Why don’t more dentists set up plans or upgrade their current plan to take full advantage of larger tax deductions and accelerated retirement savings?

The answer is misconceptions that include:

- “Retirement plans are too expensive to set-up and administer.”

- “They’re too complicated.”

- “I have to make a contribution every year.”

- “I have to provide the same contribution to the employees as for me.”

Why is this all important now? Because of COVID-19, the dental industry, like many others, had to be shut down and everyone is trying to make up for lost time, revenue and retirement savings.

With this being the case, that leaves very little time for a dentist to focus on a new plan or try and improve the current retirement plan for the practice. They want to have at least a 401(k) plan in place for the dentist, as well as, their helpful staff to retain talented employees and provide a retirement path for them as well, but can more be done than that?

Yes. With a Profit-Sharing AND a Cash Balance Plan.

How much can be contributed for me in a Profit-Sharing or Cash Balance plan?

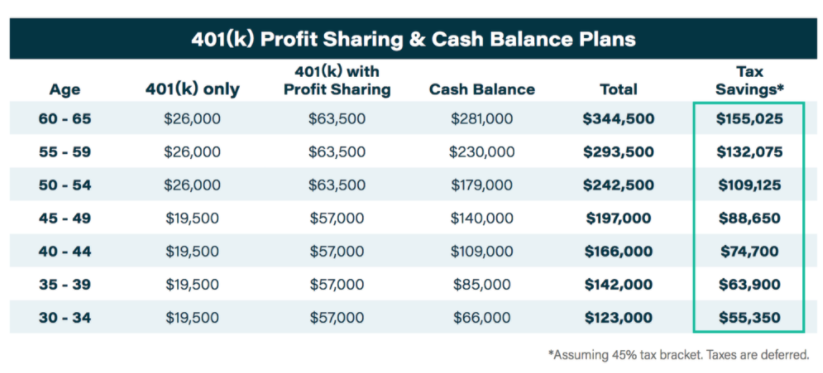

The employer contribution, the Dentist, is determined by a formula specified in the plan document. It can be a percentage of pay or a flat dollar amount, age-weighted or a new comparability. Below are the limits for 2020 (subject to change):

Can Cash Balance plans be offered in addition to 401(k) Profit Sharing plans or other plans?

Yes, the dentist can offer a combination of qualified retirement plans in order to produce a larger contribution.

In fact, in most cases, a 401(k) Profit Sharing plan in conjunction with a Cash Balance plan is necessary to produce the MAXIMUM amount of tax deductions and retirement savings, desired for the owner and employee contributions as well.

What are the distribution options upon retirement or if leaving the employer? Any vested account in a Cash Balance plan can be paid as a lump-sum distribution or annuity. A lump sum distribution can be rolled over to an IRA or another qualified retirement plan.

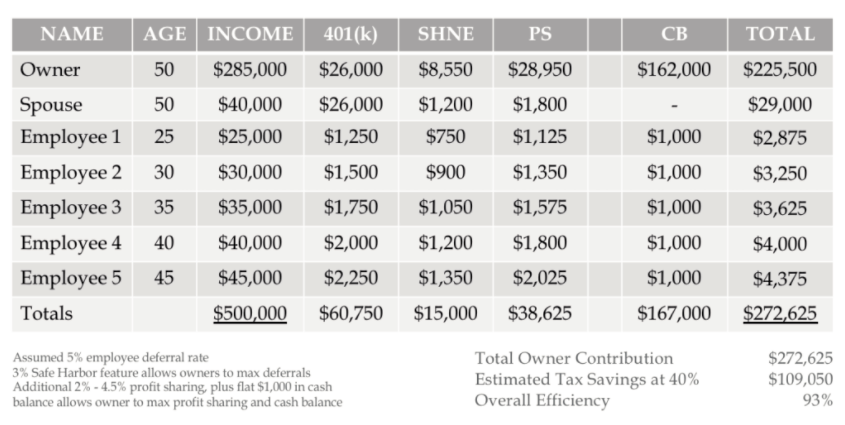

Case Study Example:

- Dental owner with spouse on staff, both 50 years old.

- 5 employees with ages from 25 to 45.

- Looking to upgrade current plan with a Profit-Sharing and Cash Balance Plan to achieve larger tax deductions and accelerated retirement savings.

Here is an example of how a Dentist can upgrade their 401(k), with a Profit-Sharing 401(k) and Cash Balance Plan with a Safe Harbor feature.

If you’re a dentist and asking yourself how can I upgrade my current retirement plan for these larger tax deductions and accelerated retirement savings? Let us show you how, contact us at info@crosspointwealth.com.

Related: HSAs Enjoy A Triple-Tax Advantage