60 Minutes

If you haven’t watched this stomach-turning segment of 60 Minutes, please do. Anderson Cooper interviews me and Terry Savage as well as three victims of Social Security’s heartless clawback abuse.

Terry and I were the impetus behind the 60 Minutes exposé. We asked Terry’s readers to submit their clawback stories. Some 150 arrived in a couple of weeks. Then, Terry used her CBS connections to share the letters with the producers of 60 Minutes, who took it from there.

Social Security Exposes Its Big Clawback Lie

Social Security claims it’s legally required to sue 6 year-old orphans, financially torture 81 year-old widows, and entrap disabled workers to the tune of $309,000! Funny, then, that Social Security waived its clawbacks of all three 60-Minutes victims days before the show was broadcast. In fact, as I told Anderson, and, as the last-minute waivers verified, there is no legal basis or requirement for Social Security’s clawback of benefits — benefits that it claims, but does not prove, it overpaid paid for years if not decades. It should not take an on-screen interview with Anderson Cooper to get Social Security to act humanely.

But the real villain here is Congress. Help us end Social Security’s abuse. Send your members of Congress a link to the 60 Minutes story and our book. Congress can legislate an end Social Security’s financial abuse in a day.

My New Book with Terry Savage

We timed the release of Social Security Horror Stories — Protect Yourself from the System and Avoid Clawbacks to the airing of the 60 Mins exposé. The book is half about clawbacks and half about ten terrible scams that Social Security is running. It’s offers ways to protect yourself.

Double Check You’re Collecting the Right Amount with Maximize My Social Security (MMSS)

If you run this $39 tool produced by my company (from which I’ve never taken a dime), you’ll be able to determine, to the dollar, the benefit you should be receiving and check that you aren’t being over- or underpaid (Yes, that’s entirely possible!). It will also tell you what benefits to take, and when to take them, to maximize your lifetime benefits. This will prevent you from being scammed.

Has Social Security Been Hacked?

Social Security is not just a financial threat — anyone, at any age, can be clawed back for tens of thousands of dollars they were allegedly overpaid based on their own or their living or deceased relatives or ex-relatives’ past benefit receipts. Social Security’s computer system is dysfunctional or worse.

In this October 20th Forbes column, I claimed that Social Security’s website was mistakenly projecting far lower benefits for worker than it had just a few months earlier. This was just confirmed by Social Security itself.

