When you’re talking about financial advice, there’s good advice, there’s bad advice, and worst of all, there’s expensive bad advice. In fact, according to the White House’s Council of Economic Advisers, poor advice costs Americans approximately $17 billion a year.

This Time, it Really Matters.

Imagine you’re about to stop working for good. As in forever. At least that’s the plan. And at that moment when you’re about to step over the starting line into retirement, it’s likely that you’ll seek some solid financial advice. But who’s going to guide your decision-making leading up to this critical point in life? This is a situation where things might either go really well or horribly wrong.Do You Choose from the 90 Percent… or the 10 Percent?

There are approximately 500,000 people working as “financial advisors” in the U.S.––and those advisors represent the ninety percent who work for well-known brokerage houses and big-name insurance companies. They are, by far, the most visible to consumers. The problem is, they work as salespeople, paid by their firms––not by you––and their compensation is not based on providing you with advice that’s in your best interest. They are paid to sell investments.The other ten percent of financial advisors in U.S. are not as conspicuous because they’re not attached to brokerage firms or insurance companies. Instead, they are independent advisors who are held to the SEC’s fiduciary standard, which means those advisors must, by law, always put their clients’ well-being first. Brokers don’t legally have to meet that standard.As it turns out, this retirement advice is a more critically important decision than you might ever have realized. But if you’re in your late 50s or 60s and nearing retirement, here’s why this decision really matters.Scenario A: No Serious Cash Flow Analysis.

This is what your retirement plan might look like coming straight from any one of several brokers or insurance agents. Note: it’s what you don’t get that may count the most.First, there’s typically no serious cash flow analysis that guides your spending. No blueprint at all for the long-term. Instead, you’ll likely get a sales presentation that promotes the broker’s investment products.Next, there’s no unbiased assessment of your current overall situation that includes your real estate or other assets tied up in 401(k) plans, or expert analysis of your current insurance needs, tax planning or any legacy planningfor your children and / or grandchildren.Third, the majority of the investments are recommendations that pay commissions or kickbacks to your broker (though how would you know this?). These proposed investments are expensive and are not necessarily recommended in your best interest because brokerage firms are not willing to accept fiduciary responsibility.Those investments, more often than not, include insurance annuities or other high-ticket insurance products, and your broker will receive his or her commissions, regardless of the outcome for your portfolio.Your Investments Can Cost You Tens of Thousands in Overpaid Fees.

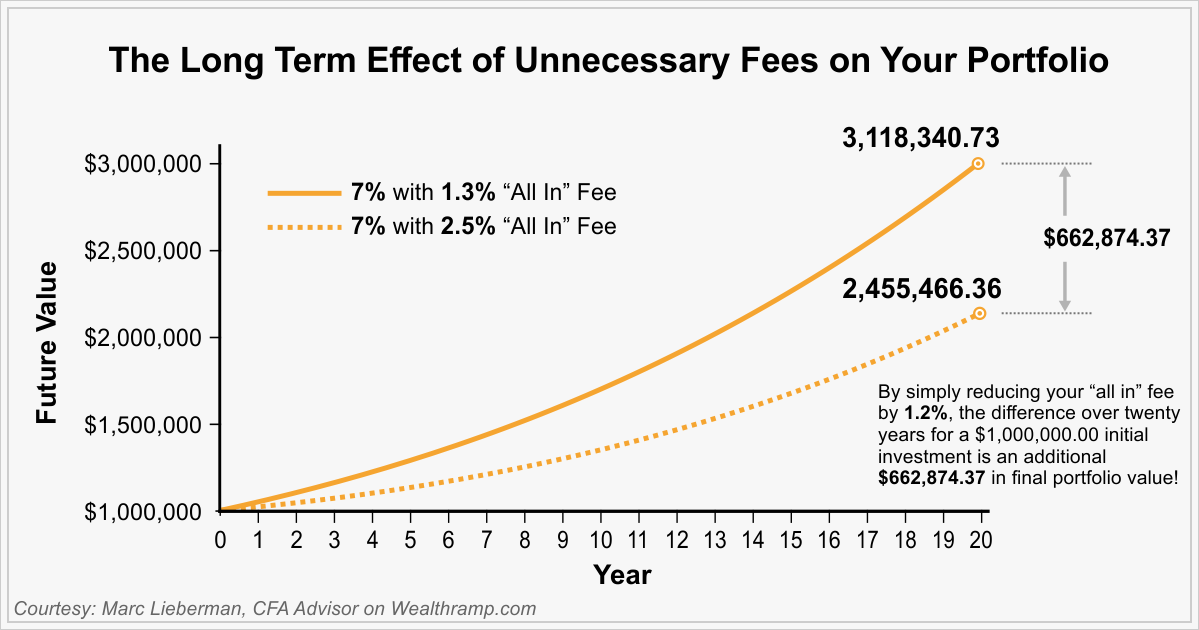

Furthermore, if that financial advice consists of expensive, complicated investment products and does not include real planning, your portfolio may easily be tens or even hundreds of thousands of dollars lower than it could be simply because of all the fees you overpay.After all, every dollar you’re spending in fees and expenses is a dollar that is not invested. But even worse than the excessive and unnecessary fees, it’s those timing decisions that can and will directly affect the rest of your life.Ask Yourself a Few Critical Questions.

These decisions can start with questions such as:Scenario B: A Fiduciary Advisor.

But what if you had started taking advice from one of the ten percent of financial advisors who are truly competent, independent fiduciary advisors?What if all the investment recommendations you needed for your future finances were based on a sound financial plan that is adjusted periodically with your circumstances, not a sales pitch because a broker has a sales quota to meet? What if your financial advisor was, by law, always working in your best interests because that advisor reports only and directly to you, the client. And what if his or her advice costs you less?The money you don’t pay to fees could make a huge difference in your nest egg… as much as an additional $622,874 in final portfolio value per the chart below over 20 years for an initial $1,000,000 investment.

Over time, unnecessary investment fees can make a sizable difference in your portfolio’s value, draining it of potential income.

But, thanks to the carefully crafted cash plan, the better outcome drives your investment decisions. That “plan” is the financial blueprint for your future. It dictates all of your spending and investing, taking into consideration how to maximize your social security options.A solid plan may help you sleep better at night if it is based on reality because it incorporates your actual monthly income and expenses, down to the annual or monthly fees you pay your accountant, bookkeeper, financial advisor, attorney, veterinarian, housekeeper, gardener, and the like. A real retirement plan is dynamic. It changes as you change.Related: What The Passing of John Bogle Means to Everyday Investors