It was recently announced that the state of South Carolina was pushing to pass a bill that would require all high school students to take a course on financial literacy in order to graduate. Five states (Alabama, Missouri, Tennessee, Utah, and Virginia) are the only other states to have passed a similar law. As professionals who strive to preach the importance of this topic, we are very happy to see these developments. In fact, we think it’s particularly great that we, as a nation, are beginning to demand that children learn the basics of personal finance , before they step out into the real world.

But first off, let’s tackle what the actual definition of “financial literacy” is.

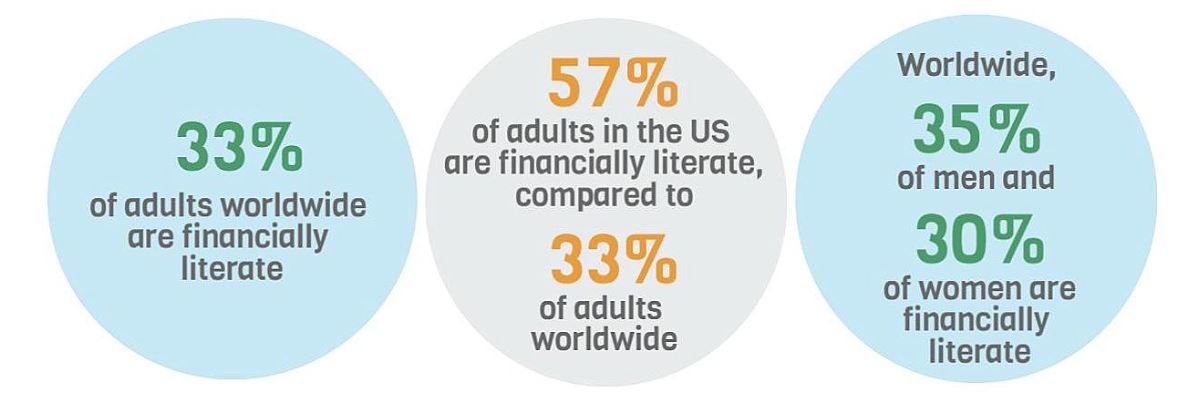

Financial literacy is the combination of financial, credit and debt management and the overall knowledge that is required to make responsible decisions regarding financial matters. Really, we are talking about the impact of finances on the daily issues an average family may encounter.Is the rate of financial literacy low in the US? Yep. (Actually, it’s low around the world.) Of course, the level of financial literacy varies according to education and income levels. However, there is a lot of evidence out there that shows that highly educated individuals with above-average incomes are almost equally as under-educated on these topics as those who may live a more modest lifestyle. source: S&P GLOBAL FINLIT SURVEYGiven this information, it is becoming increasingly more important to ensure that we are preparing our children with this knowledge well before they are starting college, creating families, and living an “adult” life. Why? Because it’s about the “long game”. Financial literacy is critical in helping people plan for retirement and avoiding high levels of debt. Last year, a study from TIAA-CREF showed that those with high levels of financial literacy are more likely to make astute decisions and typically, over their lifetime, amass twice as much wealth as those without a plan.Related: The Bridge Between Financial Planning and Reduced StressIf you can’t build a simple household budget, then you are likely financially illiterate. If you are oblivious to money-related decisions, are unsure of the consequences of these decisions, or you simply don’t care, then you’re financially illiterate. Most importantly, If you have learned the “hard way” over the years that not being up-to-date on financial matters has affected your life in a negative way, it is imperative that you do not allow your children to make the same mistakes. Important financial decisions are popping up earlier and earlier in life, as the world becomes more complex. You don’t “build” wealth and then figure out how to manage it properly. That ability to grow comes with managing it properly along the way.The statistics mentioned above are some of main reasons we have created the “Beers with Brad” seminar series. We feel that increasing your financial literacy is incredibly important to your long term financial goals and obligations. If you are in the DC/Maryland/ Virginia area and would like to hear more, feel free to stop by our next event.

source: S&P GLOBAL FINLIT SURVEYGiven this information, it is becoming increasingly more important to ensure that we are preparing our children with this knowledge well before they are starting college, creating families, and living an “adult” life. Why? Because it’s about the “long game”. Financial literacy is critical in helping people plan for retirement and avoiding high levels of debt. Last year, a study from TIAA-CREF showed that those with high levels of financial literacy are more likely to make astute decisions and typically, over their lifetime, amass twice as much wealth as those without a plan.Related: The Bridge Between Financial Planning and Reduced StressIf you can’t build a simple household budget, then you are likely financially illiterate. If you are oblivious to money-related decisions, are unsure of the consequences of these decisions, or you simply don’t care, then you’re financially illiterate. Most importantly, If you have learned the “hard way” over the years that not being up-to-date on financial matters has affected your life in a negative way, it is imperative that you do not allow your children to make the same mistakes. Important financial decisions are popping up earlier and earlier in life, as the world becomes more complex. You don’t “build” wealth and then figure out how to manage it properly. That ability to grow comes with managing it properly along the way.The statistics mentioned above are some of main reasons we have created the “Beers with Brad” seminar series. We feel that increasing your financial literacy is incredibly important to your long term financial goals and obligations. If you are in the DC/Maryland/ Virginia area and would like to hear more, feel free to stop by our next event.