’ involvement, regardless of dependency status, is important to assess federal student aid eligibility.

Consent and Approval

Both contributors and students will need to give consent and approval for the IRS to transfer federal tax information to the FAFSA form. This applies even if you don’t have a Social Security number (SSN), didn’t file taxes, or filed outside the US. Failure to provide consent and approval means you won’t be eligible for federal student aid. All contributors and students will need to have a studentaid.gov account in order to access the FAFSA form and submit it.

Financial Aid Eligibility

The current Expected Family Contribution (EFC) formula is being replaced by the Student Aid Index (SAI). Like the EFC, the SAI is used to determine the amount of financial aid a student can receive based on cost of attendance and household income and assets. The change from EFC to SAI was partly made due to confusion around what the EFC number meant. The phrasing of EFC created confusion and led students to believe it was a calculation of what they were supposed to pay.

Important material changes include:

- The SAI will not consider multiple students in the same household to determine financial aid. This could mean less aid for middle-high income families with multiple children in college or trade school at the same time.

- Calculation of financial need for low-income households has been updated to better assist those at the lowest levels.

- Pell Grant eligibility is determined before the FAFSA is submitted and has been expanded to partially help households above the maximum SAI limits.

- Students can now send the FAFSA to up to 20 schools and the total number of questions has been reduced from 108 to just under 40.

- The net worth of a small business or family farm must now be included as an asset in the FAFSA which could potentially lower overall financial aid.

Where Should You Start With the Updated FAFSA?

With the rising costs of college and the intricacies of the FAFSA, you need to have a plan of action. The good news is that you have options to help you:

- StudentAid.gov has helpful resources to get you started on completing the FAFSA.

- You can also reach out to your child’s preferred school and speak with a financial aid advisor.

- College consultants are another popular option to help save you time and provide expertise on the college planning process.

Consider the bigger picture of how paying for your child’s college education also impacts your financial priorities. Working with a CFP® professional along with these resources can give you peace of mind that you’re making the most informed decision when it comes to paying for college education. Reach out to one of our advisors if you’d like to learn more or if you have any questions.

Related: End-Of-The-Year Financial Checklist