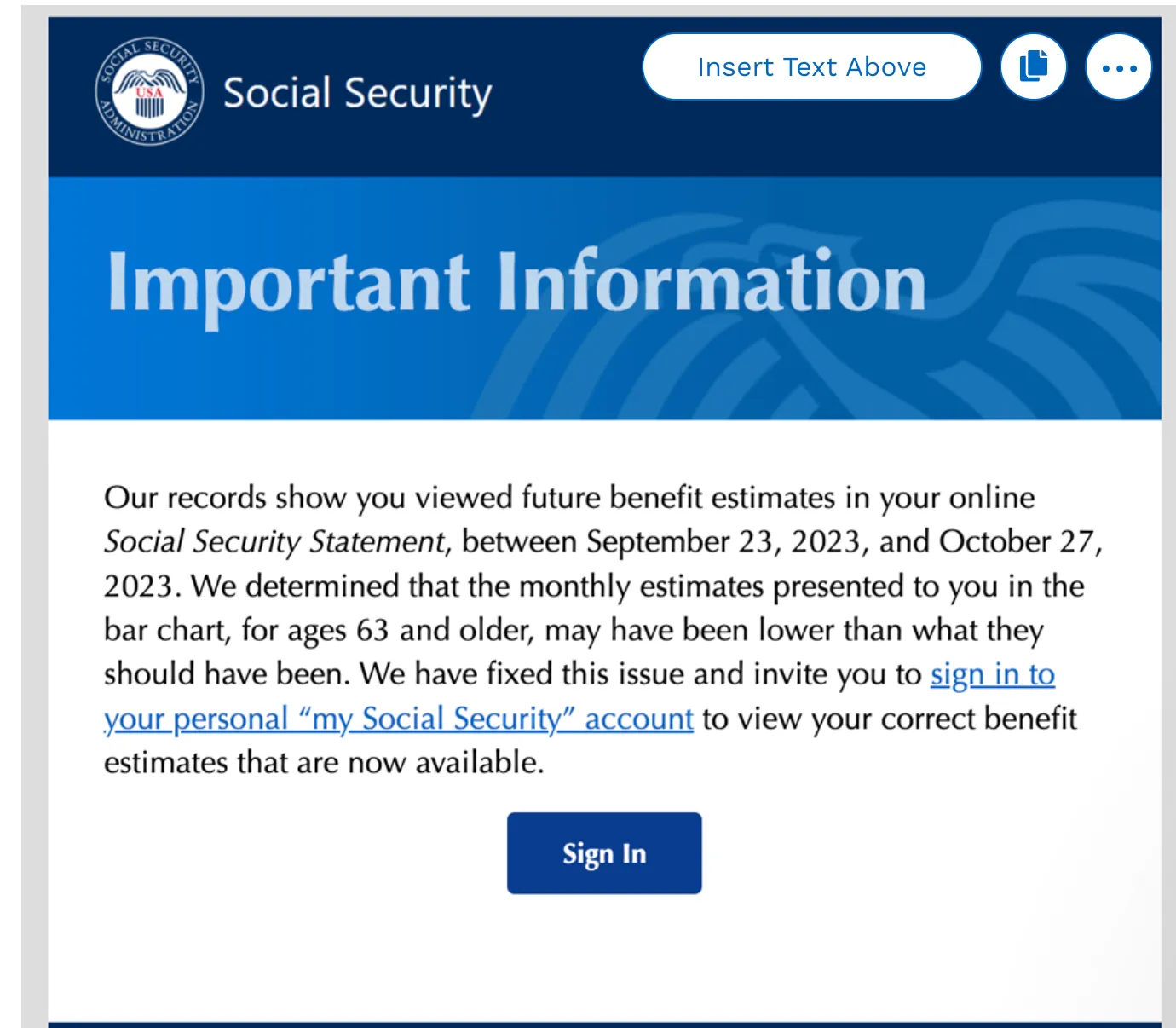

One of my company’s MMSS users sent me the notice shown below, which he received from Social Security. The notice admits that the System has been providing mistaken benefit estimates for over a month!

This is highly troubling on several grounds.

-

The mistake was major. Workers were, in the two cases I discussed, being told their future benefits were up to 17 percent lower than had previously been estimated.

-

The mistake apparently wasn’t caught until our client notified me that, unlike Social Security’s software, our software was showing no change, let alone a huge change, in his future benefit.

-

Social Security apparently didn’t realize it was providing crazy benefit estimates to, presumably, millions of visitors to its website until I notified a senior official at Social Security.

-

There was no clear reason for anyone to modify the website’s benefit estimator code. Yes, their estimates can be miles off base for those under 60 — because they assume no future economy-wide wage growth, which makes a huge difference to projected future benefit. And, yes, their estimates can be far off base for those under 60 because they assume no future inflation, notwithstanding the very high inflation we’ve just experienced and the significant inflation we continue to experience. And, yes, their estimates can be far off base for those working after age 60 due both to assuming no future inflation and that those working after age 60 continue doing so until full retirement age. But Social Security has chosen to adopt these assumptions forever and hasn’t suggested it was changing them (unless I missed an announcement).

So, if there was no reason to change the code, how did the code change to produce bizarre benefit estimates — for an entire month?!!! The answer is either someone internal was fiddling with the code for no good reason or worse — Social Security was externally hacked.

I suspect a hack, although I have no direct evidence of this. Certainly, Social Security wouldn’t disclose a hack if it did, indeed, arise. Actually, I suspect this is the second hack Social Security has experienced in the last two years.

Is this the Second Social Security Hack in Two Years?

On February 23, 2022, I reported in Forbes that Social Security had sent unknown millions of workers benefits statements that were completely screwed up. The statement emailed to me by a different client, which I copied in my column, specified essentially the same retirement benefit at age 62 as at full retirement age. It also specified a higher benefit for taking benefits several months before full retirement age.

Anyone who knows about Social Security’s rules could tell, at a glance, that the benefit statement was nuts. Benefits taken at age 62 are 30 percent lower, in real terms, than those taken at the full retirement age of 67. And they certainly aren’t higher if taken a few months before full retirement. Again, this is the same benefit statement that SSA has been sending out for years. Why would anyone internal have been assigned to “fix” it if it wasn’t broken — hence, my concern that the system is being hacked. Interestingly, I believe I was, yet again, the first person to report this to senior Social Security officials.