"Who is rich? He that rejoices in his portion." -Benjamin Franklin

I have been thinking lately about wealth and what truly makes someone wealthy. Recently our firm has onboarded several new clients who are very “wealthy”! By this, I don’t mean based on an amount of assets or the size of their portfolios. They are wealthy in the sense that their wants are well-aligned with their resources.

Many years ago, I heard someone define true wealth as all the things that money can’t buy and that death can’t take away. Things like the love of family, faith, the difference you made in someone’s life (your contribution), etc. I am reminded of this when we meet potential clients who have amassed significant wealth, but never seem to have enough and compare them to those of our clients who have what some may describe as modest means but are content, happy, and joyful. Financial services writer Nick Murray once said that if you are worried about your wealth, you are not wealthy. By this definition, those in the second category are wealthy and those in the first are not – despite the size of their balance sheet.

One of my colleagues defines having enough as whether someone is likely to have to dramatically curtail his or her lifestyle in the future. So, at a very basic level, financial success is having more than you need. Using this meaning, there are three ways to achieve financial success: 1) have more, 2) need less or 3) both.

As a wealth management firm, we work with families who have accumulated some measure of financial success. However, as a whole Americans may not be prepared financially for retirement due to a lack of saving:

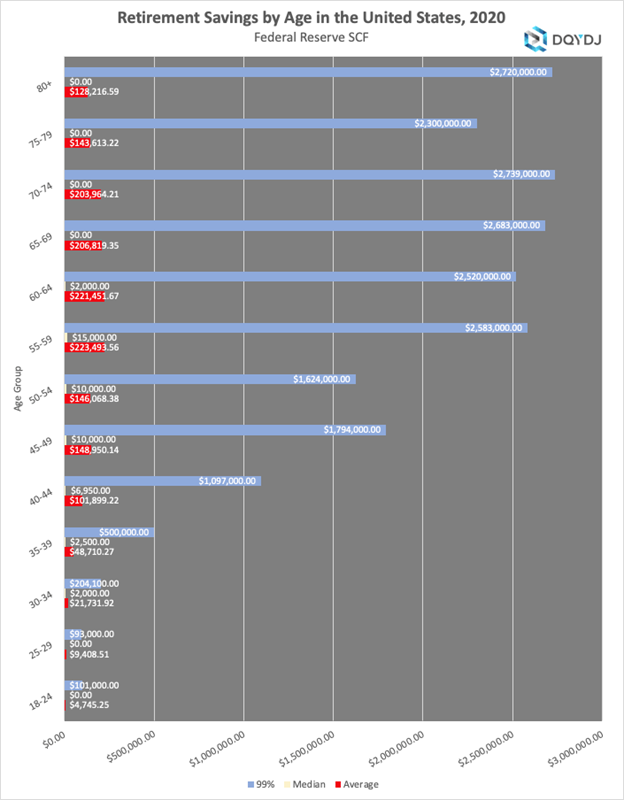

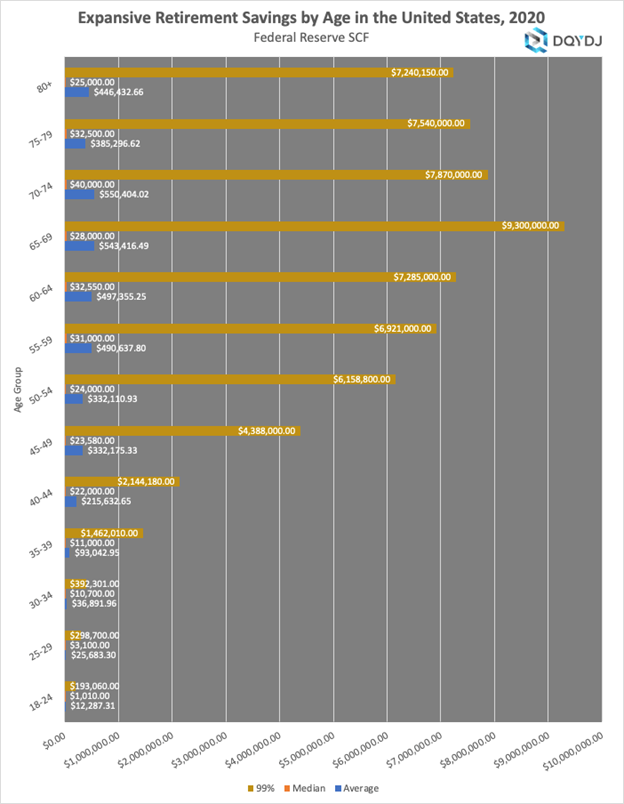

In 2020, American adults between 32 and 61 years old had on average $131,631 saved for retirement (in IRAs, pensions, 401ks). Using a more expansive definition (financial assets less checking accounts, whole life insurance, and trusts), Americans averaged $282,554.50 in savings. These numbers are skewed because high savers influence the average.

A more accurate (and depressing) state of retirement preparedness can be seen in the median statistics:

In 2020, overall median retirement savings was $6,450 per household, using a strict reading of retirement savings (only IRAs, pensions, 401ks), and $21,120 per household with the more expansive definition. Meaning, 50% of the population age 32-61 has less than $21,000 saved for retirement!

Why is this the case? Why don’t we save enough?

There are several reasons but the one I’d like to discuss is time horizon – or more technically hyperbolic discounting. Hyperbolic discounting, also called “present bias,” is a cognitive bias where people choose smaller, immediate rewards rather than larger, later rewards. A fancy way of saying that we value rewards in the present more than rewards in the future even though the reward in the future is more valuable. We discount it too greatly because it’s in the future.

