Daily distractions blur what’s important. When planning for retirement, there's really only one question: Do you have enough money to maintain your lifestyle, including inflation, for the rest of your life?

The Gap between where you are now and where you need to be is what matters. Everything else is just a sideshow.

Most investors preparing for retirement still have some ground to cover before reaching financial security.

How To Solve the Gap

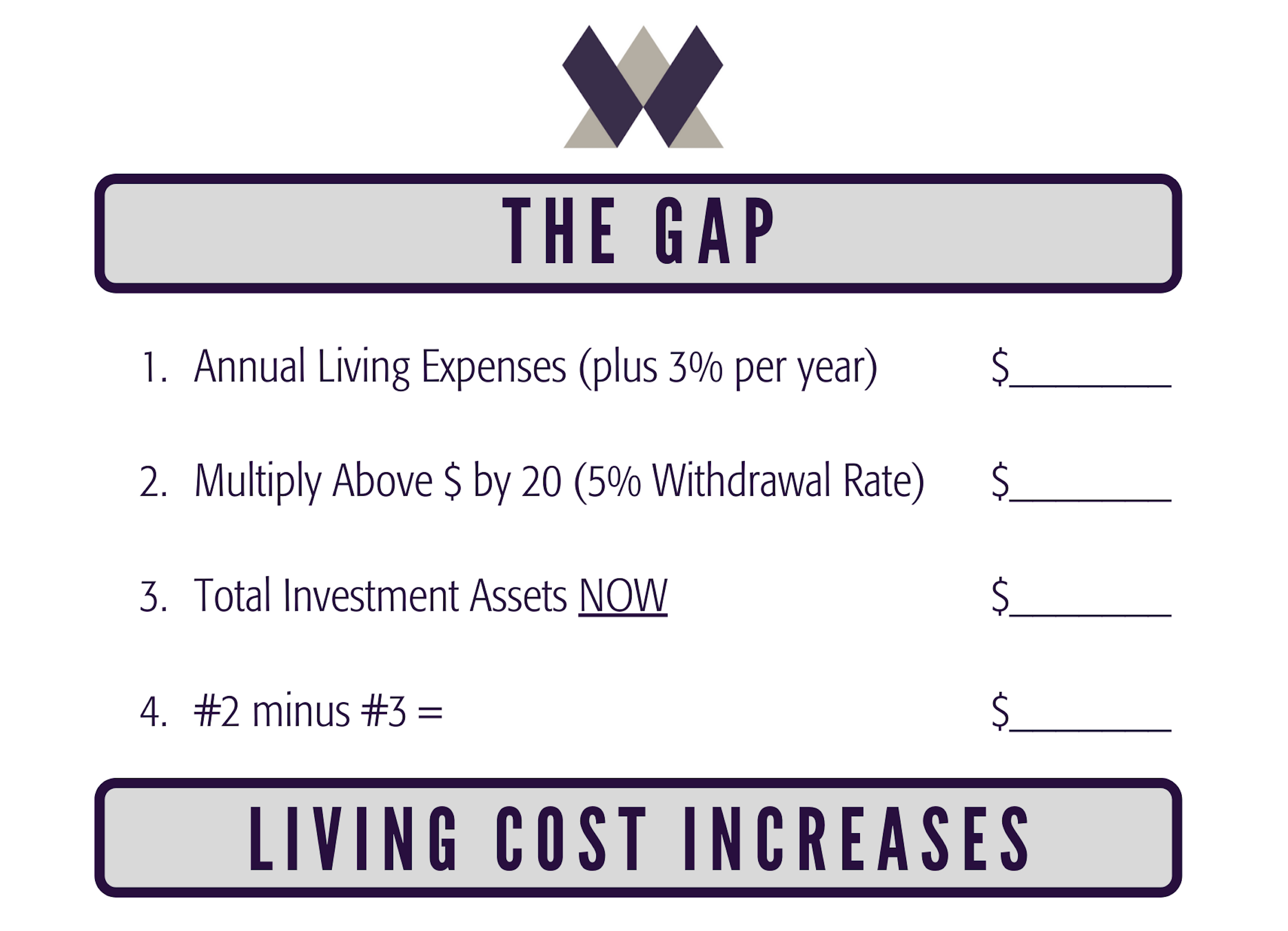

Many of you have seen the white board in our conference room titled The Gap. There are four steps to determine how close or how far away you might be from a sustainable retirement.

Step One: Annual living expenses- our experience reflects that many couples differ on this figure. A realistic estimate is needed in order to derive a reliable answer. If you need $150,000 per year today for living expenses, this amount needs to grow by about 3% per year to reflect living cost increases. Therefore, in year two you will need $154,500 to cover expenses, year three will be $159,135, and so on.

Step Two: Multiply your annual expenses by 20. The product of this is the investment asset base needed to withdraw 5% per year. 5% may not be the correct withdrawal amount for your circumstances, but it is on the upper end of what’s reasonable. It also makes the math simple. In the example above, you need a pool of investments totaling $3,000,000 in order to withdraw 5% per year.

Steps Three and Four: The difference between the Step Two answer and your total investment assets now. If your investments, (including retirement accounts but excluding your house), currently total $2,000,000 and you need $3,000,000, your gap is $1,000,000.

How you address The Gap is the second most important question you need to answer. Every financial decision involves choices. You might choose to postpone retirement if The Gap is too large. Alternatively, you could decide to save more or withdraw less in retirement.

Why Focus and Attention Matter

Inevitably a financial gap also signifies a time and attention gap. The Gap doesn’t appear from thin air all at once. The Gap is the result of chronic inattention and neglect.

For some investors, saving for retirement is an “on and off” function. We rarely see clients that are saving enough. There are always competing goals, however, and tradeoffs inevitably need to be made.

You might save more for retirement or decide to buy a second home. One has more impact on your future than the other. If you are sacrificing retirement savings for the vacation place, you need to fully comprehend the consequences and opportunity cost.

You either have enough money to sustain your lifestyle throughout retirement or you don’t. If you avoid focusing on this, the likely result will be an ever-declining retirement lifestyle. That outcome is avoidable with planning and prioritization. Start there.