Best-selling author David Allen (Getting Things Done) wrote recently “There are only two problems: Problem #1- You know what you want, and don’t know how to get it; Problem # 2- You don’t know what you want.

In my experience, financial problems indeed fit into one of these two categories.

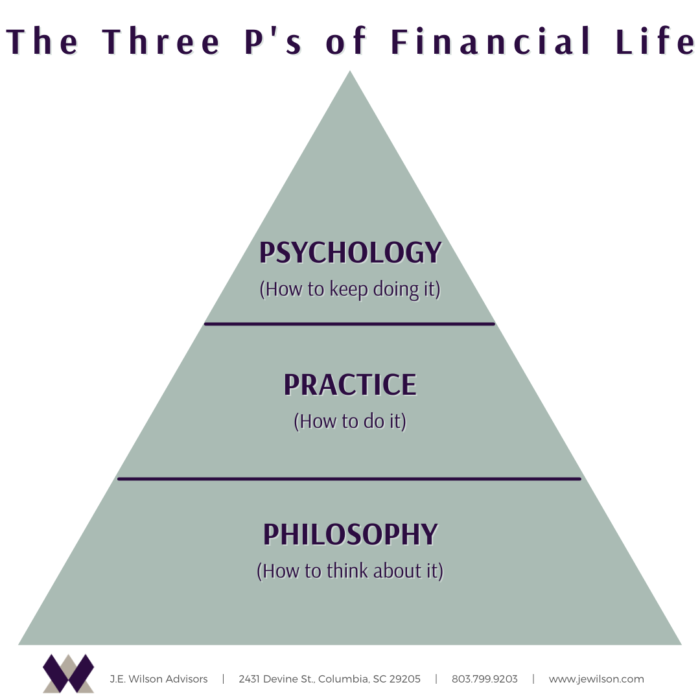

To truly address problems of any type, you need to create a framework for how to think about the issues along with possible solutions. The simple diagram below might help.

Realistic Philosophy

Many people become stuck on the first “P”, Philosophy. Without a coherent philosophy about how to make sense of life, everything else eventually falls apart. It’s not only crucial that you actually have a philosophy, but also important that you have a philosophy you can stick with.

Of course, some operating philosophies might be ill-suited for you or poorly reasoned in general. It’s easy to fall into the same predictable, repeatable traps if the philosophy is wrong for you.

Candidly, if your money philosophy centers around trying to “maximize investment returns”, you’re destined for investing failure. Investments and investment returns matter, but only within the context of a realistic philosophy that aligns with your particular goals.

For your philosophy to be realistic it should address uncertainty head on. You can’t predict uncertainty, but you can prepare for it, by having a margin of error within your planning framework. This simply acknowledges you will in fact be wrong some of the time.

Philosophy Before Practice

Once you have a workable philosophy on money and how this meshes with your circumstances you are ready to move onto the Practice stage of the process. This is where you actually put the philosophy to work within your financial life.

Experience informs me that many individuals sometimes try to skip over developing a cogent philosophy and go straight to Practice because it’s fun to follow the markets and talk about investments. It’s also potentially disastrous to your financial future.

Real life financial planning has several different steps and they need to be done in order; otherwise, you’re building a house of cards that eventually will come tumbling down.

It’s exceedingly easy to be distracted by current economic events and shiny new investments. Economic trends come and go as do new investment fads. Neither of these has much importance to your specific and particular goals. That’s all you need to remember.

Avoid the Rabbit Holes

The overall economic landscape at present provides an excellent example. With little doubt, inflation expectations are rising with every passing day. However, rather than becoming micro-focused on the monetary and fiscal causes, (a first-class rabbit hole), you should pause to remember why you invest in risky assets like stocks in the first place…to offset ever increasing living cost increases (inflation).

Exactly how you put your financial philosophy into practice is less important than adhering to age-old principles of broad global diversification, low cost, tax efficiency, and flexibility.

Stay in Your Seat

Finally, no matter how good you are with putting your money philosophy into place, all is for naught unless you adopt the Psychology needed that allows you to stay in your seat.

Keeping your financial planning structure in place during all types of circumstances and conditions is a critical ingredient to long-term financial success.

The Three P’s of Financial Life will go a long way toward solving the two big problems David Allen describes above. Spending some time on each of these will be fruitful by lowering money anxieties and improving your life. Start there.

Related: The Huge Challenges for Making Smart Financial Choices