Racing Uncertainty: The 2024 U.S. presidential election could have far-reaching implications for financial markets. Here’s an “early-days” primer on what investors need to know about the race to the White House.

Never in U.S. political history has a presidential race looked like the one that apparently will be inflicted on the American public in 2024 – Joe Biden, 81, against Donald Trump, 77. Both candidates are so gaffe-prone that voters are clamoring for another choice, but that is a very long shot. It’s looking like Biden vs. Trump in a race that once again could inflame the country.

Is there any alternative? Filing deadlines have come and gone and it’s very unlikely that a new candidate – or a third party – could emerge to change the outlook. A Constitutional challenge to a Trump candidacy is unlikely to prevail, and even if Trump is convicted of a federal crime next year, he could drag out the legal appeals process for months or even years.

Could Trump serve as president while in jail? Most legal experts say yes. Could he work with a pliant Justice Department to pardon himself? Most legal experts expect this to happen.

As of now, Trump is the narrow frontrunner to win the presidential election; he’s ahead in some of the so-called battleground states (Pennsylvania, Georgia, Arizona and Michigan). Trump is far from a shoo-in, and Biden can take some credit for presiding over a surprisingly solid economy.

But Biden faces several obstacles, not just his age. Thousands of illegal immigrants pour into the U.S. daily, gun crime is pervasive in urban America, economic anxiety persists, and there’s the likelihood that the business activities of Biden’s son, Hunter, will continue to attract congressional scrutiny.

What are the policy implications of the presidential election?

A Trump victory would usher in a laissez-faire regulatory climate, which would be a plus for energy companies, the tech sector and health care. Trump would push hard for an extension of his tax cuts because many of the provisions will expire in 2025. More tax cuts and a Trump proclivity to spend may send the budget deficit soaring; it already is close to US$2 trillion annually. Deficits may rise under Trump, but he has never been particularly concerned about federal red ink.

We take a contrarian view that Biden would be better for the defense sector because Trump would capitalize on the mood of isolationism in the country, while Biden would push for more aid to Ukraine and Israel. We have little doubt that geopolitics will be a major issue. Trump says he could end wars and defeat enemies within days, while Biden will rely on huge outlays for defense. We think Pentagon spending will exceed US$1 trillion annually within two or three years.

Even Democrats agree that U.S. shipbuilding now lags far behind China’s, and spending will surge in this crucial sector. We don’t think there will be overt hostilities with China; both sides will talk but there’s little hope for a real thaw between Washington and Beijing any time soon.

As for the hotspots, it’s difficult to imagine any improvement in relations with Russia as long as Vladimir Putin is still in power, and Iran will remain a great threat to stability in the Persian Gulf as the Ayatollahs get closer to developing a crude nuclear bomb.

These issues are deadly serious, but there’s growing support for isolationism in America. There probably will be decent support in Congress for aid to Israel, but support for Ukraine has waned as the war with Russia has hit a stalemate.

What about the U.S. congressional elections?

There will be another major U.S. election next year – the congressional elections, also held on November 5, 2024. We think the Republicans have a very good chance of re-capturing the Senate, largely because the mix of candidates up for re-election favors the “Grand Old Party” (GOP). On the other hand, the Republicans could lose their shaky hold on the House, largely because voters are strongly opposed to the GOP’s radical anti-abortion policies.

Regardless of who wins the presidential election, the country will immediately focus on who could win in 2028; U.S. campaigns never end. Our early favorites to watch are Kentucky Governor Andy Beshear, 45, a Democrat, and Nikki Haley, 51, the former Republican governor of South Carolina. Imagine that – an election between two candidates under the age of 60.