Many important decisions concerning our health, wellness, finances, and careers are affected by hyperbolic discounting. All these choices require trading off immediate pleasure for your future good. When you procrastinate, you opt for the instant gratification of enjoying yourself now rather than the future reward of accomplishing the things you set out to do. You know setting money aside in a 401K is important for your retirement. However, you instead choose to splurge on an expensive night out with friends, which is more fun right now, but might not be the best choice for future you.

If the goal is to maximize happiness, some will choose to consume – live for today. They discount the pleasure or feeling of security in the future and live for today. Savers do just the opposite. To maximize their happiness, they value peace of mind knowing their future is secure and forgo the pleasure today for this peace of mind.

Both decisions could be correct for different individuals. If the spender’s goal was to maximize happiness today (or if the world ends next Friday), maybe this was a good decision for them. For the saver, the peace of mind that comes with knowing they are secure is worth the deferral of consumption (even if the world does end next Friday).

The problem for the spender is when the future actually comes, and they find that they discounted too much. It really wasn’t worth the immediate gratification and the price must now be paid. The price could be significant – depending on what is valued. Lack of freedom due to the necessity to work, inability to support a desired lifestyle, inability to support people or causes that are important to them, etc.

If you struggle with hyperbolic discounting or are not wealthy – you worry about your wealth – a wealth advisor and financial plan may be able to help. How you may wonder?

Here are a few possibilities:

- By engaging with a firm that helps you uncover what matters most you can stop playing the comparison game and determine your unique enough. Ongoing coaching on life’s tradeoffs could be one of the most valuable aspects of an advisory relationship.

- An advisor can help you develop a realistic plan to forecast the impact of your current savings habits today and in the future. If you are in the wealth accumulation phase of life, it can be motivating to see the consequences of your current choices.

- A plan can help you break down big goals to small, measurable chunks and put time and compounding on your side,

- Once you determine the tradeoffs and choices, an advisor and plan can help you automate your savings so that you don’t have to wrestle with the cognitive bias regularly – pre-commit.

- By having specific goals that are motivating and exciting, it is easier to defer consumption today. Unclear goals like future travel are not nearly as compelling as a four-week trip to a villa in Tuscany in 2025 at a cost of $20,000 with pictures and brochures. Maybe even an Instagram page?

- Having ongoing progress reports to see how you are tracking to goals can make the process fun.

- If you are in the wealth distribution phase, a good advisor and plan could give you permission to increase consumptions and giving if you are overfunded. A good advisor and plan can help you think creatively about options (see our previous blog What’s Your Back-Up Plan?) if you are underfunded.

What does wealth mean to you? What is your definition of financial freedom?

Related: 4 Tips For Teaching Financial Literacy To Your Kids