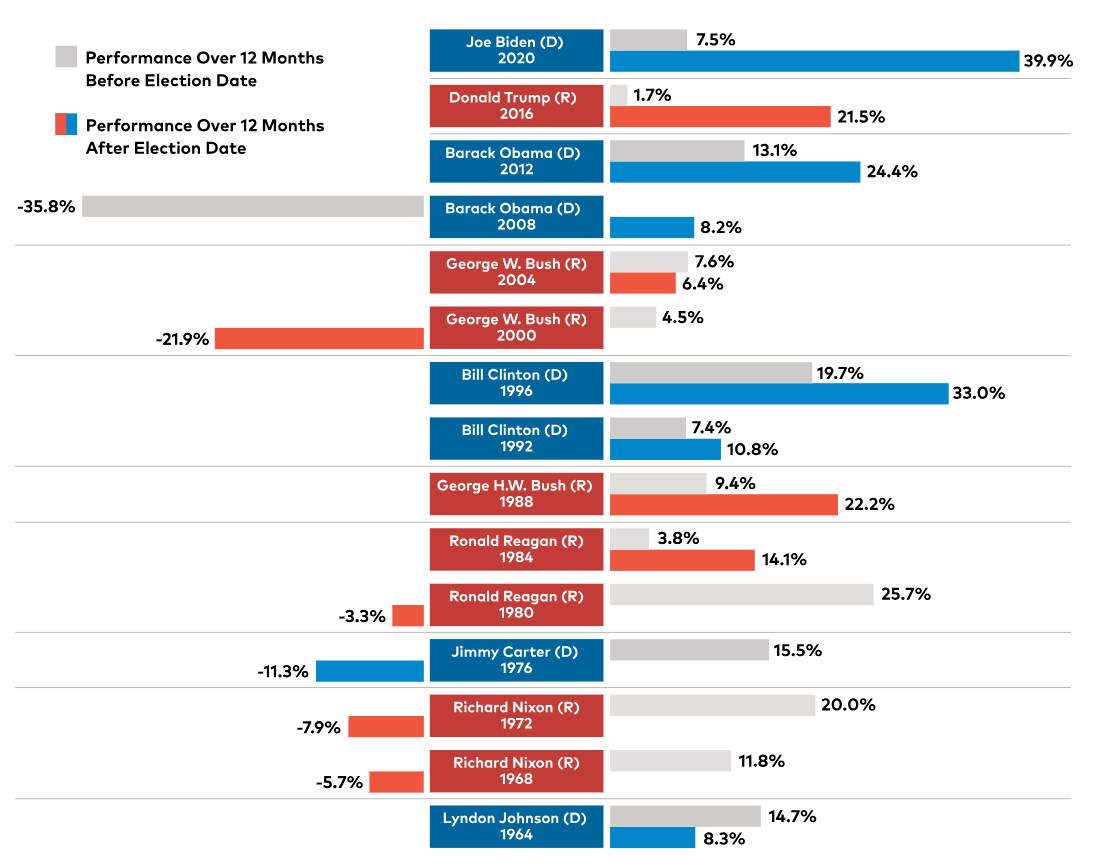

Before and After

S&P 500 Index returns one year before election date and one year afterward.

Source: Bloomberg LP. Past Performance is not indicative of past results. One cannot invest directly in an index.

Related: The Biggest Political and Economic Stories of 2024

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF Investments.

Commentary and data sourced from Bloomberg, Reuters and other news sources unless otherwise noted. The commentaries contained herein are provided as a general source of information based on information available as of December 5, 2023 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein.

This material is for informational and educational purposes only. It is not a recommendation of any specific investment product, strategy, or decision, and is not intended to suggest taking or refraining from any course of action. It is not intended to address the needs, circumstances, and objectives of any specific investor. This information is not meant as tax or legal advice. Investors should consult a financial advisor and/or tax professional before making investment, financial and/or tax-related decisions.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFI is registered as a portfolio manager across Canadian securities commissions. AGFA and AGFUS are registered investment advisors with the U.S. Securities Exchange Commission. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The term AGF Investments may refer to one or more of these subsidiaries or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

AGF Investments entities only provide investment advisory services or offers investment funds in the jurisdiction where such firm, individuals and/or product is registered or authorized to provide such services.

Investment advisory services for U.S. persons are provided by AGFA and AGFUS. In connection with providing services to certain U.S. clients, AGF Investments LLC uses the resources of AGF Investments Inc. acting in its capacity as AGF Investments LLC’s “participating affiliate”, in accordance with applicable guidance of the staff of the SEC. AGFA engages one or more affiliates and their personnel in the provision of services under written agreements (including dual employee) among AGFA and its affiliates and under which AGFA supervises the activities of affiliate personnel on behalf of its clients (“Affiliate Resource Arrangements”).